The bullish momentum still dominates the EUR/USD performance, and during yesterday's trading, it pushed towards the 1.1800 resistance, which confirms the extent of the bulls' control over the performance, with continued pressure on the American currency. The pair is stable around the 1.1790 in early trading on Thursday. Gains were supported by the cautious expression from the US Federal Reserve that the continued outbreak of COVID-19 will be a burden on the economy and employment in the coming months, and said they plan to keep the record short-term interest rate unchanged at near zero levels to help provide support.

In statement at the end of the monetary policy meeting on Wednesday, the US central bank acknowledged that the coronavirus pandemic "will severely affect economic activity, employment and inflation." Policymakers added a new sentence to their statement: "The course of the economy will depend largely on the path of the virus" - acknowledging that uncertainty about when the health crisis can be resolved has complicated the Fed’s ability to set interest rates policy.

Remarks made by Bank Governor Jerome Powell, one way or another, for months, was that most countries have only appropriately succeeded in controlling the virus with the ability of companies to remain open. It suggests that Powell and the Fed envision a long recovery, the outcome of which depends at least on the course of the virus, as it is on the actions that the Federal Reserve may take.

So Powell said in his press conference that "a full recovery is not possible until people are confident that it is safe to engage in a wide range of activities." Meanwhile, he said: “We are committed to using our full suite of tools to support the economy. We will continue to use these powers until we are confident that we are firmly on the road to recovery”. Accordingly, the Fed did not announce new policies in its statement. They said it would also continue to buy about $120 billion in treasury and mortgage bonds per month, which aims to inject liquidity into financial markets and stimulate borrowing and spending.

Beginning in March, the Fed cut short-term interest rates, bought more than $2 trillion in treasury and mortgage bonds, and unveiled nine lending programs in an attempt to keep the smooth flow of credit. Since the previous Fed meeting in June, the epidemic’s threat to the economy seemed to get worse. The number of laid-off workers applying for unemployment assistance has exceeded 1 million for 18 consecutive weeks. Credit card spending measures are down. Companies tracking small-business recruitment say the number of people at work has stabilized, well below pre-epidemic levels, after rising in May and June.

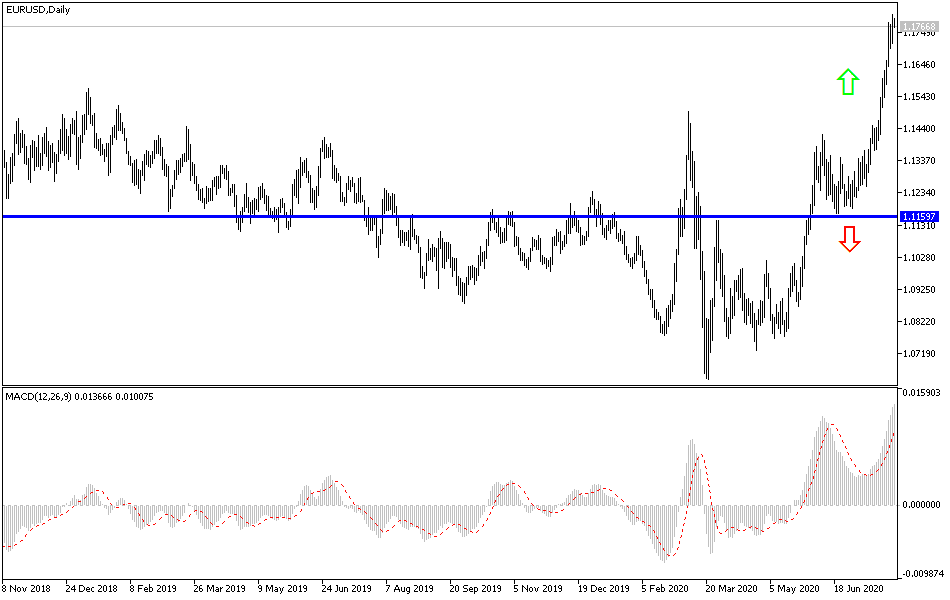

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD as the bullish momentum is still valid, and stability above the 1.1800 resistance, along with the continued collapse of the US currency, will support the move towards the 1.2000 psychological resistance. Investors ignored technical indicators reaching strong overbought areas with the continued weakness of the US dollar in light of the strength of the second coronavirus wave and the American currency was the most beneficiary in the first wave outbreak. A trend shift may occur if the pair moves below the 1.1500 support level.

As for the economic calendar data today: From the Eurozone, GDP, consumer prices and the change in German unemployment will be announced. From the United States of America, the GDP growth rate and unemployed claims will be announced.