Complementing the bullish path, the EUR/USD pair started this week’s trading by testing higher highs, and then pushed to the 1.1781 resistance, the highest level since September 2018. It settled around 1.1750 at the beginning of Tuesday’s trading. What contributed to the completion of its gains, besides the continued decline of the dollar, is the announcement of the economic recovery continuation in the Eurozone, and that it is still on the right track, according to the latest data from the Eurozone and Germany, which shows that while a sharp “V Shaped” may not be possible, The "tick-shaped" recovery is reasonable. The German IFO data - which provides a snapshot of German economic activity and forecasts for future activity - was better than expected.

The German IFO Business Climate Index came in at 90.5 in July, above 86.3 from last month and better than expected at 89.3. The business outlook index, which shows business expectations for the next six months, was up to 97.0 in July, from 91.6 recorded last month, and stronger than markets expectations for a reading of 93.7. The current rating component recorded at 84.5, up from 81.3 in June but slightly lower than what markets had expected at 85.0.

Commenting on the positive results, Holger Schmieding, chief economist at Bernberg Bank, said: “The signals from money and credit statistics, as well as the real economy, confirm that the Eurozone economy is still on its way to a tick-shaped recovery” and “companies think the worst is over, which bodes well for future spending.” On the outlook, Schmidding warns that while the recovery is on the right track, the risks remain serious.

"But it mostly stems from external factors such as the outlook for the pandemic in the United States," Schmiding added, especially after agreeing to a 750 billion Euro recovery fund, and local economic and political factors support our call for a tick-shaped recovery. Some economists believe that it would be surprising if the German economy was able to maintain the growth momentum in the first months after the closings. We are now in a mechanical bounce, and the true face of recovery will only be clear in the coming months. In general, the financial stimulus in Germany, and now also at the European level, bodes well for domestic demand and Eurozone exports, as the structural damage to the economy as well as the continued weakness in the main trading partners outside the Eurozone will hinder that recovery.

On the other hand, separate data from the European Central Bank showed that the M3 money supply for the Eurozone - the speed of money in the economy - grew 9.2% on an annual basis in June, up from 8.9% in the previous month. The M1 money supply growth rate increased by 12.6% year-on-year in June from 12.5% in May.

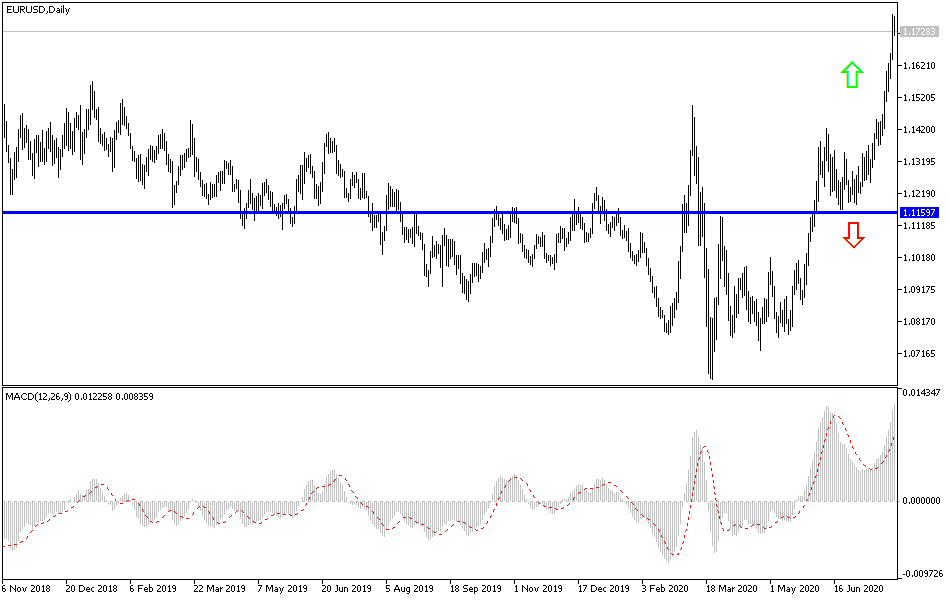

According to the technical analysis of the pair: On the daily chart, bulls control on the EUR/USD performance seems stronger, and the 1.1800 resistance will be the culmination of recent gains. Technical indicators still confirm the pair reaching overbought areas, but there are no factors that contribute to speeding up the sales operations. The closest support levels for the pair are now 1.1690, 1.1620 and 1.1530, respectively. A break of the 1.1800 resistance will be important for the current bullish trend.

As for the economic calendar data today: From the Eurozone, the Spanish unemployment rate will be announced, then the US consumer confidence will be announced.