The upward correction opportunities for the EUR/USD currency pair remain weak. With the beginning of this week’s trading, the pair moved towards the 1.1288 resistance, but soon fell back below the 1.1200 support during yesterday's trading before settling around the 1.1235 level in the beginning of today’s trading. The European single currency is still looking for stronger incentives. This will only happen by announcing a collective agreement by the European Union to stimulate the European economy in the face of the pandemic in the same way as other global economies. Now Germany, the European Union’s largest economic power, holds the rotating presidency of the bloc of 27 nations amid enormous challenges and huge expectations as the continent wrestles with the repercussions of the Coronavirus. Berlin's six months on this mission are likely to be the last big round of Chancellor Angela Merkel on the international stage.

The timing for Germany to take over the presidency of the European Union, starts today, Wednesday, amid historical moments for the future of the bloc.

On the economic side. Initial data from the European Statistics Agency, Eurostat, showed that the Eurozone inflation accelerated unexpectedly in June, as European economies began to ease closure measures to contain the spread of coronavirus. Accordingly, inflation rose to 0.3 percent from the lowest level in four years at - 0.1 percent recorded in May. Economists had expected the interest rate to remain unchanged at 0.1 percent.

The main inflation continued to remain below the ECB target level "less than, but close to 2 percent".

Commenting on the results, Bert Culligan, ING economist, said, "With the rise in unemployment expected to continue in the coming months and production remains well below the fourth quarter levels of 2019 for a long time to come, it is unlikely that inflation will move anywhere near the ECB target, which is less than 2 percent, in the short term”. Excluding food, alcohol and tobacco, core inflation slowed slightly to 0.8 percent from 0.9 percent in May. The rate was in line with expectations.

Jack Allen Reynolds, economist at Capital Economics, said the increase in headline inflation is entirely due to higher energy inflation, while the base rate has fallen and is likely to decline further over the rest of the year. On a monthly basis, the harmonized index of consumer prices rose 0.3 percent in June. Among the four major economies, coordinated inflation in Germany rebounded to 0.8 percent from 0.5 percent in May. On the other hand, French inflation slowed to 0.1 percent in June, the lowest level since May 2016, from 0.4 percent in May. Spain prices fell at a slower pace of 0.3 percent after dropping by 0.9 percent, while the Italian HICP index fell by a faster rate of 0.4 percent, after falling by 0.3 percent.

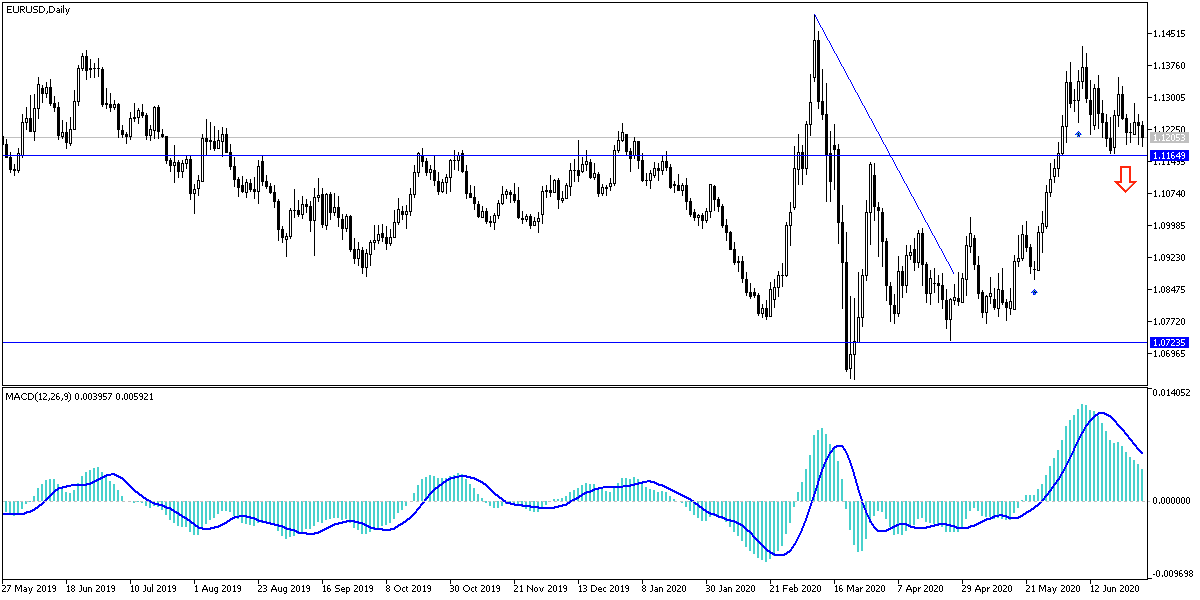

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD pair, bears’ control is still the strongest, and moving around and below the 1.1200 support will increase the downward pressure on the pair to move towards stronger support levels, with the closest ones are currently 1.1165 and 1.1080 respectively. On the upside, the 1.1400 resistance is still the key to the strength of the bullish momentum and the reversal of the current performance. The second wave of the Corona epidemic was in favor of the US dollar, a safe haven of choice for investors since the crisis began.

As for the economic calendar data today: From Germany, retail sales and the change in unemployment will be announced, along with a reading of the Industrial Purchasing Managers' Index for the Eurozone economies. During the American session, the ADP survey to measure the change in US nonfarm payrolls will be announced, along with the ISM Manufacturing PMI reading, then the content of the Federal Reserve Bank minutes for their last meeting.