Amid investor optimism that European leaders will be able to reach an agreement by the end of this week to pass the urgent stimulus plans to revive the European economy, the EUR/USD pair started this week’s trading on the rise, reaching the 1.1374 resistance after closing last week's trading below the 1.1300 level. Some analysts believe that the pair's gains were supported by the fact that the Eurozone economy is improving according to the economic data, along with the assumption that the COVID-19 pandemic is still under control. Eurozone economic prospects became more encouraging, and activity and confidence indicators showed a less severe decline in the second quarter of 2020 than previously expected.

With the control of the COVID-19 pandemic in the Eurozone, the focus has shifted to the United States, where infections, hospitalization, and mortality continue to rise. So the economic impacts of the pandemic are very serious in the United States as well, and markets still have a better understanding of which will be closer - the United States and the Eurozone - to get out of the pandemic better. Investors are waiting for the announcement of US companies' profits that may lead to fluctuations, as traders measure the damage caused by the COVID-19 pandemic that led to the closure of the world economy for several months. In return, the next European Union meeting on July 17 may ignite the risk appetite or aversion. This will undoubtedly happen if the President of the European Union Council succeeds in uniting opinions among European leaders to agree to an additional 750 billion Euros of economic incentives to revive the European economy. Although it will be complicated talks, expectations indicate that the President of the European Union Council will do his utmost to pass these plans, as European unemployment rates are likely to rise to record levels.

For her part, German Chancellor Angela Merkel said, warning that if this week's summit does not produce results, "bridges still need to be built" between European Union countries, which are at odds over plans for a massive stimulus package to help the bloc's economies recover from the Coronavirus, and that reaching an agreement may require another meeting. Leaders of European Union member states are preparing to meet in person on Friday for the first time since February to compromise on a one-time stimulus package of 500 billion Euros ($ 569 billion) proposed by Germany and France. Much of the stimulus money will go towards helping countries most affected by the virus and its economic impacts, such as Italy and Spain. Some financially conservative European Union countries oppose the Franco-German plan because it will necessitate borrowing by the bloc as a whole.

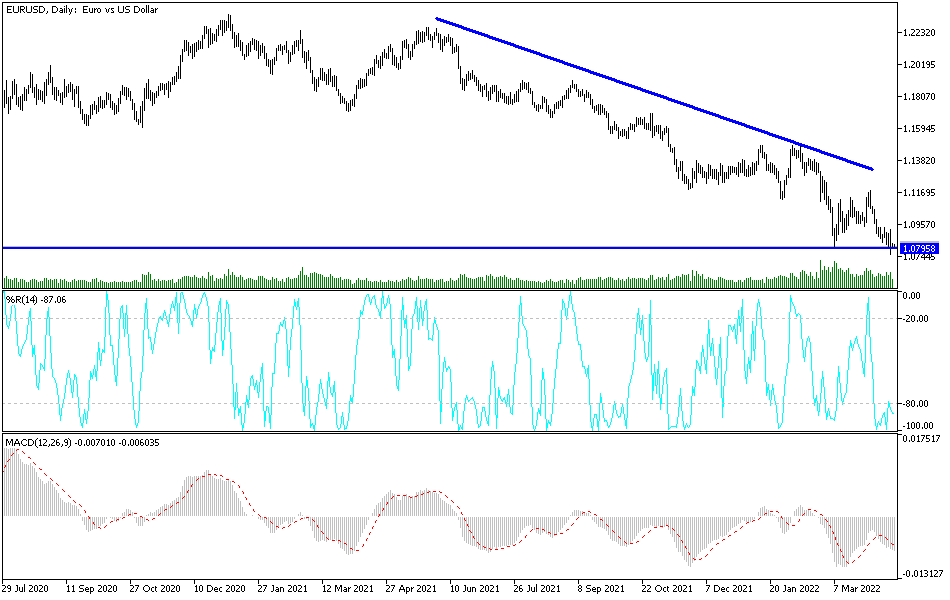

According to the technical analysis of the pair: On the daily chart, the EUR/USD needs more incentives to complete the bullish correction opportunity that awaits breaking of the 1.1425 resistance to be confirmed. On the other hand, stability below the 1.1300 support will support the bears ’move towards stronger support levels. The results of this week's European summit will determine fate.

As for the economic calendar data, today: The German consumer price index and the ZEW sentiment reading for the German economy will be announced. During the American session, the US inflation figures will be announced through the Consumer Price Index.