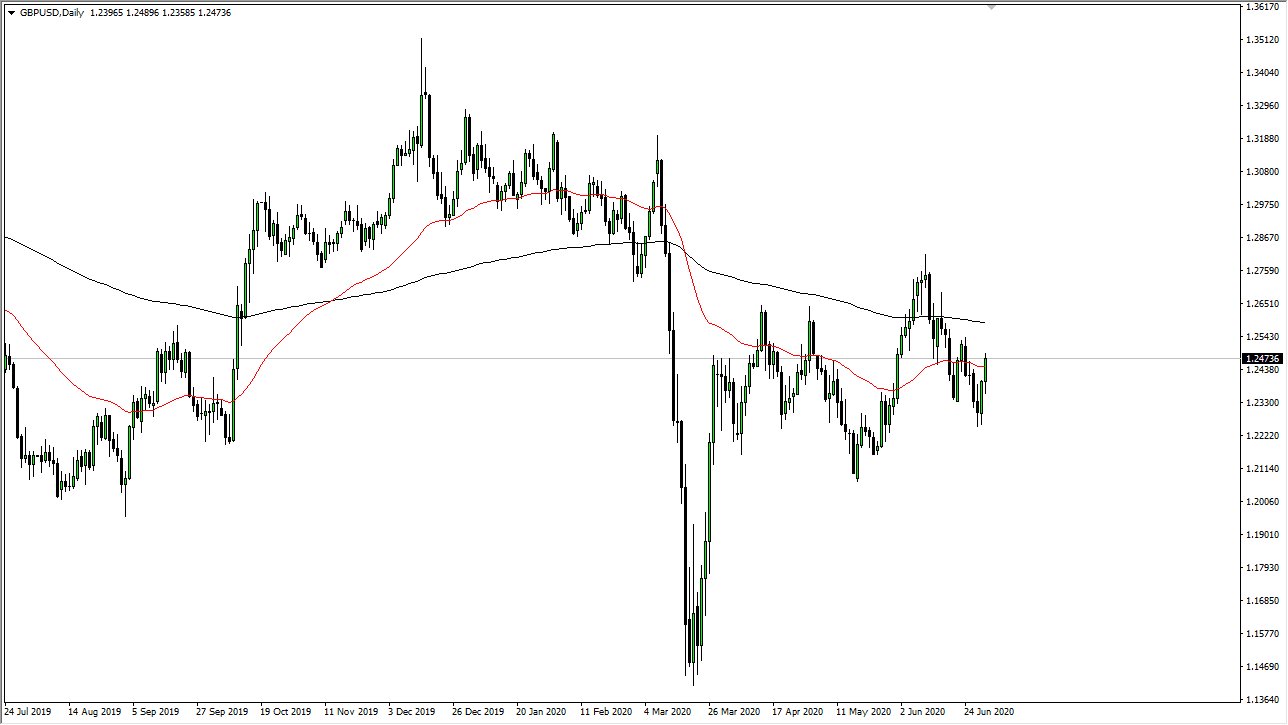

The British pound has rallied quite significantly yet again on Wednesday, as we have seen quite a bit of buying pressure to slice through the 50 day EMA. However, there is a lot of resistance in the form of the 1.25 handle and we have the Non-Farm Payroll figure coming out during the day on Thursday which will greatly influence where the market goes. The British pound has a lot of things to concern itself with, and it seems as if the Prime Minister is now going to change his spending habits. That being said, spending more is only a short-term stimulus type of situation, and at the end of the day it probably leads and more negativity for the British pound over the longer term.

If we were to turn around a break down below the 50 day EMA again, it is likely that we go looking towards the 1.22 level given enough time, and then perhaps even the 1.21 level. I am still relatively bearish on the British pound, but obviously we need to see some type of exhaustion to start shorting again. This has been a strong and significant move to the upside, and it looks likely that we are going to have a bit of follow-through considering how we have closed so bullishly.

At this point in time, I think that the 200 day EMA is also going to offer resistance, so I think it is only a matter of time before we get a selling opportunity. However, if we clear the 200 day EMA that it is obvious that the British pound will continue to go much higher. I believe that the British pound has a lot of concerns swirling around it when it comes to Brexit, and the reopening of the economy which seems to be lumpy at best. Furthermore, we have the Non-Farm Payroll figure coming out and we could see a sudden rush into the US dollar depending on how that plays out. With this, I like the idea of fading rallies that show signs of exhaustion but quite frankly we just do not have it right now. I think we are going to continue to see a lot of noise, and therefore you have to be willing to accept the fact that this is a market that is going to remain exceedingly difficult to trade as it has been for several months.