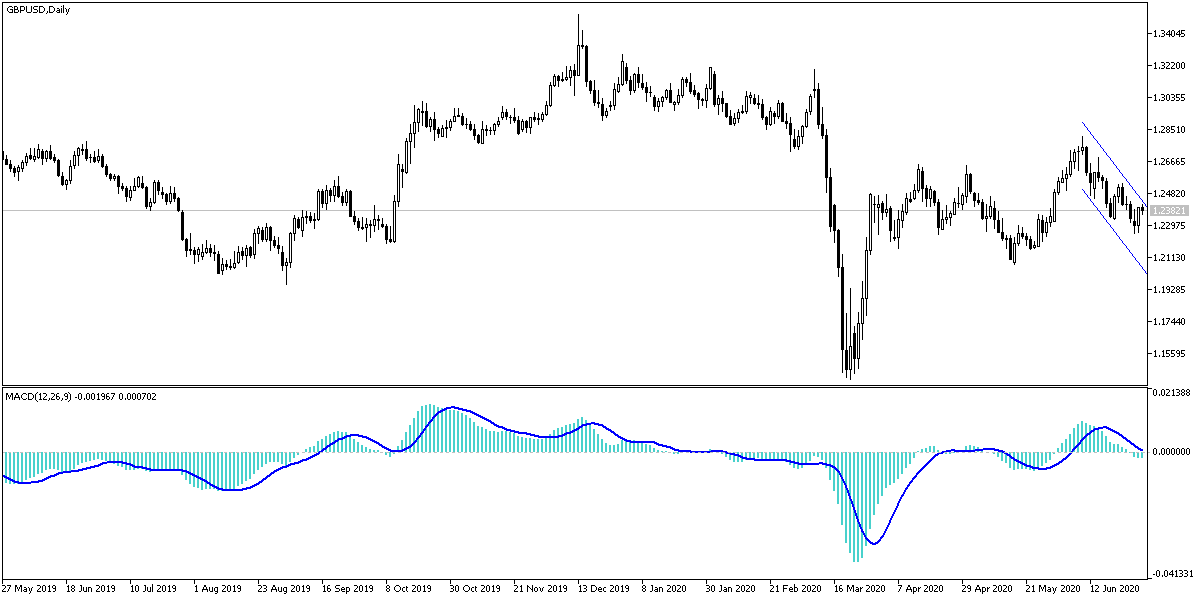

The last trading session in the first half of 2020 was good to the GBP/USD performance in a way that attracted the attention of Forex traders as the pair moved towards the 1.2400 resistance, starting from the support level 1.2257 and settling around the 1.2397 in the beginning of today’s trading. I have to take into account, as I had expected a lot in the past that the GBP gains will remain a selling target, as worries about a bleak future for Brexit remain.

European Union chief negotiator Michel Barnier has warned UK financial services companies that they should make rapid preparations to ensure they are ready to lose EU passport rights by January 1. Barnier told the European General Assembly that financial parity is not part of the current negotiations. The course of trade negotiations and -the UK's existing obligations to deviate from EU rules and regulations - mean that UK-based companies will not be able to operate without restrictions in the European Union.

Britain has a large financial services industry that provides a trade surplus for the country (as it earns more foreign exchange than it pays), and the pressure placed on the sector by Brexit has long been a concern. Barnier also added that UK-based companies would therefore need to ensure a legal presence in the European Union in order to continue trading within the bloc.

As for the future of companies, Barnier said, “This means that you need to prepare for January 1, 2021! We now know that the transition period will not be extended. The European Union was open for extension, but the United Kingdom refused. That is the UK’s choice. ”

On the economic level. The Office of National Statistics (ONS) revised its estimate of Britain's GDP in the first quarter to a lesser rate. The office also announced that household spending fell -2.9% in the opening quarter of the year, a decrease from earlier estimates with a decrease of -1.2% which raised the household savings rate from 6.6% in the last quarter of 2019 to 8.6% in the first three months of the year . When combined with production losses from the services, production, and construction sectors, the decrease in spending was sufficient to drive a -2.2% drop in first quarter GDP, a decrease greater than the -2% reported first.

Commenting on the pessimistic figures, Thomas Bugge of Capital Economics said: “The 2.2% contraction year on year in gross domestic product in the first quarter of 2020 was the largest combined decline since 1979 and paves the way for an unprecedented fall in the second quarter.” “Surveys indicate that output recovered faster than previously expected in May and June, and that the risks to our second-quarter GDP forecast from a drop of - 23.0% are highly likely to be higher. The British economy may remain so until 2022 before regaining its pre-crisis level. ”

The data confirm that Britain's path towards recovery has grown for a longer period, and that the bill for damage caused by Covid-19 is much larger than expected.

According to the technical analysis of the pair: I still prefer selling the GBP/USD pair from each higher level and the most appropriate selling levels are currently 1.2400, 1.2465 and 1.2520, respectively. Concerns about the future of Brexit continue, and the intensity of the negotiations between the two sides increases with the approaching end of the transitional period, which Britain has absolutely no desire to extend. British economic releases confirm the severity of the damage caused by the pandemic. On the other hand, there is an improvement in the American economy, although the United States is the first in the world in terms of cases and deaths. However, the US stimulus is quite huge compared to any other economy. As I mentioned earlier, the 1.2320 support will remain supportive for the bears to push the pair to stronger bearish levels.

As for the economic calendar data today: From the UK, we have the reading of the British Industrial Purchasing Managers' Index, then the US ADP releases the change in the numbers of non-agricultural jobs, the ISM Manufacturing PMI and the content of the Federal Reserve’s minutes of their last meeting.