For three consecutive trading sessions, the GBP/USD price attempt, according to the performance on the daily chart, crossed the 1.2670 resistance to complete the bullish correction path that started at the end of June trading. The pair returned to move lower with the lack of sufficient momentum for the correction, to the 1.2552 support, where it is stable around at the beginning of Tuesday’s trading, and before the announcement of a package of important British economic data. Shortly before the announcement, Capital Economics said that the British economy may be on the verge of a downturn.

According to an analysis of the Independent Economic Research firm and the financial advisory firm, Capital Economics, the contraction is likely to happen - as prices drop - as a result of the initiatives announced by British Chancellor Rishi Sunak last week, in which VAT was reduced for certain sectors of the economy in an attempt to get shy consumers out spending again.

Brexit trade negotiations are heading to Brussels this week as negotiators have to present some positive developments if the British pound wants to maintain its recent gains. That came with the support of hints and reports that indicate the possibility of imminent progress in the negotiations, which officials are said to have reached a dead-end at present. By the end of the week, there will be an update and indications of the results of those meetings.

It is difficult to say exactly when the talks will end, given that they ended earlier than scheduled for the past two weeks. We are still not yet sure what this actually means for the final outcome, as negotiations can end early either to a dead-end or progress. At the same time, there is definitely a high degree of uncertainty, and therefore we will maintain the view that the GBP gains are likely to remain relatively well contained and that the massive remaining negative risks should support its collapse.

The British pound recorded a weekly rise for the second time in a row against both the dollar and the euro last week after the decline extended to strong oversold areas, supported by more informal trade negotiations reports supporting a hard Brexit. Last Friday, an experienced journalist in Brussels announced the readiness of European Union Commissioner Michel Barnier to make some important concessions on behalf of the European Union in order to obtain an agreed upon trade agreement in the coming weeks. In a report for The Sun, Nick Guttridge said Barnier is “ready to soften his red lines - but he can only concede if the prime minister shows a willingness to concede.”

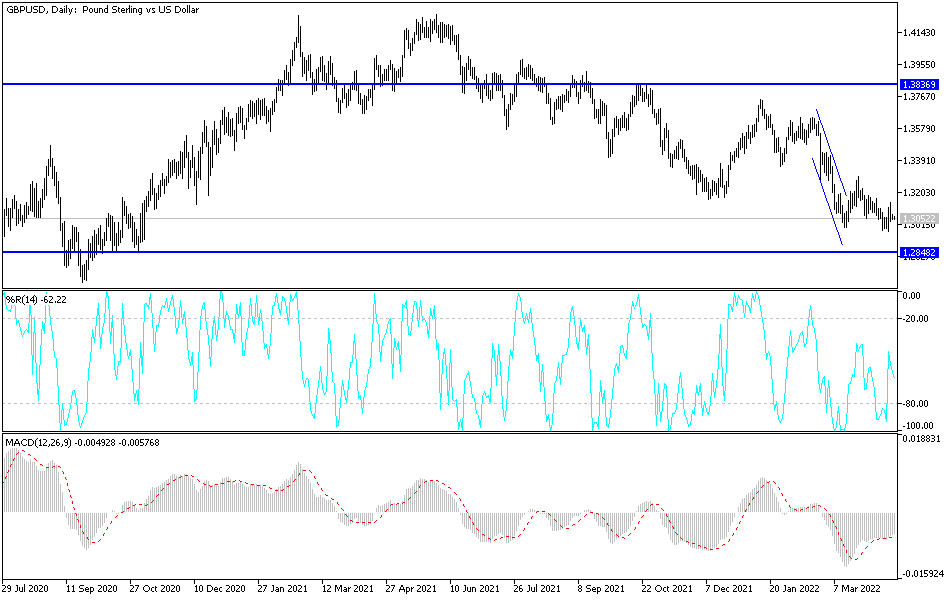

According to the technical analysis of the pair: I indicated a lot in the GBP/USD technical analysis that selling from each higher level is the best trading strategy, which is what happened, and the current decline is the biggest evidence. The closest resistance levels for the pair will currently be 1.2635, 1.2700 and 1.2785, respectively. On the other hand, the 1.2330 support will remain the most important for the return of the bear's control over the performance, as it is in the long run. The recent developments of the post-Brexit round of talks will have the strongest influence on the pair’s trends in the coming period.

As for the economic agenda data: From the UK, the GDP growth rate, the industrial production rate, and the trade balance of goods will be announced, and from the United States of America the CPI reading will be announced.