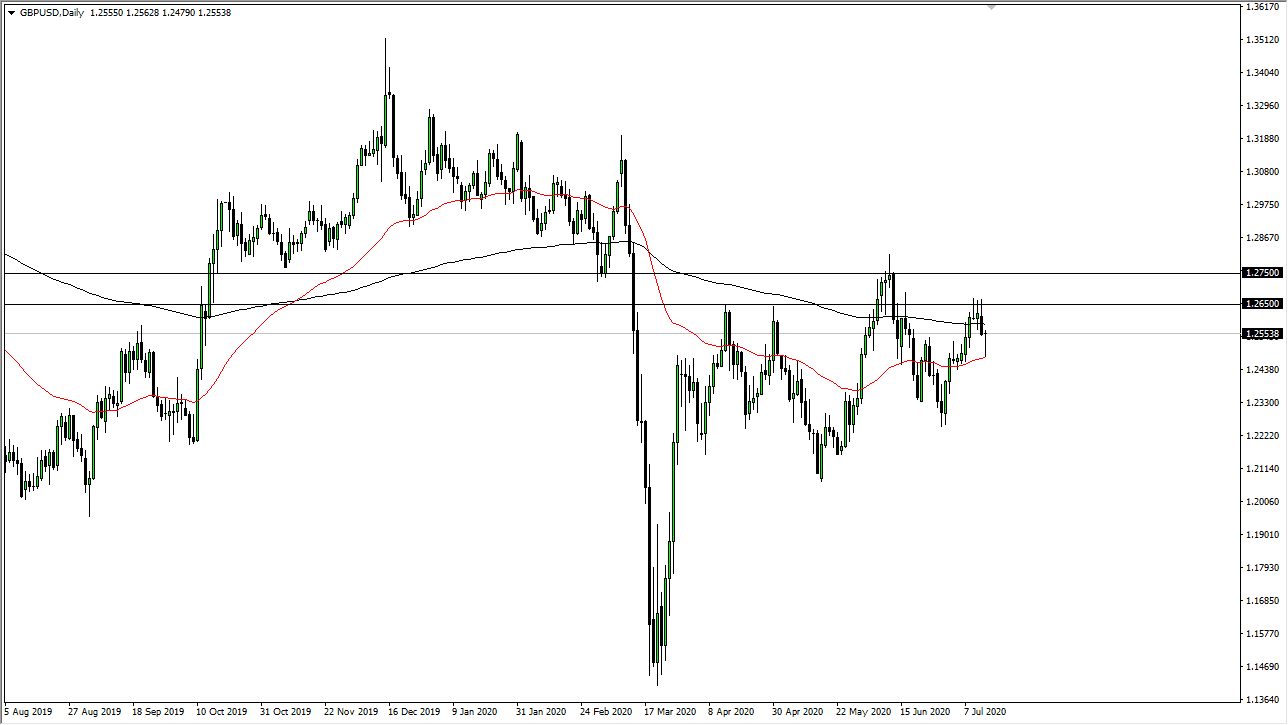

The British pound broke down significantly during the trading session on Tuesday but found enough support at the 50 day EMA to turn things around to form a hammer. This is a very bullish sign, but we also have significant resistance above. The question will be whether or not this is the real deal or is it simply the market trying to retest those wicks above again.

If you follow me here at Daily Forex, you know that I was talking about the “micro triple top” that had formed over the last couple of sessions at the 1.2650 level. Quite often, these areas get tested again, just to make sure that they are truly resistive, and that might be what we are about to see. With that in mind, at this point, I have a couple of different opportunities to trade this pair. If we fail near that area again, it will only add more confluence to the idea of shorting the British pound in that area. However, if we were to break above those wicks from the previous sessions, then I think we will go looking towards the 1.2750 level, an area that has been important more than once.

Keep in mind that the British pound has to deal with Brexit and the sluggish reopening of the British economy, but at the end of the day the Federal Reserve is working so hard against the US dollar that one would have to think that eventually, we get a rally here. If we can break above the 1.2750 level, that gives us an opportunity to go looking towards 1.30 level, which would be a very bullish sign in general for risk appetite. On the other hand, if we were to turn around a break down below the 50 day EMA which is substantively the lows of the trading session on Tuesday, then it shows that we have renewed strength in selling and that perhaps we could go to the 1.2250 level. One thing is for sure, the British pound is going to continue to be very noisy, but it has been very resilient over the last several months, something that needs to be appreciated if you are going to trade the Pound. We have made a series a “lower highs”, and they did pose the question as to whether or not that was still true yesterday, as 28 that series of wicks at the 1.2650 level. I think we are about to see whether or not there is real buying pressure here.