For four trading sessions in a row, the EUR/USD price is moving in an upward correction range that pushed it towards the 1.1451 resistance. This is its highest level in four months, before settling around the 1.1409 at the time of writing, and before the announcement of the monetary policy of the European Central Bank and a package of Important American economic data. As we mentioned before, we now confirm that the Euro gains in particular in the currency trading market, with the support of optimism about the possibility of passing stimulus plans by the European summit by the end of this week to contribute to accelerating the economic recovery in the face of the pandemic.

Ahead of the European summit. The Netherlands has expressed its unwillingness to participate in the recovery fund to be discussed at the summit. The Dutch position is not surprising to the markets. At first, Merkel mentioned that all markets are awaiting the approval of the current proposal by the European Union. For this reason, the important position of the Netherlands, Denmark, and Sweden has been ignored so far.

Beyond the anticipated stimulus plans, European governments are providing more stimulus to cope with the shocks caused by the COVID-19 pandemic. In this regard, the new French Prime Minister put on Wednesday 100 billion Euros (110 billion dollars) in new spending to save the economy affected by the virus from its worst crisis since the Second World War. In particular, the money will go to creating jobs for young people, reducing French carbon emissions, and protecting French small businesses from collapse.

Commenting on those plans, French Prime Minister Jean Castex told the lawmakers, "The crisis has highlighted our difficulties and our failures." He said that despite more than 30,000 virus-related deaths and the great strain on the public healthcare system that was previously known in France, we are now in a "state of cohesion". The new bailout plan to tackle the effects of the pandemic will include 20 billion Euros of climate-related investment, including the wider use of electric bicycles, support of local food suppliers, urban renewal, and a massive overhaul of old buildings.

The official said another 40 billion Euros would be earmarked for the repair of French strategic manufacturing sites.

Production at U.S. factories, facilities, and mines increased last month but remained well below pre-pandemic levels. The Federal Reserve Board announced that U.S. industrial production rose by 5.4% in June, the second consecutive monthly gain after a 1.4% rise in May. But it was still 10.9% below the level in February before the economy actually shut down in the face of the COVID-19 virus. June’s performance was better than economists' expectations and reversed the reopening of many parts of the US economy after the spring closings. Despite gains in May and June, industrial production fell at an annual rate - 42.6% in the second quarter, the worst decline since the demobilization of the US economy in the aftermath of World War II. Industrial production fell by a record of -12.7% in April.

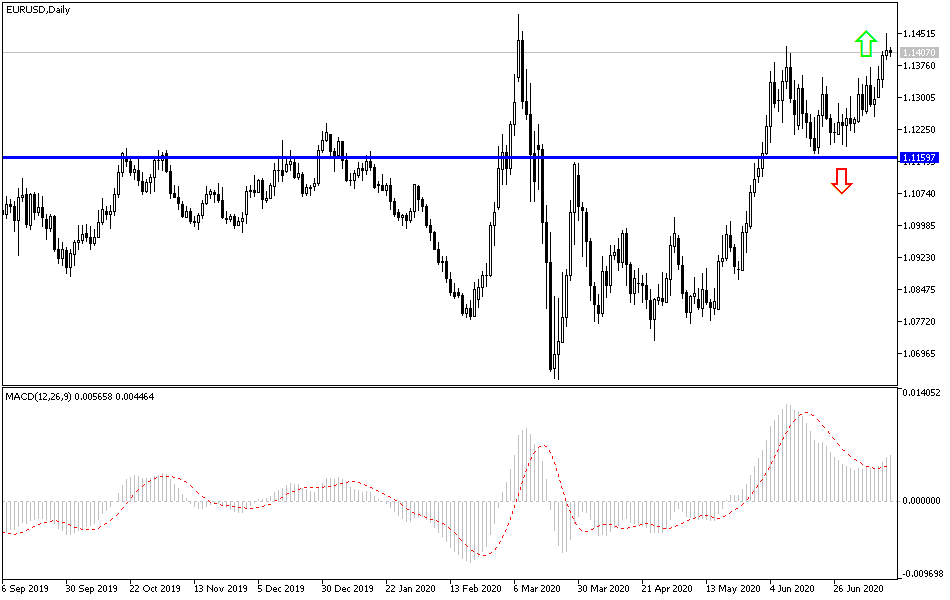

According to the technical analysis of the pair: On the daily chart, the EUR/USD is still in the range of an upward correction, and it has surpassed the resistance barrier at 1.1425, which has long been waited to confirm the beginning of the bulls control over the performance. The bullish momentum may remain stronger and its gains may increase, but on the condition of successful European Union summit to agree on stimulus plans to revive the European economy. On the other hand, the failure of these attempts and the return selling of the pair or the pressure of fears of the summit failure may push the pair back to the 1.1290 support, which may support the start of bear control and rapid collapse of the general trend hopes reversal hopes.

As for the economic calendar data today: All focus will be on the European Central Bank announcing its monetary policy decisions and the statements of the bank’s governor, Lagarde. From the United States, retail sales, unemployed claims, and the Philadelphia Industrial Index will be announced.