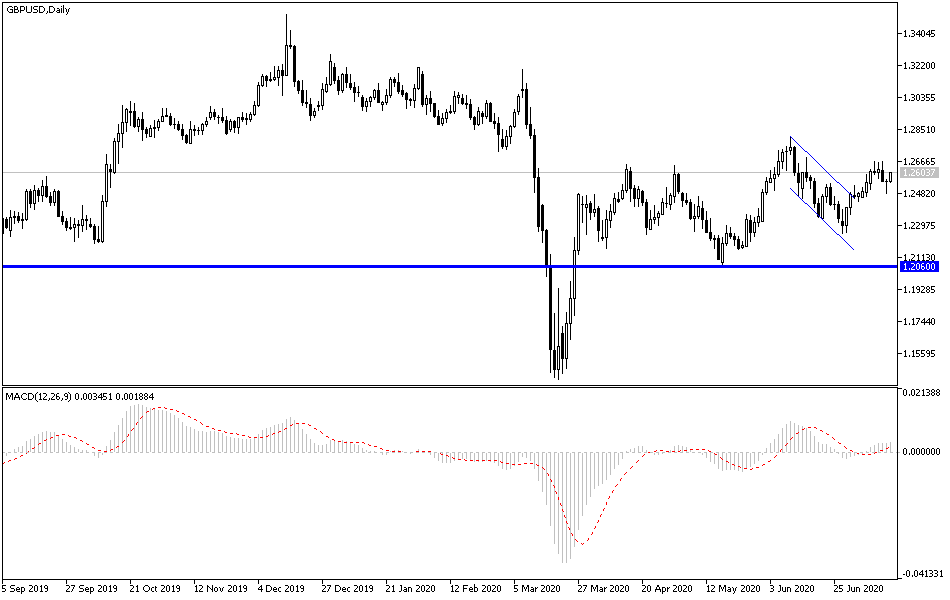

After a recent positive move for the GBP/USD path pushed it towards the 1.2670 resistance, the pair failed for three consecutive trading sessions to overcome that resistance, which is technically an obstacle for the pound in completing the correction pace. What supported this failure was the disappointment among investors from the announced British economic yesterday, which was the reason for the pair's decline to the 1.2480 support before settling around the 1.2580 at the time of writing, and before the announcement of British inflation figures.

The results of the official data showed that the British economy grew by 1.8% in May, which represents a negative surprise for the markets that were expecting the growth rate to reach 5.5%. The data showed that the country's GDP level was still - 24.5% lower than it was in February before the full impact of the Coronavirus crisis was felt. This confirms that the British economy has a hard mountain to climb given that the recovery is 1.8% in May is diminishing due to a drop in GDP by -19.1% in the three months to May, as government restrictions on movement to contain the spread of the epidemic significantly reduced economic activity. The National Statistical Office said that the most damage was a result of movement restrictions throughout the United Kingdom on March 23, 2020.

Commenting on the data, Jonathan Athow, a statistician at the Office of National Statistics, said: “Manufacturing and home building showed signs of recovery as some companies saw employees return to work. Despite this, the economy was still smaller by a quarter in May compared to February, before the full impact of the pandemic”. And added: “In the important services sector, we have seen some rebound in retail, which has seen record sales online, however, with the closure restrictions still in place, many other services remained in recession, with a number of areas seeing more declines”.

Given the size of its strength and its impact on the UK economy, the services sector was a special burden on economic activity in the three months to May. The sustained growth of services for three months decreased - 18.9% in May 2020, after a decrease of - 10.7% in the three months to April 2020. This was driven by declines in almost all of the industry, in particular, Education, which fell - 37.8% as a result of school closures during March, April, and May, and in healthcare, which decreased by - 31.4% as a result of the decrease in activity in the optional operations and the decrease in the number of accidents and emergency visits, and food and beverage service activities, which decreased - 69.3% as a result of the closing of bars and restaurants throughout March, April and May. Wholesale and retail trade, repair of cars and motorcycles, which decreased by 71-%, is mostly driven by lower registrations of new cars.

Production grew 6.0% in May 2020, with manufacturing growing by 8.4%. The manufacturing sector experienced an increase in 11 out of 13 sub-sectors after a significant decline during March and April 2020. Despite the growth in the last month, production growth was 19.1% lower than the previous COVID-19 level in February 2020, with manufacturing declining by- 22.3%.

According to the technical analysis of the pair: As per the performance on the GBP/USD chart, the pair still needs to overcome the last resistance level at 1.2670 in order to complete the upward correction. If that failed, especially with the announcement of any negative development of the path of post-Brexit negotiations, the pair may return to the vicinity of the 1.2330 support, which remains important for the return of the bears controlling performance again. I still prefer to sell the pair from every higher level.

Soon, the British inflation figures will be announced, and from the United States, the industrial production rate will be announced.