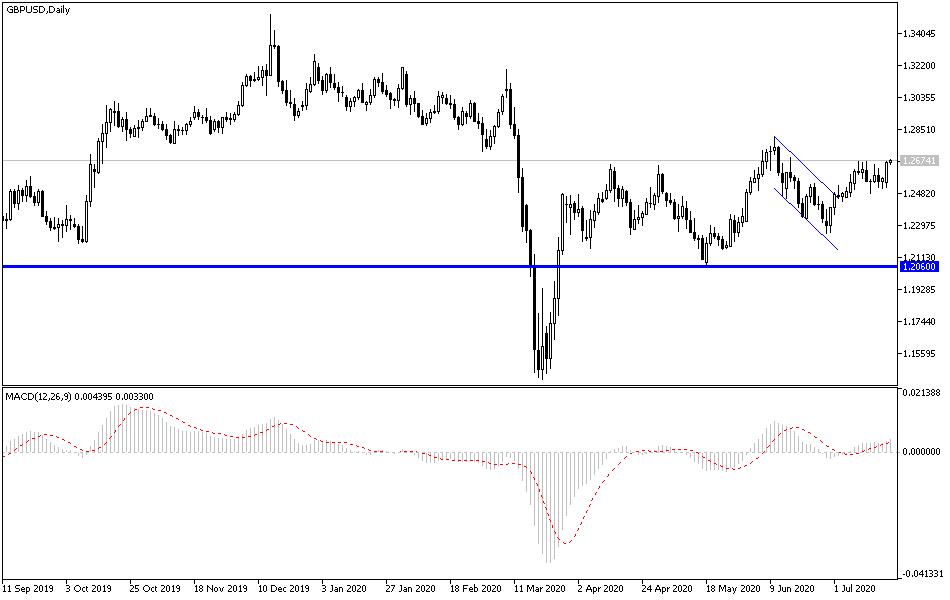

The weakening of the US currency allowed the GBP/USD pair to achieve gains in the beginning of this week's trading and subsequently moved towards the 1.2665 resistance, where it was stable at the beginning of Tuesday's trading. The pair tried in previous trading sessions to overcome the resistance barrier to enable the bulls to control the performance, but it failed amid persistent concern of failure that has become normal for negotiations between the European Union and Britain. Analysts believe that the UK's economic recovery from the COVID-19 crisis seems to be lagging behind that in other global economies, which could create another source of weakness for the British pound in the future.

Derek Halpenny, Head of Research at Global said: “From a Forex perspective, it always comes to relativity, and we can say that the overall relative position of the UK appears to be darker than most other major economies which will further weaken the pound in the future.” The pound will continue to be driven by financial market sentiment, Bank of England policy, Brexit trade negotiations for, and economic data that give insight into how quickly the economy emerges from the Covid-19 crisis compared to other economies.

With fears mounting about a delayed recovery in the UK, this week could see that markets choose to pay more attention to the UK retail sales release on Friday than would normally be the case. As the UK economy relies heavily on consumer spending, the data should give good guidance as to how the recovery has evolved. Markets expect retail sales to rise 8.5% in June, and a win or loss on this number could lead to some near-term fluctuations in the currency. Friday, however, will actually prove to be a crucial day for the British Pound from the economic data perspective, and it also sees the release of PMI data which will give the first experience of how economic activity advanced in July. Crucially, the figures should cover the period in which restaurants, bars, and hospitality were reopened.

Commenting on the expected data, Martin Beck, UK chief economist at Oxford Economics said: “With large parts of the hospitality sector reopening in July, the PMI for this month was supposed to receive a boost. We expect readings of 53.0 and 52.0 for services and manufacturing sectors respectively. If these expectations are met, the British Pound may find itself better supported, and vice versa.”

In a positive development in facing the Corona epidemic, scientists at Oxford University stated that their experimental vaccine for COVID-19 had shown in an early trial to stimulate a protective immune response in hundreds of people who got the vaccine. British researchers began testing the vaccine for the first time in April on about 1,000 people, half of whom had received the experimental vaccine. Such early experiments were designed to assess the safety and know the type of immune response that was evoked, but it could not tell whether the vaccine can really and fully protect. In a study published on Monday in the Lancet Magazine, scientists said they found that their experimental vaccine for COVID-19 produced a double immune response in people between the ages of 18 and 55 and lasted at least two months after their vaccination.

According to the technical analysis of the pair: On the GBP/USD performance chart, the pair will wait for an important moment, which is the success of penetration of the highest resistance at 1.2665, which the pair previously failed to breakthrough, because it will confirm stronger bulls’ control on the performance and thus push the pair towards stronger bullish levels, with the closer ones being 1.2720, 1.2800 and 1.2885 respectively. On the other hand, the breach failure will support the profit-taking sales that might drag the pair towards the support levels at 1.2590, 1.2500 and 1.2445 again, which ends the hopes of the current bullish correction.

For the second consecutive day, the economic calendar has no important economic data, whether from Britain or the United States of America.