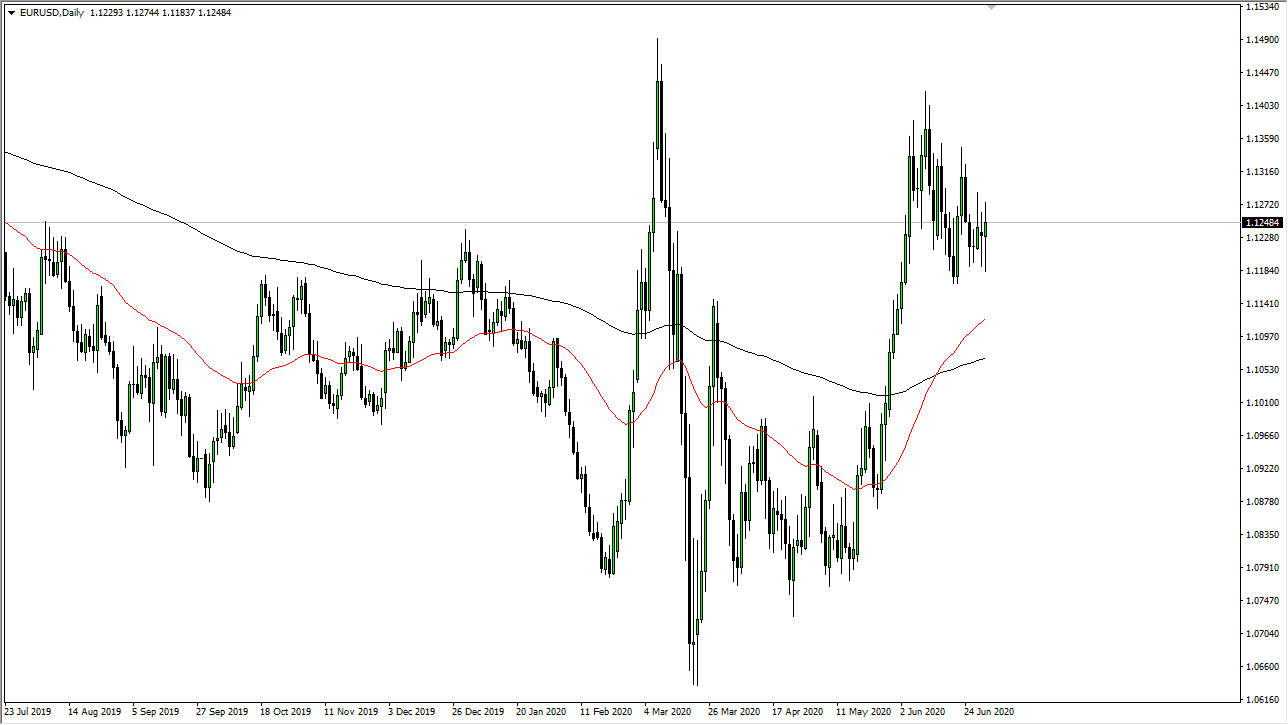

The Euro initially fell during the trading session on Wednesday, but then shot straight up in the air only to pull back yet again. In other words, the Euro continues to be very volatile which of course should not be a huge surprise. With that being the case, it looks like we are setting up for yet another day of headaches when dealing with the Euro trading around the jobs figure. This is the worst day of the month to trade Euro, because it is a very choppy currency pair, to begin with, and with the headline risks when it comes to the jobs report. Ultimately, this is a market that will probably go back and forth during most of the day, only to end up basically where we started.

To the downside, I believe that the 1.12 level is essentially the gateway to much lower pricing, but we have not gotten through that level recently. Once we do, that opens up the possibility for a move down to the 1.1050 level where we see the 200 day EMA. On the other hand, if we were to rally from here then I believe that the 1.14 level will continue to be massive resistance that extends all the way to the 1.15 handle. With that being the case, the market is likely to see a lot of selling and supply in that area, so I would be overly cautious about trying to get long of this market in that general vicinity.

The Federal Reserve is looking to buy bonds for eternity, and therefore devalue the currency. However, the European Central Bank is doing the same thing and is likely to continue playing a bit of catch-up. In other words, I think the volatility that you are seeing on this chart is going to be the norm, and therefore it is going to be a matter of trading short-term chop more than anything else. What I see on the chart is that we are grinding lower and I think that might end up being how this plays out. This is not a pair that you are going to get quick profits anytime soon, but I do think that eventually, we could go quite a bit lower. A breakout above the 1.15 level allows the breakout for a move to the 1.1750 level, but there is a lot of work to do before that happens.