For the third consecutive day, the GBP/USD performance witnessed a noticeable improvement, which pushed the pair towards the 1.2490 resistance before settling around 1.2477 at the beginning of Thursday’s trading, and before announcing the details of the important US jobs report. Analysts are watching with caution that the pair managed to cross the 1.2520 resistance, which motivates the bulls to get the pair out of the downward swamp. However, due to concerns about the future of Brexit, the cable gains will continue to be a stronger selling target. It should be noticed that global stock markets and risk assets such as the Sterling will react to the continued flow of negative geopolitical news heavily and quickly, as Reuters reported that Senator Marco Rubio will introduce a bill in the coming weeks that seeks to prevent 20 Chinese companies from operating in the American capital markets.

This came after the US-China Economic and Security Review Committee found that the "significant expansion" of American companies operating in China since its accession to the World Trade Organization nearly two decades ago puts American leadership in technology at risk.

Elsewhere, new coronavirus cases recorded high levels in some US states, including North Carolina and California, but the S&P500 rose. These headlines competed for investor interest with more suggestions from US President Donald Trump that there will likely be another big round of "stimulus checks" coming this month or later, which has boosted risk assets globally but will provide little of positivity for the troubled UK economy, which is facing a lot of pressure locally and globally.

There was no positive reaction in Chancellor Angela Merkel's announcement that the European Union needs to prepare for the possibility of the United Kingdom leaving the transition period at the end of the year without agreeing on preferential trade terms. Despite the economists’ fears that the risk of a no-deal Brexit will increase fears of a bigger economic blow. Especially if no progress is made in trade negotiations between the UK and the European Union.

Those are the risks that constantly haunt the British economy. The British GDP in the second quarter of 2020 was the worst in 40 years, though not surprisingly, in the era of the Corona epidemic.

Merkel's comments came after British Prime Minister Boris Johnson said at the end of last week that the United Kingdom could leave the transition period at the end of the year without preferential trade terms, while a "accelerating" round of talks was about to begin. For his part, David Frost, the British negotiator, believes that “the sovereignty of the United Kingdom, over our laws, our courts, or our fishing waters, is of course not a matter of discussion. Likewise, we are not seeking anything that would undermine the integrity of the European Union's single market.”

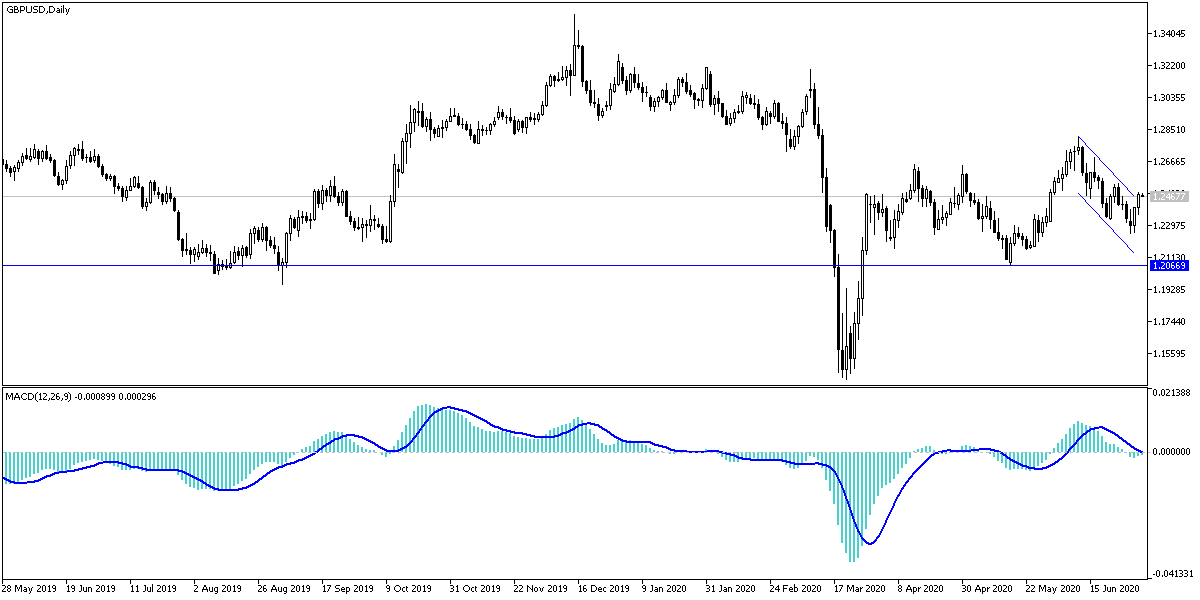

According to the technical analysis of the pair: Recent GBP/USD gains are in the first stage to break the general downward trend and still need more momentum to confirm this, and this may happen if the pair moves towards the resistance levels at 1.2535 and 1.2600 respectively. On the downside, as mentioned before, the 1.2320 support will remain important for the bear to continue controlling the performance for a longer period. I still believe that selling the pair from every higher level would be the best way to deal with the pair.

As for the economic calendar data: There are no significant UK economic releases today. The greatest interest will be for the American session data, which includes announcing the change in the US non-agricultural jobs number, the unemployment rate and the average hourly wage. Then the Unemployment claims, the Trade Balance and factory orders data will be announced. The announcement of the US data will be intensified today before the Independence Day holiday on Friday.