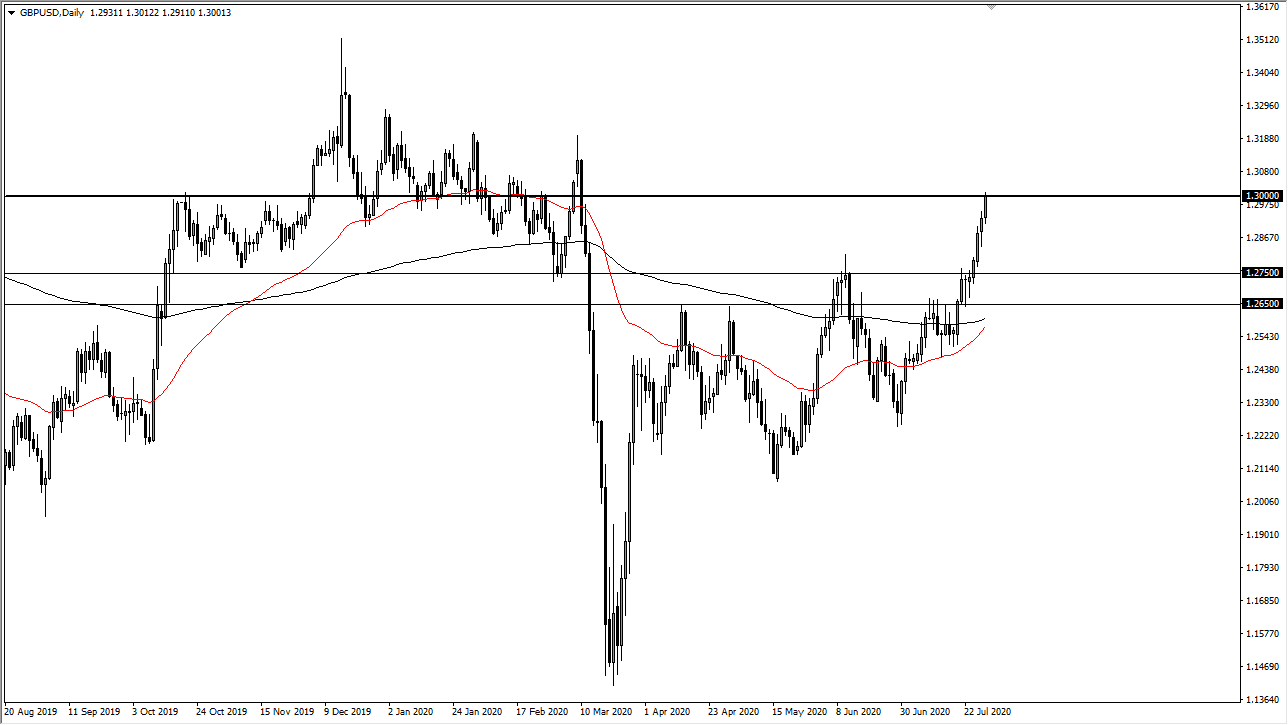

The British pound has rallied significantly during the trading session on Wednesday as we reached towards the $1.30 level before pulling back ever so slightly. The FOMC meeting and press conference seems to reiterate the idea that the Federal Reserve is willing to keep the spigot wide open when it comes to monetary policy, so it is only a matter of time before the US dollar loses even more value. That being said, we are a bit parabolic at this point, so I am looking for a pullback in order to get involved.

It is a bit difficult to get overly excited about buying the British pound, but if we break above the $1.30 level it is likely that we could make a run towards the $1.3050 level. At that point we have seen a lot of selling pressure, and therefore it is likely that we would pull back from there as well. Quite frankly, I like the idea of a gradual grind higher, because the United Kingdom has a lot of issues attached to it, not the least of which will course be Brexit. Brexit is going to cause havoc when it comes to the UK economy, so although I do think that we go much higher here, it is all about the US dollar and has nothing to do with Great Britain itself.

Underneath, I believe that the zone between the 1.2750 level and the 1.2650 level will continue to be massive support, so I am more than willing to take a long position in that general vicinity. Obviously, we will very likely get a bit of a pullback, but that is going to be thought of as an opportunity. Only the truly foolish would start shorting this market right now, in fact this is a perfect example of what separates retail traders from professionals: recognizing the state of the market and staying out of trouble. Yes, we could very easily drop 100 pips from here, but quite frankly the way the markets been going, it is very likely to rise another 1000 pips before it is all said and done. With that, you need to look for value like you do with any other thing you buy, be it the British pound or a television set, it comes down to finding the best price.