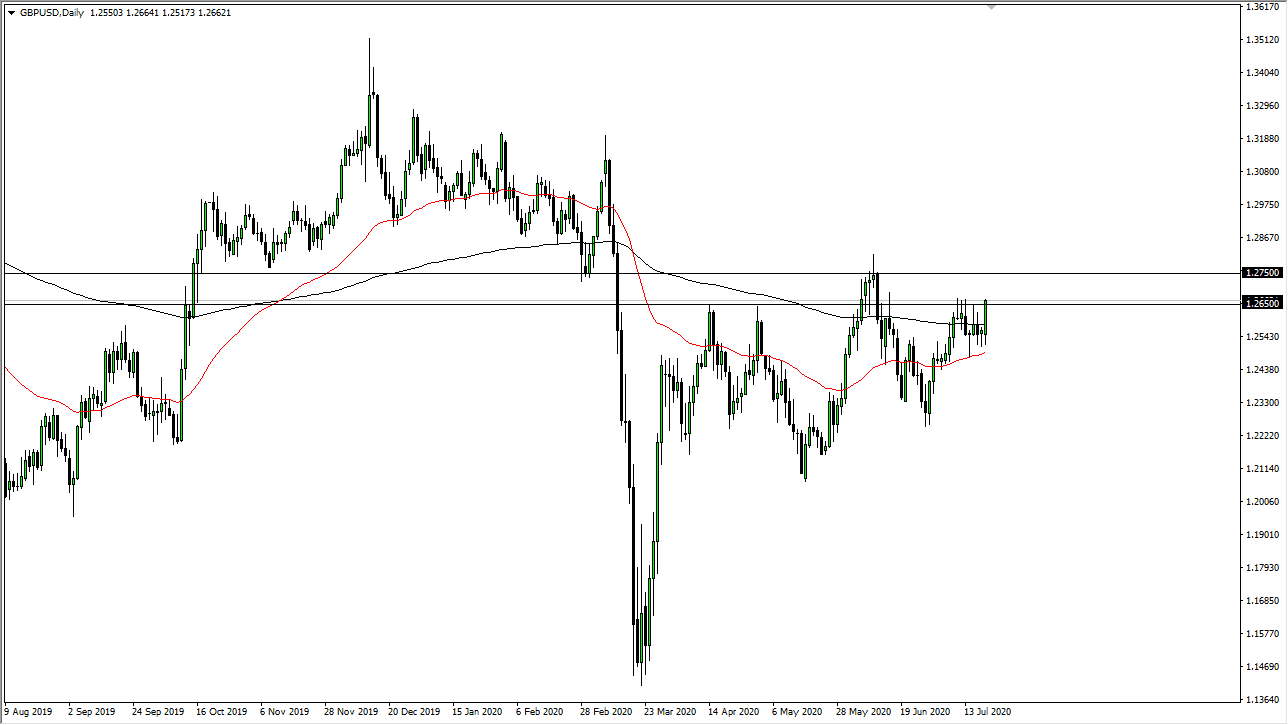

The British pound has initially pulled back a bit during the trading session on Monday but then shot straight up in the air to break above the 1.2650 level. At this point, I think there is plenty of resistance between there and the .2750 level, an area that has been crucial for this pair. Breaking above the 1.2750 level opens up a move towards the 1.30 level above. The 1.30 level above is a major round figure that will attract a lot of attention but at this point, I do think that eventually where we go looking. This is especially true considering how the market closed at the very highs of the candlestick for the day, and that is something worth paying attention to as it typically leads to follow-through.

That does not necessarily mean that we will get some type of pullback today, but I think that there will be plenty of value hunters underneath to take advantage of this, especially near the 200 day EMA, and most certainly near the 50 day EMA, which is painted in red on my chart. I have no interest whatsoever in trying to short this market, as we have seen the market continue to be so resilient. In fact, as I record this it looks like we are getting close to breaking the “micro triple top” at the end of the session. I do not know that we do right away, but I would fully anticipate that sometime during the Tuesday or Wednesday session that does in fact happen. Once it does, there will be a lot of short covering and it is all but a foregone conclusion that the 1.2750 level will be targeted.

To the downside, if we were to break down below the 50 day EMA it would change a lot, but I do not see that happening anytime soon. The resiliency has been something to behold, so at this point, it is difficult to imagine a scenario where the US dollar suddenly crushes the British pound, unless there is a major “risk-off” type of move around the world based upon a headline. (Full disclosure, that is entirely possible but not as likely.) At this point, I think you should buy short-term dips in the British pound against the US dollar and continue to watch the pressure buildup before the massive breakout that is almost certain to happen.