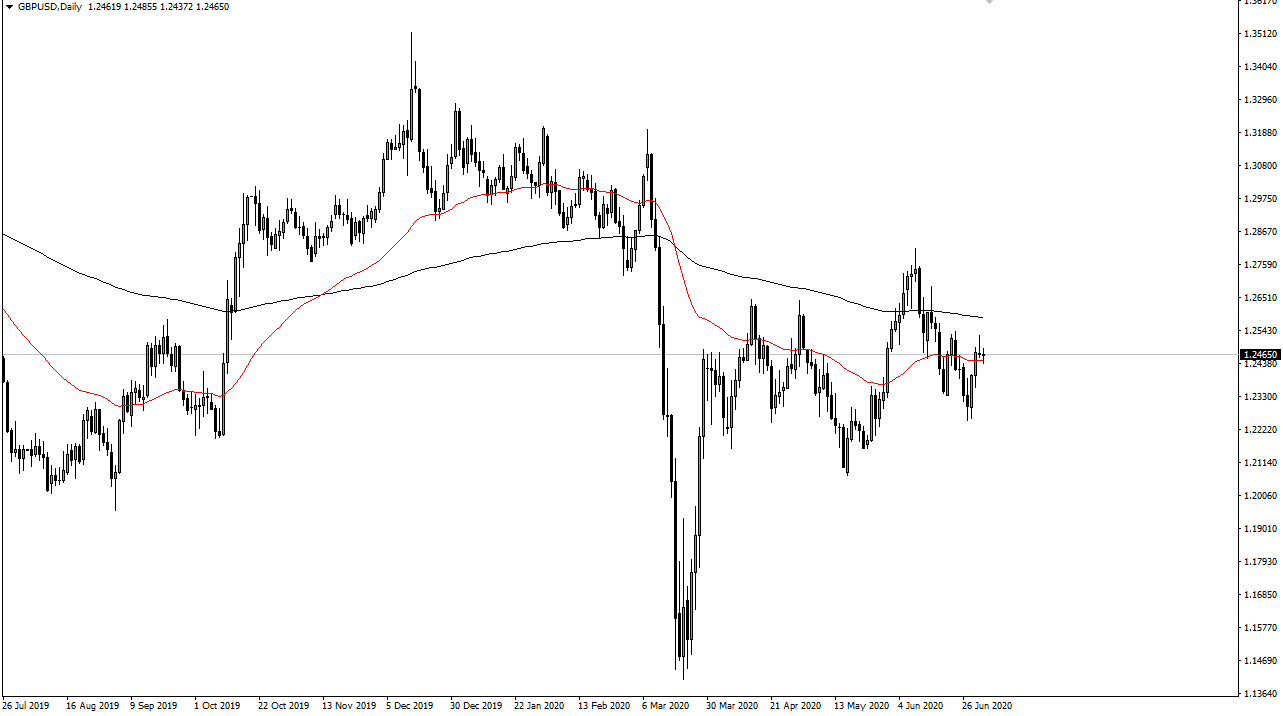

The British pound did little during the trading session on Friday, as we are dancing around the 50 day EMA. Keep in mind that the Americans were celebrating Independence Day so there was not a lot in the way of liquidity coming from North America. The candlestick is very neutral, and it does follow a shooting star so it is likely that we will eventually roll over. A break down below the bottom of the candlestick for the trading session on Friday opens up a move down to the 1.23 level, perhaps even the 1.22 level.

To the upside, I see a significant amount of resistance near the 1.26 level which also features the 200 day EMA. With that, there is a lot of noise in this overall region, so it would not be surprising at all to see this market pull back. On the other side of that coin though, you can see that the market has made a “higher low” as of late, so to get a bigger move, we need to see the low from earlier in the week taken out to the downside. Otherwise, we will probably chop back and forth more than anything else. I think that is probably more likely the case than not because we have so many different things moving at the same time. We have Brexit, the global economic situation slowing down, the US/China trade tensions, and a whole list of other things like the coronavirus. If we go rushing toward safety, that generally will help the US dollar, the only thing that I think is keeping money away from the US dollar and the safety of the treasury market is probably the Federal Reserve printing as many US dollars as they can.

If we can break above the 200 day EMA, then we go looking towards 1.2750 level, followed by the 1.30 level. Looking at this chart I can make an argument for both, based upon the technical analysis. We are clearly headline-driven though, so expect some type of panic in one direction or the other eventually, and keep these levels in the back of your mind as far as the 200 day EMA is concerned, the 1.2750 level is concerned, the 50 day EMA, and the 1.23 level. We will continue to see a lot of “push-pull” in this pair as we have seen in the line of markets worldwide.