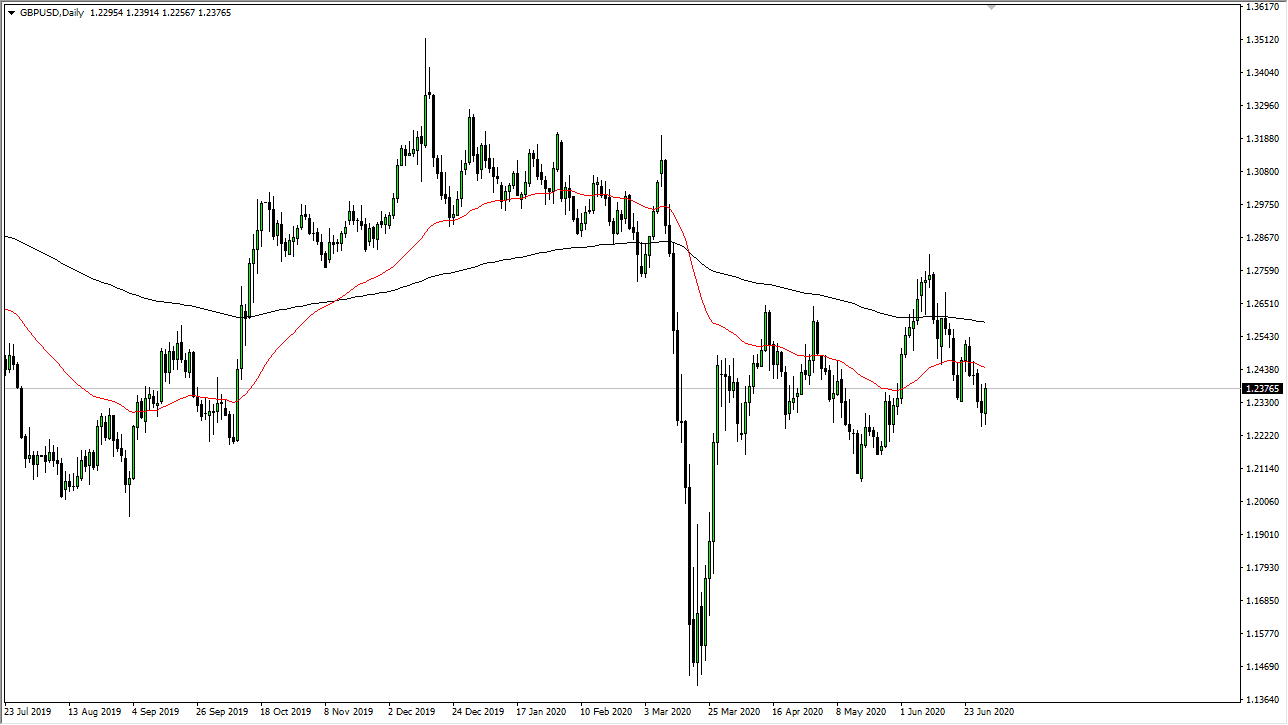

The British pound initially pulled back during the trading session on Tuesday but found enough support underneath the turn around and rally. The rally looks rather impressive, as we have closed towards the top of the candlestick. This may be because the British economy has outperformed the expectations of the Bank of England, so therefore we would have had a bit of a “knee-jerk reaction.” Having said that, it is still functioning on life-support of sorts, and of course there is Brexit that has to be worried about. The 50 day EMA is just above and that of course shows signs of resistance, so I do think that there will be sellers between here and there.

Even if we broke above the 50 day EMA, it is likely that the market will find plenty of support between there and the 200 day EMA. This is a zone of support and resistance that quite often causes reactions in the market. At this point, I think it is a bit premature to think that the British pound is suddenly going to turn around and start rallying again, but overall, I think that the market will continue to be noisy in general, so keep that in mind. The British pound will have a lot of headline risks out there, as the market has been throwing this market around. Because of this, the volatility is something that people need to pay attention to, so therefore you can keep your position size a bit lower in order to protect your account. The market is one that I like fading on short-term rallies, and it is possible that we had recently reached the bottom of the most recent leg lower. However, if we were to turn around a break down below the candlestick from this session, then it is likely that the market goes down to the 1.21 level.

I think one thing you can count on is a lot of volatility in this market, as the British pound has to worry about the Brexit, the UK economy slowly opening up, and now we are starting to see certain cities in the United Kingdom perhaps close back down. With that in mind, I think it is probably only a matter of time before the sellers come back. If we get some type of shock to the system, then we will probably see buyers jump in and start buying US Treasuries.