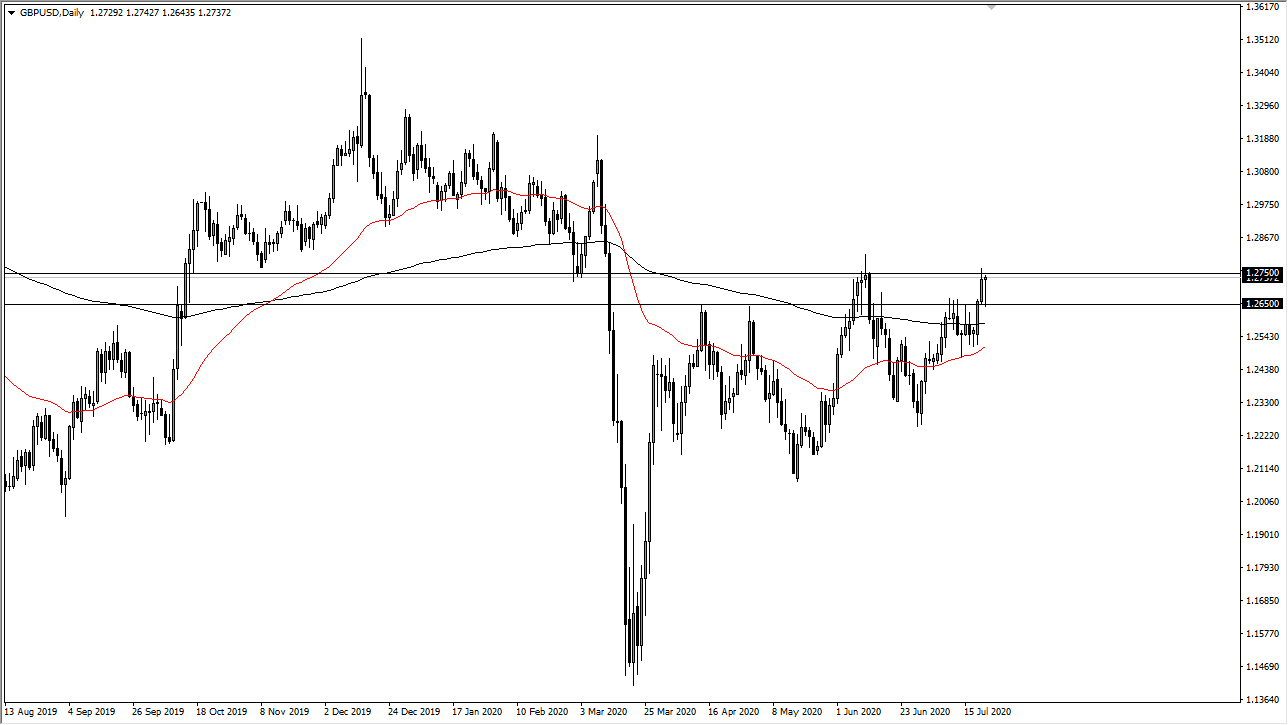

The British pound initially pulled back a bit during the trading session on Wednesday but found enough support near the 1.2650 level to show just how strong things are getting in the British pound. Ultimately, this is a market that I think does break out above the resistance barrier and the 1.2750 level, which should send this market towards the 1.30 level after that. The candlestick is forming a bit of a hammer, and as a result, it is likely that we will continue to see buyers press against the resistance barrier above.

To the downside, if we were to break down below the 1.2650 level, then the market is more than likely going to find plenty of support underneath. This will be in the form of the noise in that range that we see just below, extending all the way down to the 50 day EMA. In the midst of the consolidation, we have the 200 day EMA so, therefore, it is likely that we will continue to see a lot of interest. This is a marketplace that gives me quite a bit of confidence that we will eventually break out to the upside and it appears that the US dollar will continue to propel this market higher because quite frankly the Federal Reserve is going to do everything you can to kill the dollar.

The British pound might be a bit of a laggard though because the Euro has already broken out, but the Pound is still trying to do so. We could get a little bit of a pullback during the early part of the session on Thursday, but I do think that we will get back to selling the US dollar overall later in the day, or by Friday. This is because the other currency pairs have broken out and perhaps gotten a little bit overextended. All things being equal, I believe that buying dips on short-term charts should continue to be the way forward and we will eventually get that squeeze higher that I have been waiting for. The 1.30 level is my longer-term target, but it may take a few attempts to break out in order to get the momentum to run that far. If we can break above the 1.30 level, we will more than likely continue to go even higher, perhaps to the 1.3150 level. I have no interest in shorting this market as long as we are above the 50 day EMA.