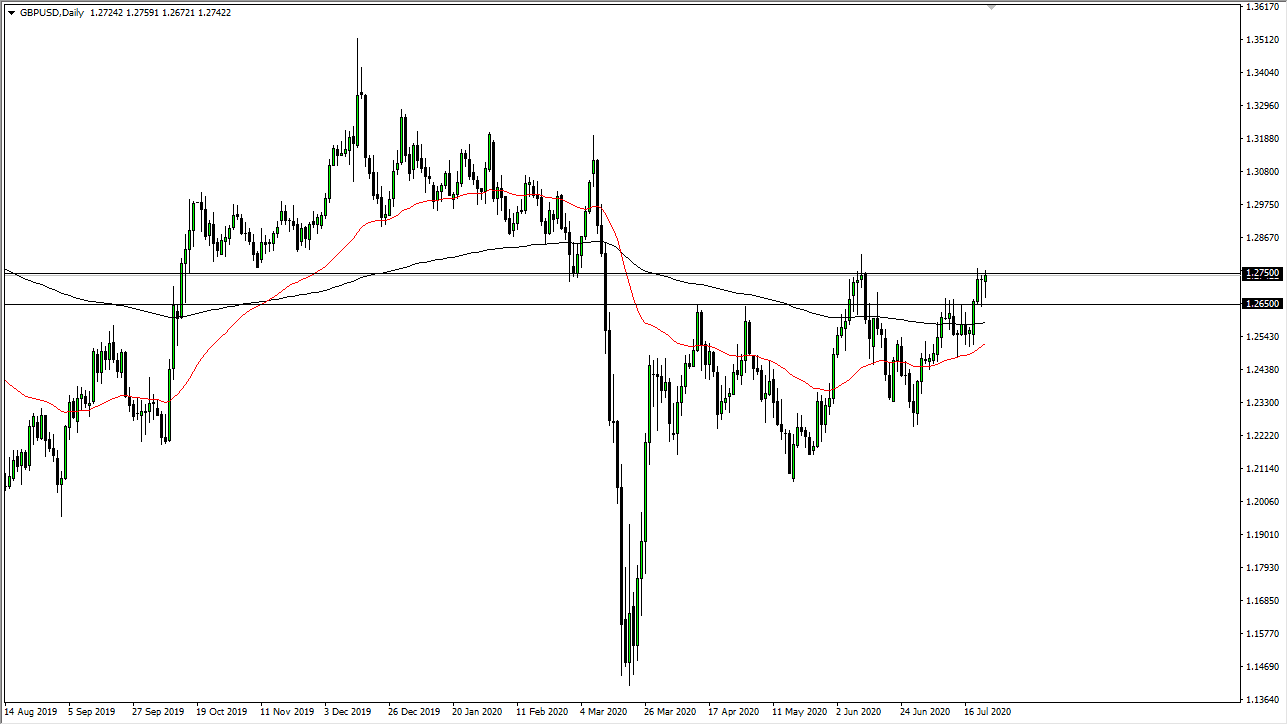

The British pound initially pulled back during the trading session on Thursday but has seen support at a very familiar level near the 1.2650 level. By bouncing the way, we have, we ended up forming a bit of a hammer, which matches the candlestick from the previous session. The fact that we have formed a couple of these in a row does in fact suggest that there is still a lot of buying pressure underneath.

However, the 1.2750 level remains crucial, so we need to see a close above there in order to get long for a bigger move. At that point in time I would fully anticipate that the British pound goes looking towards 1.30 level, which of course has a certain amount of psychological importance built into it as these big numbers tend to attract a lot of attention. Having said that, there is an even more important resistance barrier near the 1.3150 level, which I think is where we are going.

The British pound has been extraordinarily resilient over the last several months, making “higher lows” for some time. That does not mean that this is an easy pair to trade, but clearly something is changing in the overall attitude of traders, sending the market into more of a “pro Britain” type of scenario. With the Federal Reserve out there trying to flood the market with US dollars, that would be the first culprit that I would pin the blame on for the greenback losing strength the way it has. I think at this point you continue to buy short-term dips, and the fact that we have formed a couple of these candlesticks tells me that there are still plenty of believers when it comes to the British pound so I like the idea of buying dips, and most certainly would love to buy a breakout if and when it happens, which I would be remiss if I did not suggest that I am more in the “when it happens”.

Even if we did break down below here, I believe that the 200 day EMA which is colored in black on the chart is support, just as the 50 day EMA is based upon the last several candlesticks. The British pound is going higher, the question is whether or not you can deal with the volatility between now and that move