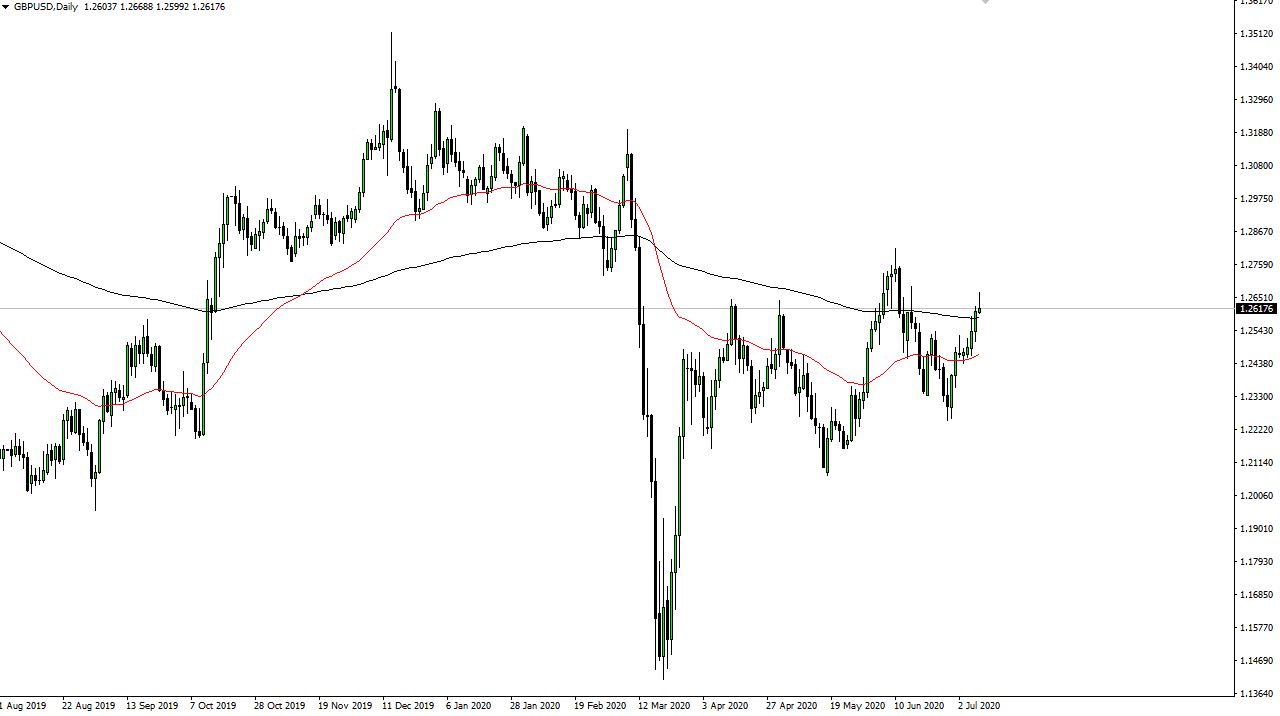

The British pound rallied initially during the trading session on Thursday but gave back quite a bit of the gains in order to form a bit of a shooting star. The shooting star of course is a negative sign, but we have cleared the 200 day EMA, meaning that certain long-term traders will be willing to throw money into this market again. When you look at the most recent lows, they are all higher than the one previous to it, so that is also something that you can put in the “positive column.”

The British pound itself is a bit of an enigma for me, because it has a lot of headwinds, but it appears that the market is looking past most of them. Yes, the United Kingdom has reopened its economy, but there are still pockets in the UK that could cause major issues as far as disruption is concerned. Beyond that, traders need to worry about Brexit going forward, as there is still a lot of uncertainty when it comes to that potential problem. With that being the case, it is not surprising at all to see this market pull back a bit. I think if we break down below the 200 day EMA we could get a test of the 50 day EMA underneath. Ultimately, I do believe that there are buyers underneath waiting to get involved so although this looks like a pullback just waiting to happen, I am a bit reticent to start shorting the British pound. If I want to buy the US dollar, I will do so against other currencies not one as strong as this one. On the other hand, if we broke above the top of the shooting star for the trading session on Thursday, that would be a sign that we are going to continue to go towards the 1.2750 level. One thing is for sure, the British pound has shown itself to be extraordinarily resilient, so I am not necessarily looking to get aggressively short of it anytime soon. I can give you 100 reasons why this market should fall, but it does not seem that the market cares and that is really all that matters. I have no interest in trying to fight what has been an absolutely stubborn market, so if I see this pair breakdown I will probably short something like the Australian dollar or the Euro.