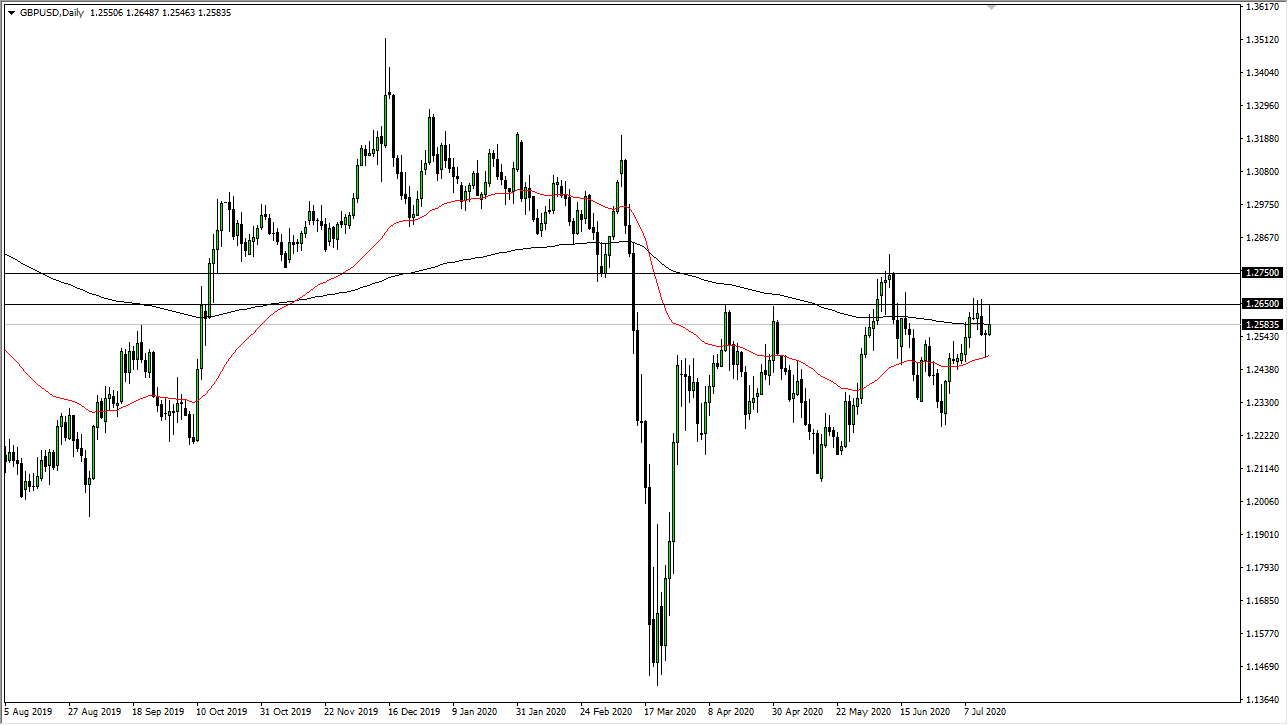

The British pound has been all over the place during the trading session again on Wednesday as the 1.2650 level continues to be a major barrier. If we can break above this area then I think this market will not only go higher but probably much higher. The fight at the 1.2650 level over the last five or six trading sessions has been rather severe, so obviously there is a lot of interest in this general vicinity. I also believe that if we break above there it is more or less going to be a range of resistance that extends all the way to the 1.2750 level. The 1.2750 level has been important on a lot of longer-term charts anyway, so this is not a huge surprise. If we can finally break through this area it will be a move to the 1.30 level at the very least.

With the Federal Reserve working against the US dollar the way it is, and of course adding liquidity to every market it touches, this is driving down demand for the US dollar and putting traders into other currencies such as the British pound or more specifically as of late the Australian dollar and Euro. In other words, this is not necessarily a pro-United Kingdom type of trade, it is more or less an anti-US dollar trade.

To the downside the 50 day EMA should continue to offer support, as it did during the hammer that formed on Tuesday. A breakdown below that could open up a move down to the 1.22 level but it does not look like that is as likely to happen after the last couple of trading sessions. I think it is going to be exceedingly difficult, but it appears that we are trying to build up the necessary momentum to finally break out to the upside again. I think this story in the Forex markets is probably going to be more selling the US dollar than anything else, so although I do not like the British pound and the market still has to deal with Brexit, the reality is that the US dollar is being sold by almost everybody so it is what it is. Price is truth, and that is the way this needs to be approached.