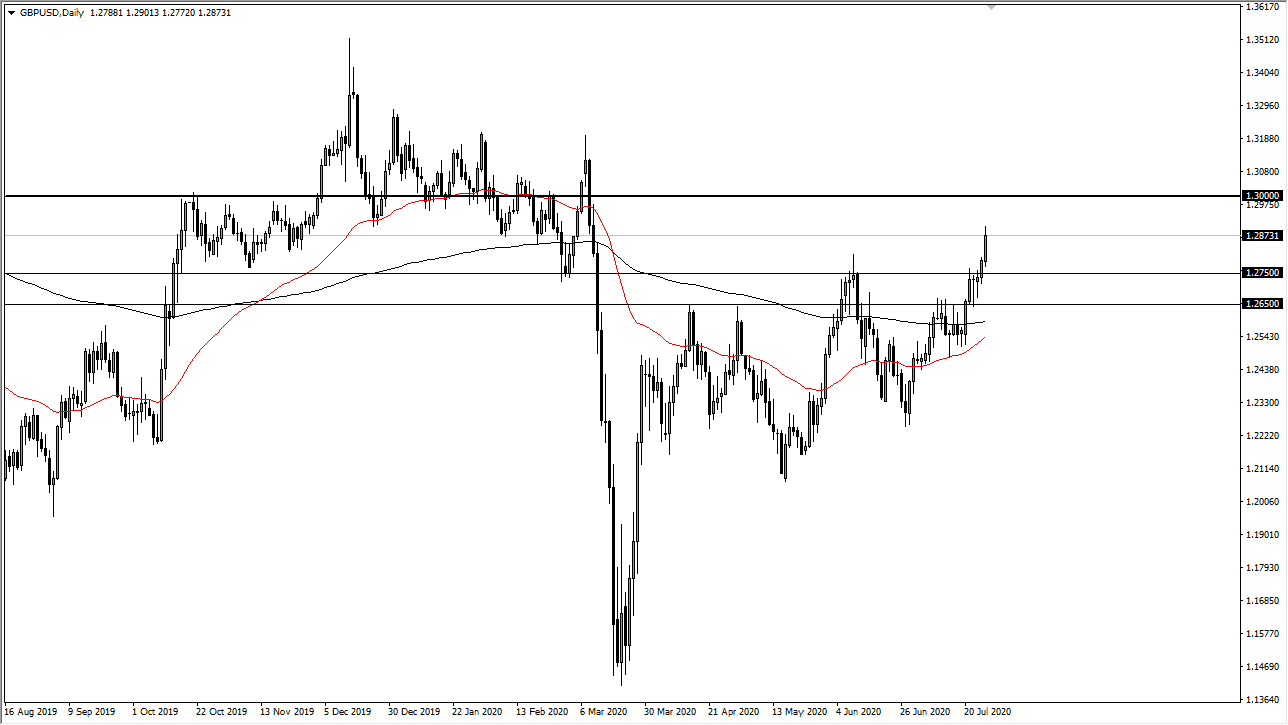

The British pound rallied significantly during the trading session on Monday, breaking towards the 1.29 level. At this point, we will probably get a short-term pullback, but that pullback should be thought of as a buying opportunity. Clearly, the US dollar is getting crushed and the British pound is a benefactor of this. Looking at this chart, the 1.2750 level has significant support, and I think that support extends down to the 1.2650 level. That is a “zone of support”, and I think it is only a matter of time before we find some type of support if we drop down to that level.

My target is the 1.30 level, but I do believe we can break above there given enough time. Looking for value is probably the best way to go, and shorting is all but an impossibility unless something changes fundamentally with the US dollar. I doubt that happens anytime soon, so it is likely that we will find plenty of buyers regardless of what happens next. If we do break above the 1.30 level, and I do think we do eventually, we then go looking towards 1.3150 level.

The British pound still has to deal with Brexit and a whole handful of issues, but obviously that is not what the market is paying attention to right now. The candlestick does look like a breakout candlestick and I think that it is only a matter of time before we continue the overall momentum. In fact, momentum is one of the biggest movers in the Forex markets are now, as we have seen time and time again.

If we were to break down below the 1.25 handle, then it could change some things when it comes to the British pound, but that seems to be very unlikely. I think we will continue to see a lot of the same choppy upward motion that has been the main feature of this market. Quite frankly, I welcome pullbacks as they give me an opportunity to pick up the British town “on the cheap.” Now that we have seen the US dollar finally get beat backed by the Federal Reserve, we may be beginning multitier trends in several currencies, including the British pound. There is a whole host of fundamental issues out there, but price tells us one-story, while a lot of fundamental analysis tells us differently. You are better off following price.