With the loss of hope that the two sides of Brexit - the European Union and the UK - will soon reach an agreement that will chart relations between them after the end of the transitional period. This will be at the end of this year, as the GBP/USD pair has returned to correct lower. Its recent losses reached the 1.2511 support, while gains last week did not exceed the 1.2650 resistance. This week, trading will start with stability around 1.2567. We expect the downward pressure to increase on the pair in the coming days. The pressure on the GBP came back after a failed economic recovery in May, according to the results from the Office for National Statistics data, and the Bank of England (BOE) restored concerns about the focus of monetary policy for the future of negative interest rates.

Commenting on the future of negative interest in Britain, Silvana Tenreyro, a member of the Monetary Policy Committee, said that the idea is still under review at the Bank of England, which helps further losses of the pound against the major currencies group, even with a desire for risk among investors.

At the same time, some technical and fundamental analysts point out that GBP/USD price has room to rise above the current levels given the increasingly horrific expectations for the dollar, although stock markets are testing their highest levels in June, the pound will definitely need the continued gains of the stock markets. This will make the price of the GBP/USD dependent on responding to the quarterly earnings figures, which include Tesla on Wednesday as well as Twitter and Amazon on Thursday.

Zach Pandl, Goldman Sachs foreign exchange analyst, sees “an active debate about negative interest rates could become more focused on during the August monetary policy committee, as our economists believe that the Bank of England will revise its estimates to the minimum, perhaps in the form of a qualitative description (” Now moderately negative”). “Given our constructive market expectations in general, we still expect the bullish trend to rise (with a 3-month target of 1.28), but we recognize that discussing the negative interest rate could be headwinds in the near term”.

Goldman Sachs also notes the positive relationship that the pound has with the stock markets that have proven resilient to the second wave of the Coronavirus in the United States, a pandemic that is still growing, with tensions between the world's two largest economies. It has a three-month target of 1.28 pounds. Technical analysts at Scotiabank and Commerzbank are also looking for the GBP/USD to make further gains in the short term, but with the dollar tumbling to a four-month low before earnings reports from some of America's biggest technology names this week.

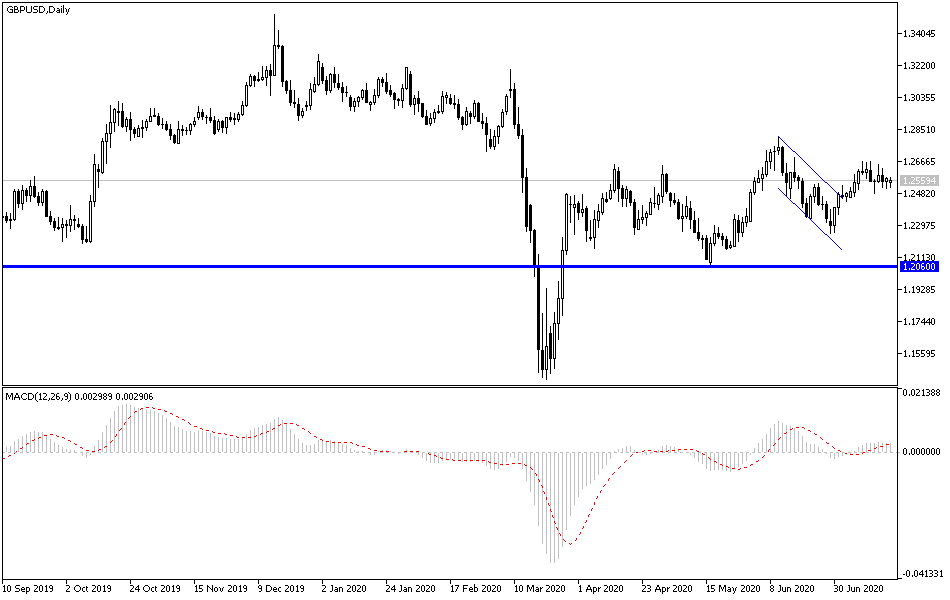

According to technical analysis of the pair: On the daily chart below, it seems clear the neutrality of the GBP/USD pair with more bearish tendency, and stronger control of the bear may occur again if the pair moves towards the support levels at 1.2510, 1.2452 and 1.2370 respectively. To the upside, the break of the 1.2670 resistance will be important to cause a shift in performance towards the upside.

The pair does not expect any important data today, whether from the UK or the United States of America.