Amid optimism in financial markets after the European agreement, along with the decline of the US dollar, and the announcement of a Coronavirus vaccine, which overcame concerns about the strength of numbers from the second epidemic wave, there was a good opportunity for the GBP/USD pair to break higher towards the 1.2767 resistance, the highest level in a month and a half. The pair is trading around 1.2715 at the time of writing. The Pound will be watching the results of a new round of negotiations between the European Union and Britain, as markets await a penetration and an agreement on the future of their relations after the transitional period that ends at the end of this year.

The pound sterling rose against the Euro, the dollar, and other currencies, due to the improved investor and stock markets sentiments, which confirms the continued sensitivity of the British currency to the global image. Markets were boosted yesterday by news of an agreement among European Union leaders who agreed to spend 1.8 trillion Euros, including a 750 billion Euro bailout fund to deal with the grinding crisis, of which 390 billion Euros would be provided as grants.

The news of the deal will support the Euro in the long run, but given that developments are positive for investor sentiment, and therefore for stock markets, the Pound is proving to be an unexpected beneficiary on the short term. In this regard, says Michael Cahill, a foreign currency analyst at Goldman Sachs: "Forex foreign investors should bear in mind that the British pound integrates "beta" in the broad market risks circumstances." The term “beta” refers to the association of financial assets with the broader stock market, especially the S&P500 Index, as the rise of the British beta itself has shown that it is particularly reacting to movements in the S&P500. Consequently, the outlook for global stock markets will be relevant to the pound sterling in the coming days and weeks, especially in times when there is not much news regarding Brexit and Bank of England’s policy.

Shares and the pound sterling rose since the beginning of this week’s trading in light of a set of expectations for the European Union agreement on the economic response to COVID-19, as well as calls for the US Treasury Secretary for more financial support. Currently, the pound will remain vulnerable to the broader market movements, but we remind readers to be alert to any unexpected developments regarding Brexit and the Bank of England’s policy, as these developments will emerge again soon.

In particular, we are awaiting an update tomorrow, Thursday, on the last round of trade negotiations between the European Union and the United Kingdom for signs of progress between the two sides. If and when an agreement was announced, that would be good for the sterling to achieve stronger gains. Another round of talks is scheduled for the week beginning August 17, but expectations indicate that Germany, which currently holds the rotating EU presidency, has indicated that it will not start focusing on trade talks until September.

Meanwhile, Forex markets will remain cautious about the British Pound due to concerns that the Bank of England will cut interest rates to 0%, or even less, sometime in 2020 in the face of bad economic data outside the British economy.

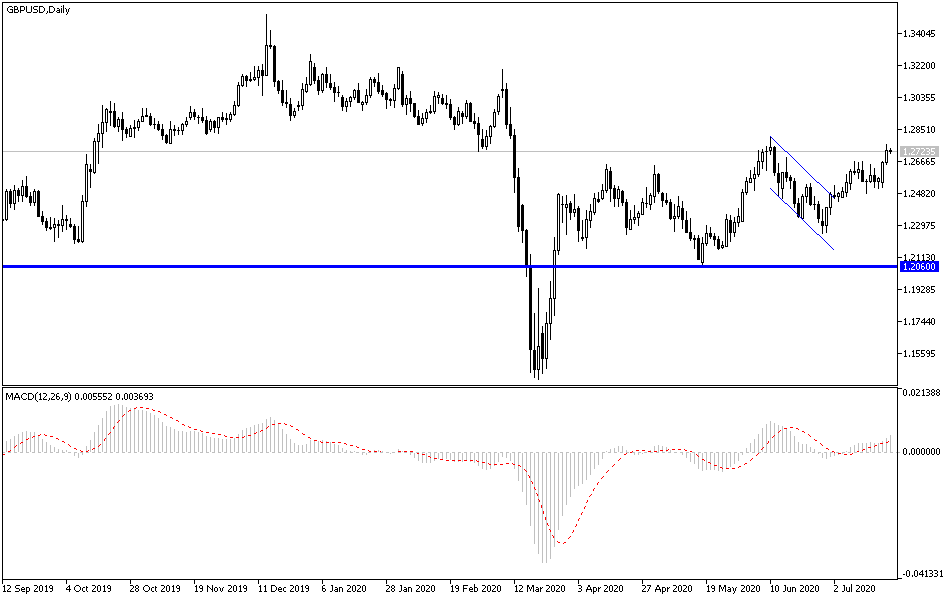

According to the technical analysis of the pair: The recent GBP/USD performance supports the bullish correction, but these gains will remain cautious to the factors mentioned above. The current optimism will not last very much in light of the strength of the second wave of the Corona pandemic, and investors began focusing on the economic performance of both Britain and the United States in the pandemic era. Do not forget that the United States has provided more stimulus figures in the face of the crisis and is ready to do more. The optimism about the Corona vaccine has evaporated and the global figures for infections will eventually boost the dollar as a safe haven. I still prefer to sell the pair from each higher level, and the nearest resistance levels for the pair are currently 1.2760, 1.2835, and 1.3000, respectively. The pair will once again return to the downward pressure if it moves below the 1.2500 support.

There are no significant UK economic releases today. From the United States, existing home sales will be announced.