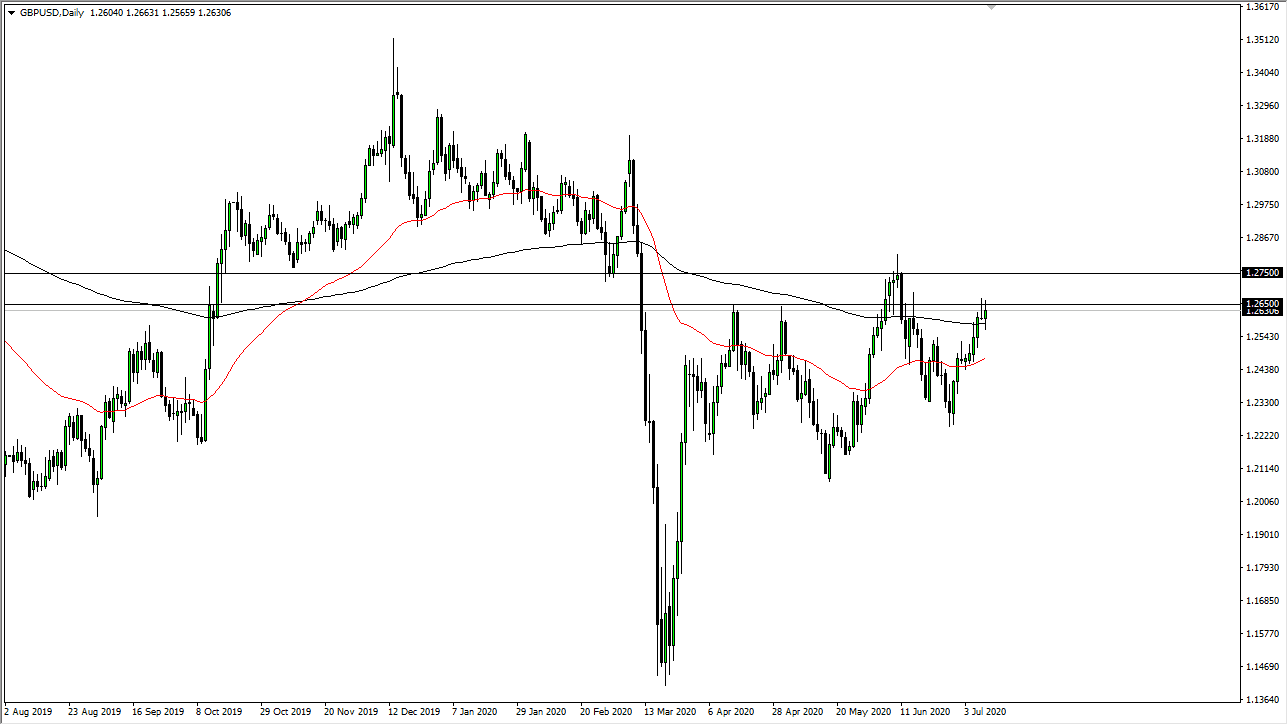

The British pound had an interesting trading session, initially dropping during the day on Friday, and even piercing below the 200 day EMA. After that, we turned around to show signs of strength and test the top of the candlestick from the Thursday session. If we can break above the Thursday session candlestick, then it is likely that this market goes much higher, reaching towards the 1.2750 level. That is an area that has been resistive in the past and therefore it should be paid close attention to.

The one main take away I have from the British pound over the last several weeks has been the fact that it simply does not seem to want to rollover. The British economy is strengthening due to the fact that we are finally opening up after the coronavirus lockdown, although it is going somewhat slow. It is interesting because it was not that long ago where Brexit was the only thing people cared about. Now it seems as if the market has completely forgotten about it.

One of the main drivers of this market going higher would probably be the Federal Reserve. They are throwing too much liquidity into the market and they are likely to do nothing but massive damage to the greenback. That being said though, the US dollar is historically strong, especially against this currency. It was not that many years ago that we were trading near the 2.00 level. With that being said, I think that the British pound might be a bit of an outlier and therefore if we can break above the 1.2750 level, I would be more of a “buy-and-hold” type of trader due to what I see on the weekly charts. As far as selling is concerned, if we break down below the bottom of the candlestick from the Friday session, we may drift down to the 50 day EMA where I would anticipate seeing buyers. Breaking down below there could send this market down to the 1.2250 level. This is a market that is going to continue to chop back and forth, but one thing that should be paid attention to is that the shooting star was not violated from the Thursday session yet, so there is still the possibility we fall. This is a market that continues to defy logic, but the price is what it is, so therefore you have to follow which direction it goes.