GBP/USD performance last week was remarkable, as the pair moved positively towards the level 1.2670 resistance despite the failure of the last round of negotiations between the two sides of Brexit, the European Union, and Britain, and the pessimistic comments by the British Treasury Secretary after announcing the stimulus plans. It appears that investors focused on stimulus plans and ignored these latest concerns. The pair closed the week's trading around 1.2620. This performance is important to complete the bullish correction path. But one must keep in mind that anxiety about the post-Brexit future is still vague and unsure, and therefore the pair's gains may be at risk of collapse at any time.

Trade talks between the United Kingdom and the European Union have not shown any significant results, with the parties indicating that they have not yet agreed on several things. So, there is some small evidence that a decision has been reached on the controversial issue of fisheries. However, it looked as if it was not enough to move forward on the current fisheries issues being discussed. This is because talks finished barely one day after the mentioned progress was made. This was an affirmation that the UK-EU trade talks remain an issue that needs further negotiations. As a result, and according to the political obstacles the UK is currently facing, the outlook for the British Pound remains very cautious as was evident in recent PMI readings.

This week, the cable is to interact with a bundle of UK data, which includes inflation and GDP figures. On the other hand, some believe that the British pound is highly expected to witness a silent reaction, as the information provides a backdrop to the country's economy. As expectations are still far from the possibility of a "V-shaped" recovery. The focus will also be largely on the Bank of England speakers; Bank Governor Andrew Bailey and Bank member Silvana Tenreyro.

The negotiators will meet in Brussels this week to try to make more progress, and we believe that the update either on Thursday or Friday will be a key moment in the British pound's expectations in the near term. As for the US dollar, it still interacts with the number of new coronavirus cases, the decisions of the US government regarding the situation, and the possibility of closure or containing the situation.

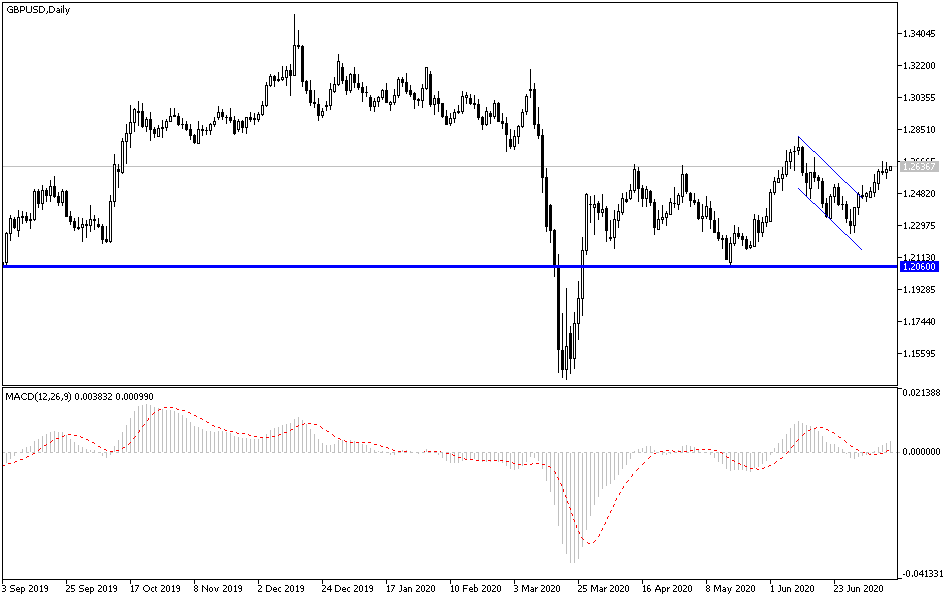

According to the technical analysis of the pair: On the daily chart, there is a clear break of GBP/USD downtrend, and its success in testing the resistance at 1.2800, which was recorded on the 10th of June, will be important for stronger bulls control. On the downside, as mentioned before, the 1.2330 support is still important for the continuation of the bearish momentum, which is still stronger in the long run. I still prefer to sell the pair from every upper level.

The pair will interact today, and with the beginning of this week’s trading, with the forthcoming statements of the Governor of the Bank of England. Any hint of the possibility of adopting negative interest rates will lead to a rapid collapse of the pound's gains.