Despite the lukewarm reaction of the European single currency after the final announcement of a long-awaited agreement between European leaders on stimulus plans, markets absorbed the outcome of the agreement and continued the collapse of the US dollar. The bulls then had a stronger opportunity to push the EUR/USD pair towards the 1.1546 resistance, the highest level since January 2019. The European Union leaders have agreed on new spending plans worth 1.8 trillion Euros, which includes a 750 billion Euro rescue package to counter the effects of Coronavirus, which will be largely funded through the issuance of European Union bonds.

From the 750 billion Euro recovery fund, 390 billion Euros will be paid in grants and 360 billion Euros in loans. France and Germany were pushing for 500 billion Euros of grants to be awarded, but some resistance from the “Five Economical”; Denmark, the Netherlands, Austria, Sweden, and Finland, meant that this amount was eventually reduced. In fact, this appears to be a bit of a relatively small compromise for the “Five Economical” who seem to eventually comply, and we expected markets to show genuine disappointment if the fund’s total was cut or the value of grants decreased significantly.

"This is an important moment for the European Union as the European Commission will raise funds through capital markets and it is the first step towards debt exchange," said Richard Perry, an analyst at Hantec Markets. "The markets are reacting positively."

While skeptics may argue that this is another example of what Germany wants, the rest will follow, yet the deal shows a new sense of purpose among the 27 member states of the European Union, and the issuance of European Union bonds represents an important step towards financial unity in the European Union.

“With the greatest effort ever made for cross-border solidarity, the European Union is sending a strong signal of internal cohesion,” said Holger Schmieding, an economist at the Bank of Berlin. “In the short term, the effect of confidence can be more important than money itself”. "The European Union and the Eurozone are not on their way to financial union, but they take a big step toward stronger financial coordination, and this deal sets a precedent. The European Union issues debt at a time of crisis. We expect some joint financial response to playing a bigger role in future crises as well. ” he added.

The Euro has been rallying in recent weeks as markets welcomed the proposal of the European Commission's rescue fund, but after news of the deal finally passed, the single European currency initially fell. Another important point to note is that the additional budget agreement for the European Union, amounting to € 1.074 trillion for the period 2021-2027, means that, in the end, the loophole that Brexit will cause will be closed.

Consequently, the possibility for the European Union to be more stable in the coming years has increased.

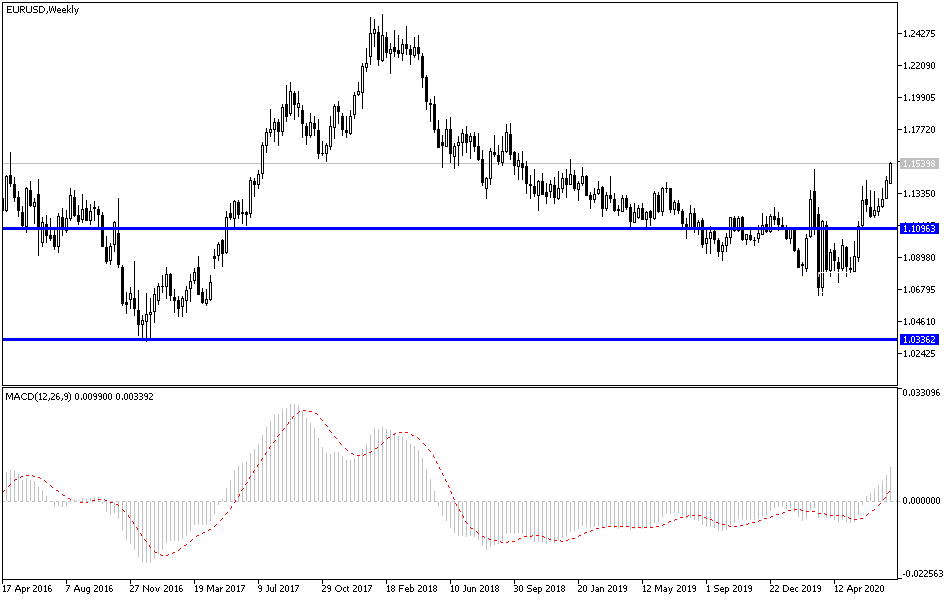

According to the technical analysis of the pair: The continuous pressure on the US dollar and the European agreement were a strong double catalyst for the EUR/USD in achieving gains. Today, technical indicators reached strong overbought areas, after passing the agreement, investors and markets will focus on the results of European economic issues, the European Central Bank policy and the Corona Virus Path in the United States of America. The nearest resistance levels are now at 1.1565, 1.1630 and 1.1800, respectively. And there will be no reversal of the current bull control without breaching the 1.1440 and 1.1380 support levels, respectively. Despite recent gains, I still prefer to sell the pair from every upside level. The strength of the second coronavirus wave will ultimately be a catalyst for the US dollar as a safe haven.

There are no significant European economic releases today. From the United States, existing home sales and weekly oil stocks will be announced.