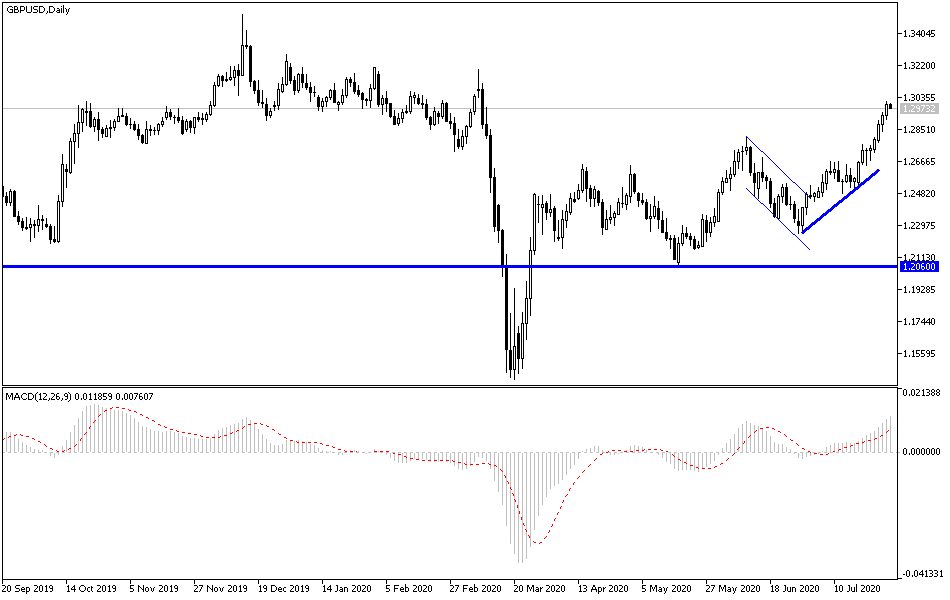

Almost a month ago, it was highly unlikely that the GBP/USD could reach the 1.3000 psychological resistance, as the pair was moving inside a bearish channel that pushed it towards the 1.2257 support at the time. Now, with the last sessions of July, the pair succeeded in overcoming this important resistance, achieving stronger bulls’ control on performance due to the continued collapse of the US currency and the improvement of British economic data readings, which confirmed that the British economy will not be far behind the path of other global economies in the path of recovery from the consequences of a coronavirus. All of this was offset by concern about the future of relations between the European Union and Britain, amid a continuous failure of a series of meetings between the two sides that did not result in any final agreement.

As for the global Coronavirus developments, the British government came under pressure due to tightened travel policies after criticizing its sudden decision to remove Spain from its safe list, a sudden change that affected many holiday plans and shooked the troubled travel industry. In the same measures, London Heathrow Airport urged an increase in COVID-19 testing and advised largest tour operator in the UK to take a more regional approach to quarantine. For his part, Minister of Culture Oliver Duden played down the chances of any change, arguing that "there is no applicable alternative”

The change has disrupted the plans of many British families currently in Spain or planning to travel there this summer. It is another blow to the travel industry, which is trying to save something from the summer. Spain is traditionally the top destination for British holidays - with almost 18 million people going there in 2019 - resorts such as those on the Costa del Sol or the Balearic island of Majorca depend heavily on British tourism.

Although the UK has the highest official number of coronavirus-related deaths in Europe by nearly 46,000, new daily infections are stable around 700. Spain, which suffered severely during the epidemic with more than 28,000 deaths, saw a sharp rise in cases over the past week or two towards a 7-day progressive average of around 1,900 a day.

From the United States of America, and in a widely expected move, the Federal Reserve announced that interest rates will remain at near zero levels amid the economic hardships posed by the Coronavirus pandemic. Accordingly, the Fed said that it had decided to keep the interest rate target at zero to 0.25%, as it has maintained it since the interest rate cut on March 15. The accompanying statement indicated that economic activity and employment have recovered somewhat in recent months after sharp declines, but are still well below their levels at the beginning of the year.

This is partly due to the recent improvement in public finances, along with policy measures to support the economy and the flow of credit to American families and companies. The bank also reiterated that it remains committed to using a full set of tools to support the US economy in this difficult time.

According to the technical analysis of the pair: The bullish momentum of the GBP/USD pair is still continuing, crowned by the movement towards the 1.3000 resistance. We noted in the recent technical analyzes that reaching that level will move technical indicators to overbought areas, and investors may think of activating the profit taking orders. This trend is reinforced by the continuous failure of the negotiations between the two sides of Brexit to reach an agreement that maps out the features of their relations after the end of the transitional period. If that happens, the pair's closest support levels will be 1.2935, 1.2875 and 1.2790, respectively.

For today's economic calendar data: There are no significant UK economic releases today. All focus will be on US data, gross domestic product growth and weekly jobless claims numbers.