The British pound has gone back and forth over the last several sessions and Friday was not any different in the fact that we are still in the same range. That being said, it is worth paying attention to the US dollar and how it is getting hammered against several other currencies around the world. The biggest problem here is that we are talking about the British pound, which needs to deal with the Brexit situation, and a sluggish and uneven opening to the economy.

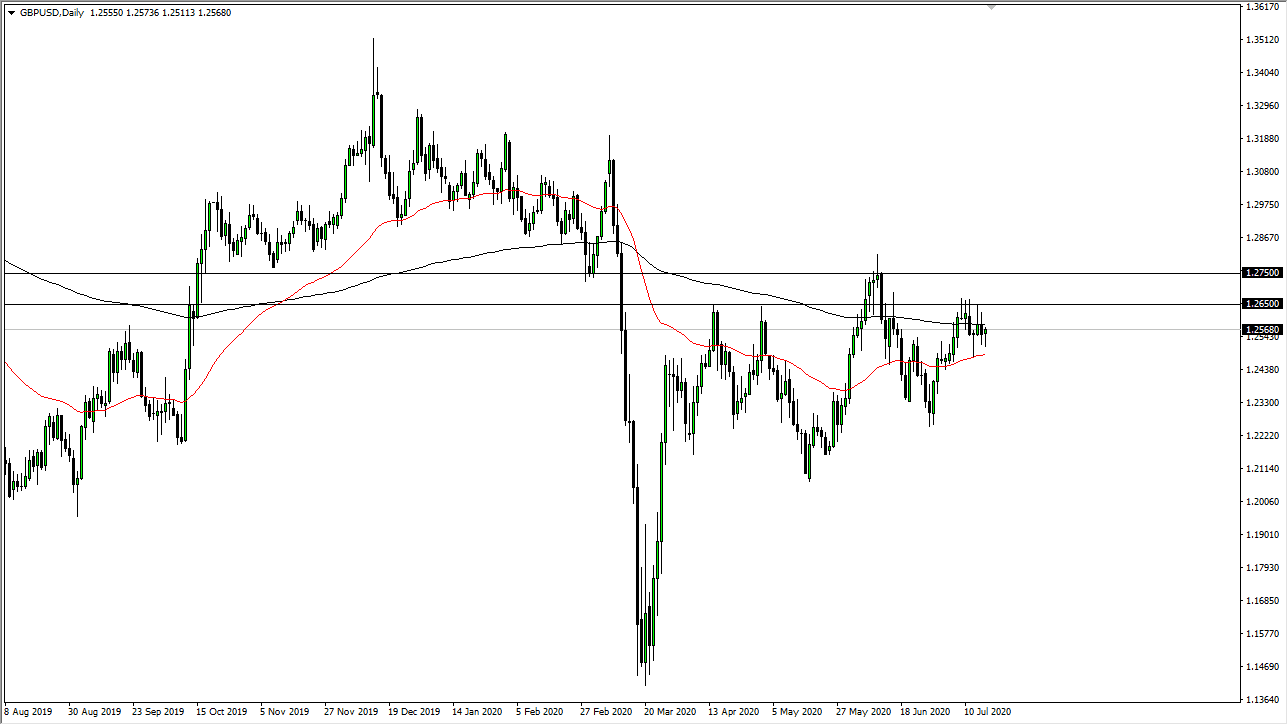

Underneath, we have the 50 day EMA, which is painted in red on the chart offering a significant amount of support. I think at this point we are likely to see that level continue to offer the same. Just above, we have the 200 day EMA but we have crossed through that several times although we cannot seem to keep the gains above there for awfully long. This tells me is that there are a lot of people trying to slice through that area, and it is likely that we will continue to fight more than anything else. I like the idea of buying dips going forward and simply trying to take advantage of the market trying to punish the US dollar in general. Looking at this chart, I see a significant amount of resistance above at the 1.2650 level, which extends all the way to the 1.2750 level. If we finally clear that level, then the British pound will continue to go much higher, perhaps reaching all the way towards the 1.30 level over the longer term.

I think the one thing you can count on it’s a lot of choppiness and volatility, but that is going to be the case anywhere else. The markets are looking to change the overall trend, and that something worth paying attention to. After all, trend changes come only every couple of years typically in the Forex markets, so you have to unwind a lot of opposite positions for that to happen. While I am not a huge fan of the British pound, the reality is that it is going to continue to be stronger than the US dollar due to the fact that the Federal Reserve is doing everything it can to kill the greenback in general as the quantitative easing is stretching the value of the dollar a bit thin.