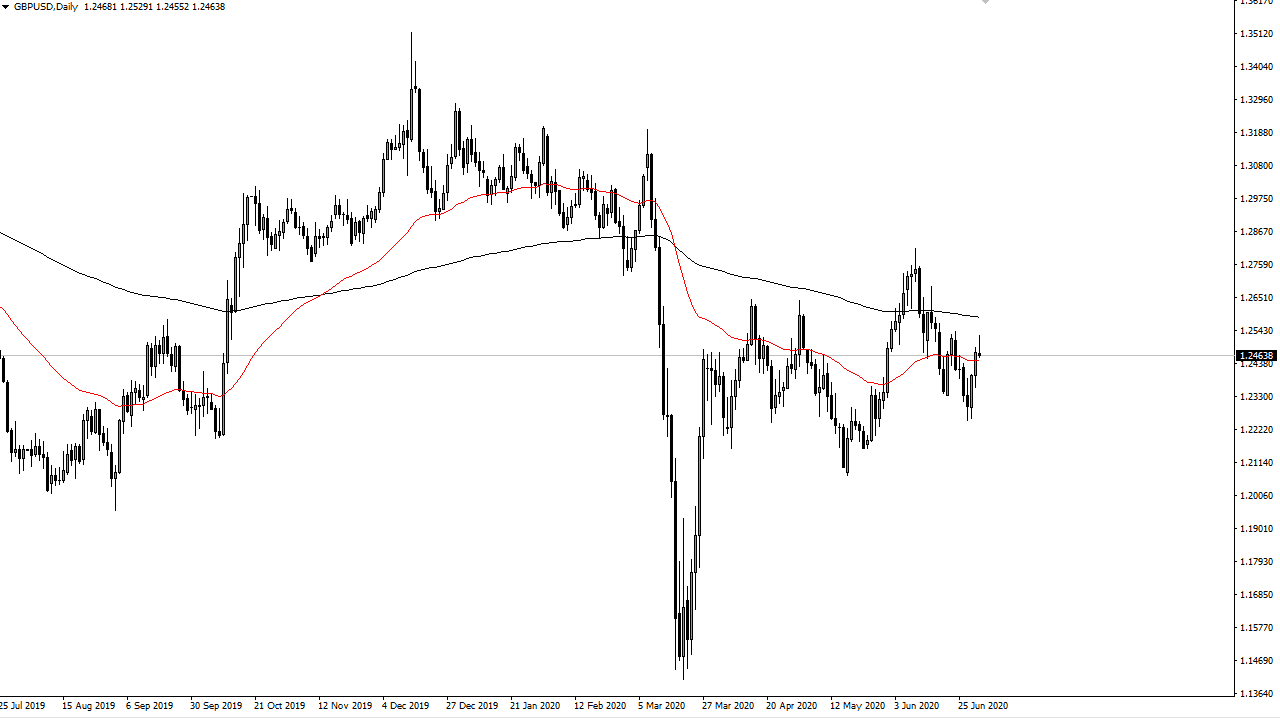

The British pound initially tried to rally during the trading session on Thursday but rolled over as the US jobs number came out much better than anticipated. In other words, it is very likely that the traders started to favor the greenback as we went into the Independence Day weekend, and therefore it is possible that the traders that had picked up the British pound over the last couple of days simply collecting profits. However, at the end of the day we ended up forming a bit of a shooting star and that of course is a negative candlestick. With that in mind, I do think that the British pound probably rolls over yet again.

The other scenario could be that we break above the top of the shooting star for the Thursday session which would of course be a very bullish sign. At that point, we would probably go charging towards the 200 day EMA which is closer to the 1.26 handle. Having said that, we are between the 50 day EMA and the 200 day EMA, an area that typically causes a bit of support or resistance depending on what direction we come from. It would make sense that we will sell off in this area because a lot of traders will be paying such close attention to it.

To the downside, if we break down below the bottom of the candlestick and of course if we break down below the 50 day EMA, then I think we go looking towards 1.23 level. Keep in mind that Friday is a holiday in the United States, so therefore the liquidity will be a bit thin during a large portion of the day, and by the time London goes home it is highly likely that the markets will be all but stopped.

I think that the British pound continues to be very difficult to trade in general, as there is a lot of volatility out there looking to cause major issues in the form of negative coronavirus figures, the economic condition around the world, and of course Brexit which is still a huge question at this point, and we have no idea what that is going to bring at the end of the day. As things stand right now, it is highly likely that we will continue to see more of a “hard Brexit” that will cause major problems.