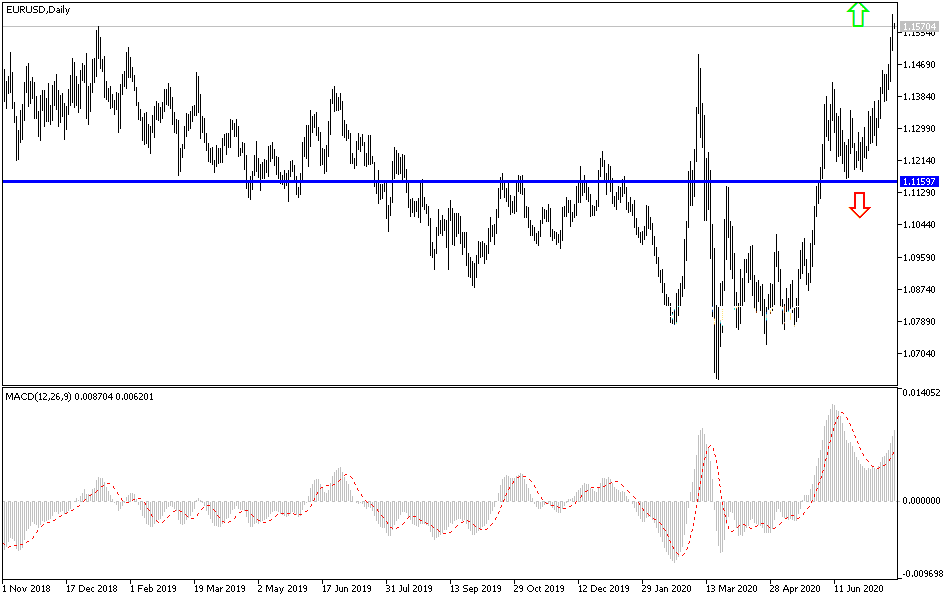

Constant pressure on the US dollar and a distinct optimism due to announcing the European stimulus plans, contributed to increasing the pace of gains for the EUR/USD pair, which culminated in testing the 1.1600 resistance, its highest level in 21 months, before settling around 1.1570 in the beginning of Thursday's trading. Technical expectations indicate that the pair's success in stabilizing above the 1.1600 resistance will open the door for a move to the 1.18 resistance in the coming weeks. The pair briefly tested the 1.16 resistance, its highest level since October 2018, after hitting the 50% Fibonacci level, based on a long-term technical downtrend that dates back to April 2018.

The Euro rose by more than half a percent during yesterday's session as investors continued to avoid the dollar with their focus on the historic agreement that took place Tuesday between European Union leaders, which allows the European Commission to raise funds from financial markets to finance loans and grants to member states seeking to get themselves out of the crater that destroyed European economies that were most affected by the epidemic economically and humanly.

Commenting on the pair’s recent performance, Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank, says that once the daily close is achieved above 1.1596, the Euro will then target 1.1815, the peak in the European single currency in September 2018, which also coincides with the %61.8 Fibonacci retracement of the movement down from the peak of 2018. But the Euro first has to overcome the 50% retracement level at 1.1596 which prevented its rally in the Wednesday session, and Jones insists the charts are warning that this could take more time.

The European Recovery Fund has the ability to raise the level of financial support available in the poorest countries of the European Union so that it corresponds to the richer countries in terms of GDP and thus may limit the negative side of GDP at the cluster level. But this has never sparked the enthusiasm of the Euro or investors, who instead gave more value to the signal of political solidarity that comes from mutual fund financing as well as the precedent it creates to deal with future crises in a bloc that suffers greatly and for a longer period of poor economic performance.

The European Commission will be able to raise 750 billion Euros from financial markets that will complement its budget for the next seven years and will be divided roughly equally with non-reimbursable grants covering 390 billion Euros of the package while loans constitute 360 billion Euros. Funds will be allocated mostly over the next two years, but only after the European Commission approves a "recovery and resilience" plan, the conditions around which provide scope for economic, financial and structural reforms imposed on members, among other things.

According to the technical analysis of the pair: On the daily chart below, the bulls control over the EUR/USD performance is getting stronger, and at the same time, the technical indicators continue to confirm the price reaching strong overbought areas, and starting today, the pair will interact with the announcement of important economic issues both from the United States and the Eurozone. Resistance levels at 1.1586, 1.1635 and 1.1700 will be currently best suited to gain on a bounce to correct with profit-taking sell-offs. Bears will no longer control performance without the pair moving towards the 1.1330 support.

As for the economic calendar data today: First, the German consumer climate GFK index will be announced, and later the Eurozone consumer confidence index. From the United States, jobless claims and the reading of the leading indicator in the United States.