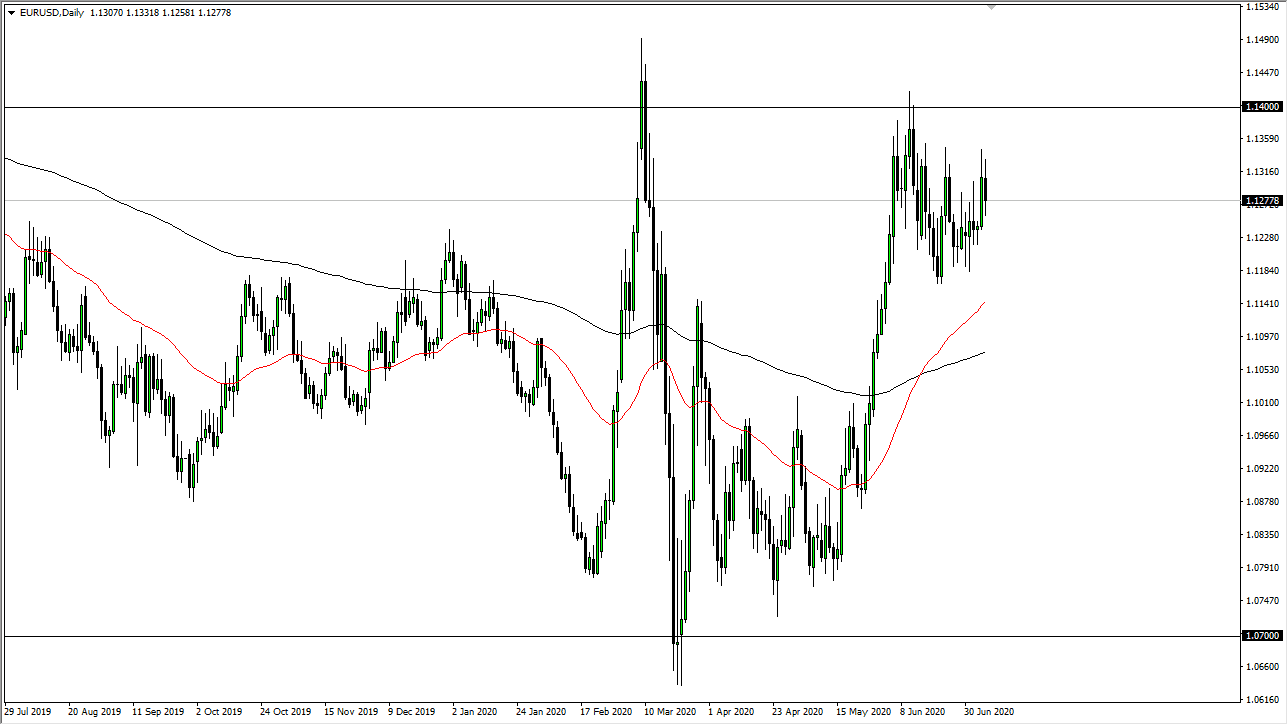

The Euro continues to see a lot of resistance above, especially near the 1.1350 level. That being said, it certainly looks as if we are resilient and trying with everything to break out to the upside. That being said though, the market has formed several candlesticks on the weekly timeframe that show signs of exhaustion, so I do think that it is only a matter of time before the Euro rolls over. However, that does not mean that is going to be easy but I think we are in general trying to grind lower, and if we can break down below the 1.1175 handle it is likely that the market will drop towards the 50 day EMA which is painted in red, followed by the 200 day EMA which is painted in black.

Rallies at this point in time should continue to see sellers, and that is what I am going to continue to do in this market, sell on signs of exhaustion on short-term charts. Even if we break above the 1.1350 level, I think that the 1.14 level above is also resistant, and it extends to the 1.15 handle. Even though the Euro has shown itself to be somewhat resilient, the reality is that there are massive amounts of selling pressure above that will continue to keep this market somewhat sedated.

If we do break down to the downside, it is likely due to more of a “risk-off” type of move, and although the US dollar has been getting hit rather hard as of late, the reality is that it is still in great demand, and therefore it is likely that we will continue to see demand for the greenback given enough time. The stock markets do not reflect this, but there is still a lot of concern out there and therefore I think there is still going to be demand for the US dollar.

However, one thing that we should pay attention to is the fact that the Euro failed to hang onto any type of gains during the day, while many of the other currencies were much stronger than the Euro, showing that perhaps there is even more negativity out there just waiting to cause the Euro to break down. At this point, I think that we are going to see choppy and difficult trading more than anything else right now. With this, keep that in mind and keep your position size relatively small.