A state of volatility dominates the GBP/USD performance in the last trading sessions, as with the exploitation of the USD decline and the optimism of the European agreement. The pair moved upward towards the 1.2767 resistance, then returned quickly to the 1.2643 support and then stabilized around 1.2730 at the time of writing. Traders await an important update for the results of the current round of negotiations between the European Union and Britain. Pessimism is taking over with expectations of a new failure in the negotiations, and if that is the case, it will bring new pressure to the pair.

The cable was negatively affected against the other major currencies soon after the Telegraph report that the government is giving up hope for a trade deal with the European Union. Where the Telegraph newspaper reported that the central government assumption is that Britain will trade with Europe on WTO terms when the transitional period ends on December 31. Senior sources told the newspaper that there is now an assumption that "there will be no deal", although a "basic" agreement can still be reached if the European Union gives ground to an agreement in the fall.

Commenting on this, Commerzbank Forex Market Analyst Thu Lan Nguyen said, “The possibility of a no-deal Brexit has increased dramatically. This is why we expect a weak pound in the short term and only a very mild recovery later in the year. In fact, there is a high risk that the British pound will suffer from more severe setbacks at the present time than our expectations suggest due to the high risk associated with Brexit”.

The European Union and UK negotiators are currently in discussions scheduled to end on Thursday, and we believe any signs of progress could boost the value of the British pound. However, given today's headlines and the general tone surrounding the talks in recent weeks, the chances of a breakthrough are slim and there are no further negotiations scheduled for this month, and the UK deadline in its blueprint for an agreement is this month. To be fair, the deadline for July was always expected, with the European Union’s preferred deadline in October being the most likely target chosen by the markets.

A source told the Telegraph newspaper, "We wanted to see an agreement this month. It is clear from the European Union that this will not happen. "No business deal should be the practical assumption, because that's what we have to prepare for, but this does not mean that it is what we want or work to achieve." the source added. The source expected levels of concern about Brexit to remain high in the coming weeks, an environment that will cause the British pound to suffer greatly.

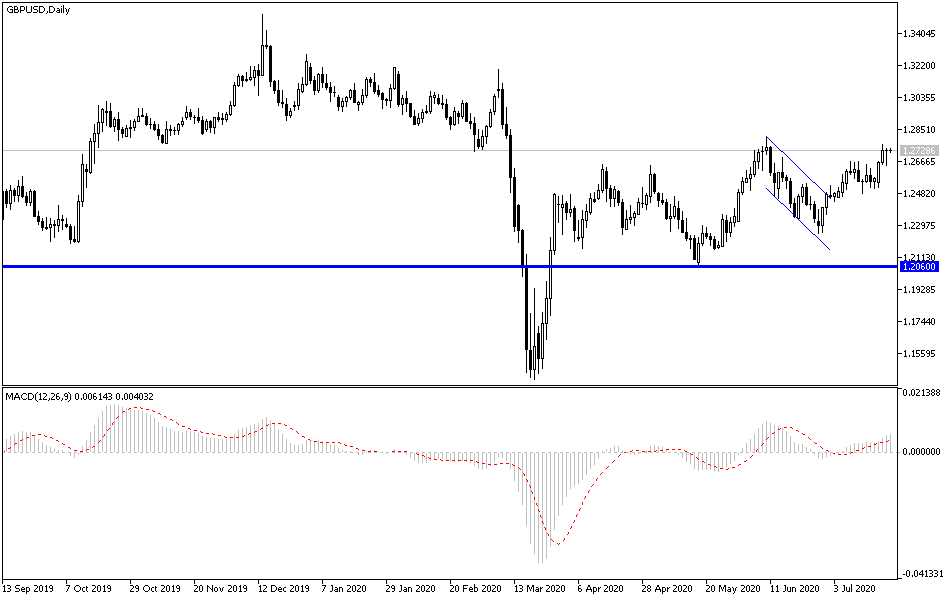

According to the technical analysis of the pair: Breaking the GBP/USD bearish channel on the daily chart is still valid, and at the same time, gains will still face the risks of Brexit talks failure and in general, the pair is still reaping the fruits of the USD decline amid optimism in the markets and risk appetite. I still prefer to sell the pair from each upper level, and the closest resistance levels are now at 1.2770, 1.2830 and 1.2925, respectively. The current breakout failure could start forming a head and shoulders formation, which could technically support short selling. For the Bears to re-take control of the pair, they need to move below the 1.2500 support.

As for the economic calendar data today: With the anticipation of the results from the Brexit negotiations round, the pair will react to the announcement of the US jobless claims.