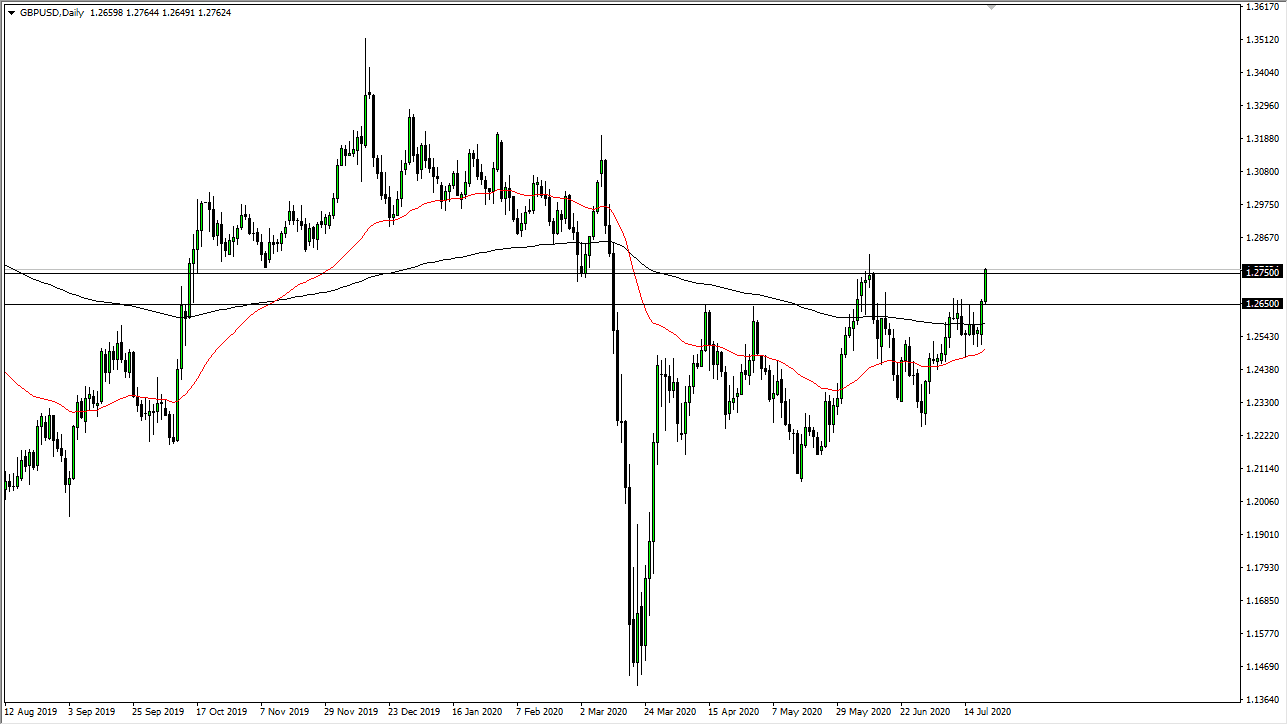

The British pound has broken higher during the trading session on Tuesday, breaking above the 1.2750 level. This is an area that has been crucial more than once so it is likely that we can see the occasional pullback offer value that we can take advantage of. The 1.2650 level has been resistant in the past so I would expect it to be supported going forward. Quite frankly, it took a lot of work to get above the 1.2650 level, so I think that people are just going to simply give up at that point.

I like the idea of picking up the British pound “on the cheap” if we get the opportunity. If we were to break down below the 1.2650 level, I think we are likely to see more of a reset situation where we have the step on the sidelines and figure things out. In general, this is a market that I think will continue to see more of an uptrend than down, but it does not necessarily mean that it is going to be easy. I think we need to continue to build a bit of support so I think it is only a matter of time before buyers would get involved again. The 50 day EMA underneath is the “floor” in the market from the longer-term so if we were to break down below that read EMA, then things could get ugly. However, after we have seen a significant amount of momentum in this market, it is very likely that we do not get anywhere near that level.

To the upside, I think that if we break out to a fresh high above the candlestick that pierced the 1.2750 level, then it is likely that the market goes towards the 1.30 level above. That is an area that will attract a lot of attention, but I think it is likely that we will eventually get there. Ultimately, the market likely will see volatility, but it is almost impossible to imagine a scenario where we would be selling unless there is some type of major “risk-off event” that changes things suddenly. It is not that we cannot see that, it is just that right now it seems like everybody is worried about the Federal Reserve and its liquidity measures more than anything else. At the end of the day, “price is truth.”