The EUR/USD pair last week trading was distinguished. The pair succeeded in gaining more with the support of the European leaders’ final agreement to stimulate the European economy as well as the US currency retreating from its mission as a safe haven in the pandemic era, and the increasing tensions between the United States of America and China. Therefore, gains of the pair reached the 1.1657 resistance, its highest level in 21 months, and closed the trading week around those gains. The pair will be on for an important date this week with many economic data releases from the United States of America and the Eurozone.

What contributed to the Euro holding on to its gains was the announcement by the end of last week of urgent survey data from IHS Markit that the private sector in the Eurozone witnessed the fastest growth in a little more than two years in July as economies continued to reopen after applying closings measures to limit the spread of the coronary virus. Accordingly, the composite production index - which includes the industry and services sectors together - rose to the highest level in 25 months at a reading of 54.8 in July from a reading of 48.5 in June. This was higher than economists' expectations of a 51.1 reading. The improvement in part reflected a technical recovery from recent closings, as companies and their customers are increasingly returning to business after more relaxation in Covid-19 containment measures across the region.

The poll also showed that output expectations improved in July, new demand flows increased and jobs weakened. The survey showed that the average prices of goods and services fell for the fifth month. Both manufacturing and services returned to growth, with growth peaking at 23 and 25 months, respectively, in July. The Services PMI rose to 55.1 from 48.3 in June. The expected reading was 51.0. The Manufacturing PMI came in at 51.1 vs. 47.4 in June and expectations were at 50.0.

Commenting on the results, Chris Williamson, chief economist at IHS Markit, said: "The data adds signals that the economy should see a strong recovery after the unprecedented crash in the second quarter." Williamson added: "Although the survey outcome measures indicate an initial V-shaped recovery, other indicators such as work accumulation and employment warn of negative risks to expectations."

From the United States of America, after reporting a sharp increase in new home sales in the United States in the previous month, the US Department of Commerce released a report showing that new home sales continued to rise in June. The report recorded an increase of 13.8 percent in new US home sales to an annual rate of 776,000 in June, after rising 19.4 percent to an average of 682,000 in May. Economists had expected new home sales to jump 3.6 percent to 700,000 from the 676,000 that was reported the previous month.

With a much larger increase than expected, new home sales continued their recovery after dropping to the lowest annual rate in more than a year in April and reaching its highest level since July 2007.

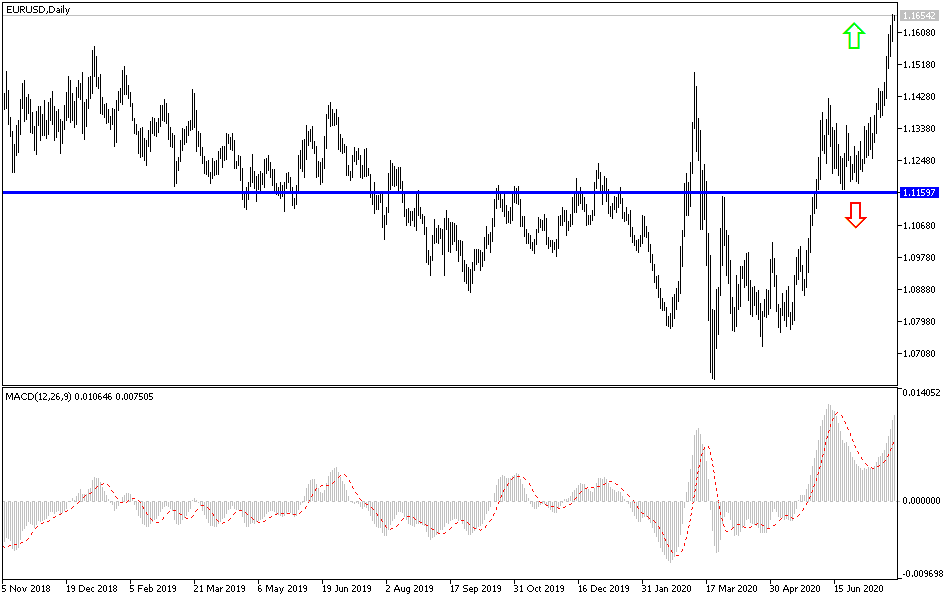

According to the technical analysis of the pair: On the daily chart of the EUR/USD, the bulls' control of performance is still stronger. Taking into account that technical indicators reached overbought areas, and with events and data this past week, there may be an opportunity for profit-taking sell-offs, or vice versa, by continuing the pace of current gains, it all depends on the investors’ reaction to what will happen this week. In general, the closest resistance levels for the pair are currently 1.1665, 1.1735, and 1.1820, respectively. Over the same time period, there will be an opportunity for the bears to control the performance of the pair moves steadily below the 1.1450 support, which was an important peak in the near future.

As for the economic calendar data today: From the Eurozone, the money supply and the German IFO index reading will be announced. From the United States, durable goods orders will be released.