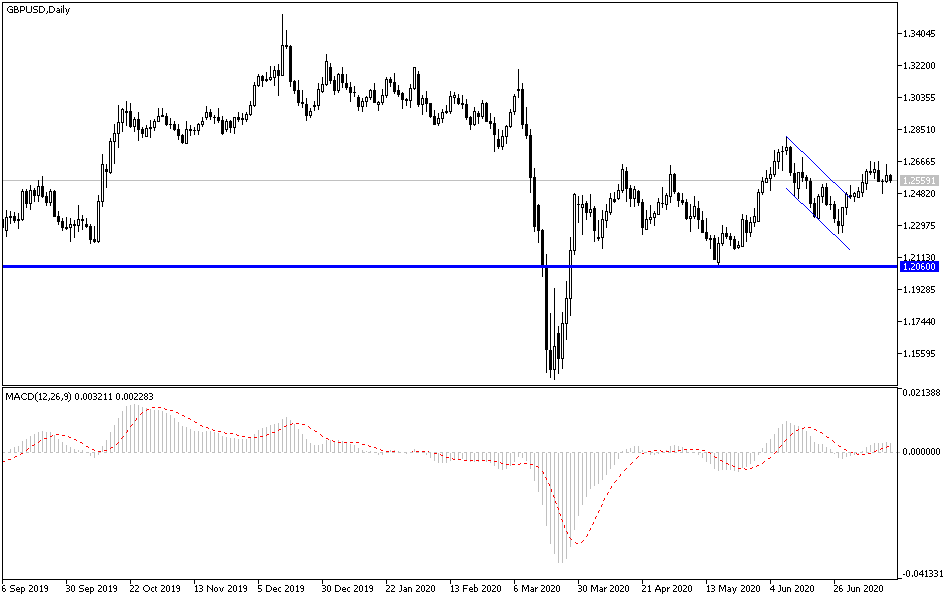

With the end of the week nearing, markets are awaiting updates regarding what happened in the new round of negotiations between the two parties of Brexit- the European Union and the UK. In the last rounds, negotiation ended before the due date, confirming the depth of differences between the two, which puts a negative impact on the GBP. During yesterday's trading, the GBP/USD pair rebounded to the 1.2650 resistance and quickly returned down to the 1.2573 level at the beginning of Thursday’s trading. The volatility in the pair’s performance is very clear in the recent period, besides the anxiety of Brexit, cases of COVID-19 are increasing in America. The variation in the British economic data results, which confirms the need for more stimulus than what was announced recently by the Conservative government.

On the economic side, the UK consumer price inflation accelerated unexpectedly in June for the first time this year. Data from the Office for National Statistics showed that consumer price inflation rose to 0.6 percent from 0.5 percent in May. The rate was expected to slow to 0.4 percent. The outlook was alarming for a 0.2 percent drop, and consumer prices rose 0.1 percent after remaining unchanged in May. Excluding energy, food, alcohol, and tobacco, the core inflation rate rose to 1.4 percent from 1.2 percent in May. The price was expected to remain unchanged at 1.2 percent.

Prices of toys and clothes made upward contributions to inflation, while food prices made a downward contribution in June. Another report issued by the Office of National Statistics also showed the production prices fell by -0.8 percent year on year, slower than a decrease of -1.2 percent in May, and the expected drop of -1.1 percent. This was the third consecutive month that the price was negative.

On a monthly basis, the production prices increased by 0.3 percent, reversing their 0.2 percent decline in May. Economists had expected a 0.2 percent monthly growth. This was the first time that the monthly rate had been positive since January 2020, the highest since July 2019. Input prices decreased 6.4% year on year in June compared to a 9.4% decrease in May. Economists had expected a 6.5 percent drop. On a monthly basis, input prices rose 2.4 percent in June, faster than the 0.9 percent gain recorded in May, but slower than the 3 percent growth economists had expected.

Prior to that data, investors had welcomed news of vaccine development by Moderna to combat the Covid-19 virus. The company said its potential vaccine for Covid-19 provided a strong immune response at an early stage of human experience, which boosted market sentiment.

According to the technical analysis of the pair: The recent move proves the strength of our view towards selling the GBP/USD pair from each upper level, the developments of the Brexit negotiations and the success of the European summit will have a strong impact on the pair's performance. The further stimulus may support the next upward move towards 1.2670, 1.2760, and 1.2940 levels, respectively. The failure of the Brexit negotiations and the failure of the European summit may give the bears enough momentum to control the performance, thus moving the pair to the support levels of 1.2480, 1.2390 and 1.2255, respectively.

As for the economic calendar data today: There will be statements by the chief economist at the Bank of England, Haldane. From the United States, retail sales, unemployed claims, and the Philadelphia Industrial Index will be announced.