For two weeks in a row, the EUR/USD pair witnessed an upward correction path that succeeded in having the pair bounce back to the 1.1451 resistance, its highest level in four months. It was supported by the decline of the US dollar at one time, and also due to optimism of a European agreement on stimulus plans at another time. The pair closed last week's trading around 1.1425. The beginning of this week's trading might be bearish. Whereas after three days in a row, the meetings of the European leaders fail to approve the important and necessary trillion stimulus plans to revive the European economy, which was strongly affected by the Coronavirus.

The pair's performance for this week is very likely to be subdued as the single European currency did not react much to the announcement of the European Central Bank meeting results last week. Whereas, during this meeting, monetary policy in the Eurozone did not change, as expected. The weekend's European Union summit, convened by the European Union Council to discuss a European Union recovery fund, was also badly hit by the COVID-19 pandemic. However, it seems that the bulls on the EUR are about to take a target closer to the current 1.15 level of the EUR/USD pair, its highest level since January 31.

On the other hand, the strength of the second coronavirus wave, the increased tensions between the United States and China, and the impact of weak corporate earnings reports may lead to funds flowing to safer havens such as the US dollar.

This week, the fifth round of talks between the United Kingdom and the European Union is scheduled to discuss their current relationship after Brexit. However, no important data will be released until next Thursday, as it is likely to publish a report on consumer confidence in Germany. This also includes Eurozone consumer confidence figures for July. Both of these reports are expected to show some progress from the previous month, in the same way, that Eurozone PMIs will, which will be released on Friday. Markets are still waiting for readings of this important indicator to cross the 50-point level that separates growth from deflation.

It is the United States of America. The death toll from the COVID-19 pandemic reached more than 139,000, with more than 3.6 million confirmed cases. The strength of the second wave of the pandemic is imposing a reality on the US administration to pass more trillion-dollar stimulus plans to confront the historical pandemic. A federal payment of $600 per week for regular unemployment benefits will end at the end of the month. The same applies to the federal ban on evictions of millions of rental units. With 17 consecutive weeks of unemployment claims exceeding one million - usually, about 200,000 households face a cash crisis and lose employer-supported health insurance coverage.

Despite flashes of an economic boom as states eased closing measures in May and June, the unemployment rate remains at two figures, higher than ever in the Great Recession of the past decade.

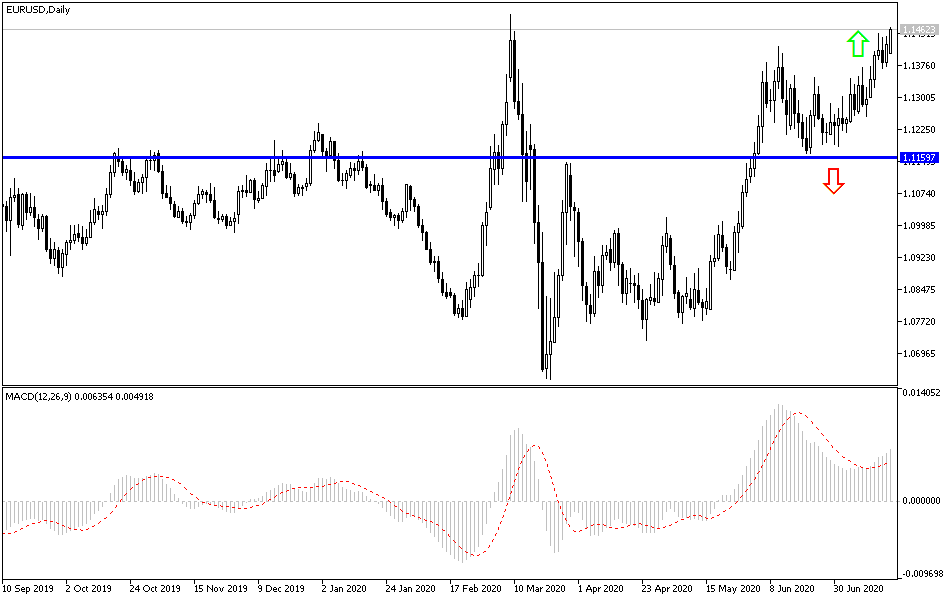

According to technical analysis of the pair: Until the closing of last week’s trading, the performance of the EUR/USD was in the range of an upward correction supported by the move around and the higher than the 1.1425 resistance. If markets reacted negatively with a failure in the European Leaders’ summit, the pair may lose a lot of its gains, and therefore, the closest support levels with sell-offs will be 1.1365, 1.1280 and 1.1190 respectively. So far the trend is supported by stronger bull control.

As for the economic calendar data: From the Eurozone, German producer prices and the current account of the Eurozone data will be released. There are no significant US economic releases today.