GBP/USD: Bulls need more momentum to break resistance

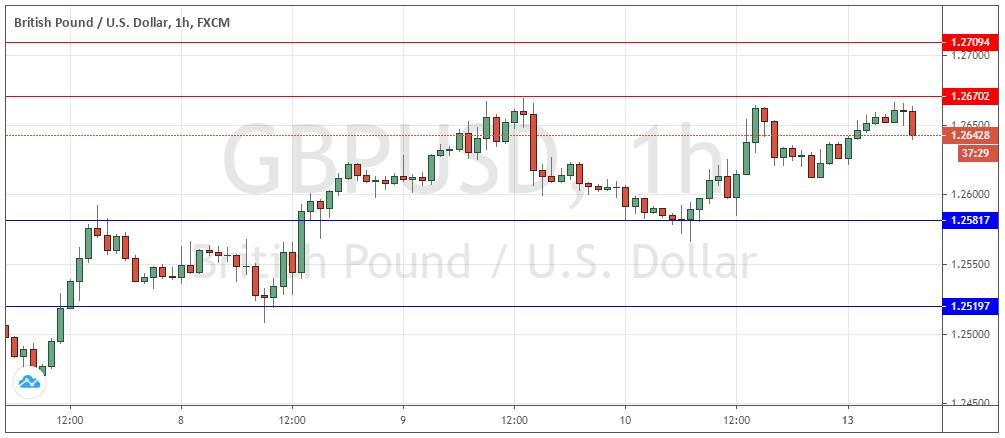

Last Thursday’s signals produced a profitable short trade from the bearish doji candlestick which rejected the resistance level identified at 1.2670 to the pip.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered before 5 pm London time today only.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2670 or 1.2709.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2582 or 1.2520.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that we had bullish signs of the price trading well above 1.2600, and the Pound performing more positively than the Euro.

However, I also thought that bulls should be cautious as the 1.2650 area acted as pivotal resistance earlier in the year, so what happened next in this 1.2650 to 1.2750 area should tell us a lot about the strength of this bullish movement.

This was a good call as we saw the resistance level at 1.2670 hold. The price has again got very close to it, but again seems to be making a bearish reversal.

If the price cannot get established above 1.2670 today, there is an increasing chance of a deeper bearish retracement, and we may see the price hit 1.2582 later.

I am prepared to enter either a long trade from a firm bullish bounce at 1.2582, or a short trade from a bearish reversal at a retest of 1.2670.

Concerning the GBP, the Governor of the Bank of England will be giving a minor speech at 4:30pm London time today. There is nothing of high importance scheduled today regarding the USD.