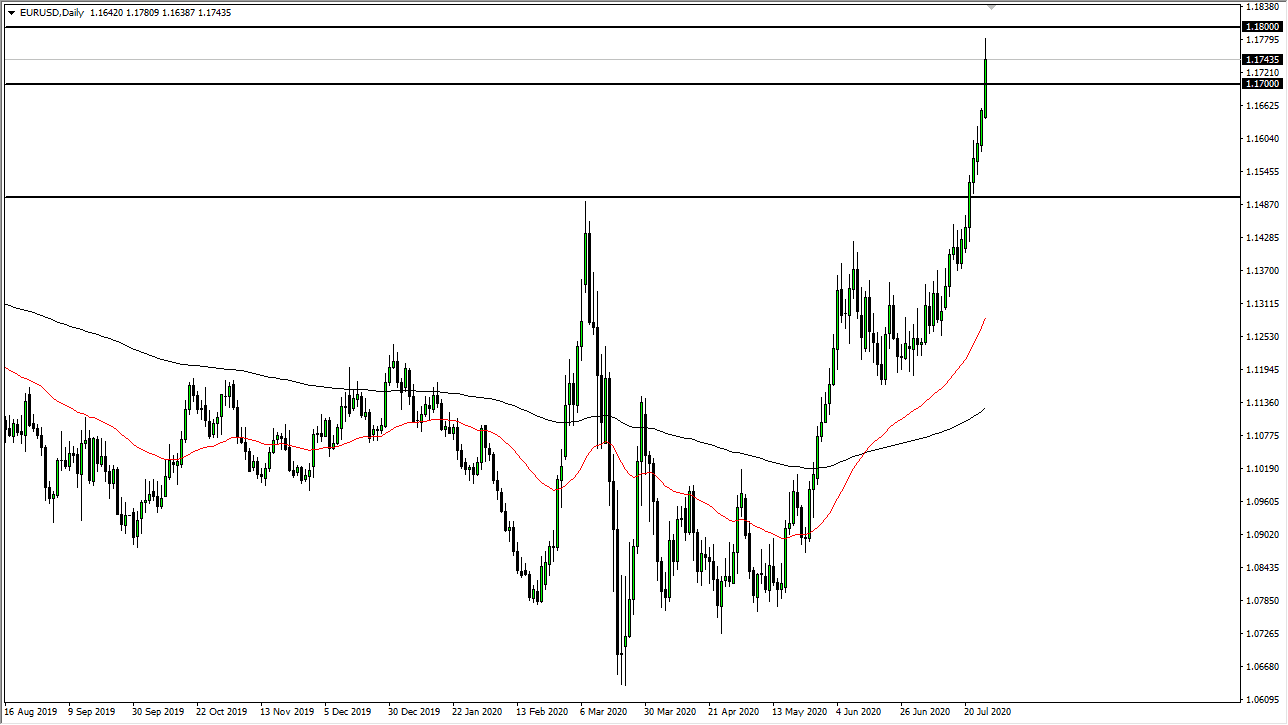

The Euro has rallied significantly during the trading session again on Monday, breaking above the 1.17 level. As we have broken above there, the market is likely to see quite a bit of bullish pressure still, but it is worth noting that we pulled back a bit during the trading session on Monday once we got well above there. It is possible we may see a bit of a pullback but this is a runaway trade that tells me the longer-term trend has definitely shifted to the upside. With that being the case, I think that the Euro has much further to go, maybe not necessarily because of anything going on in Europe, but mainly because of the Federal Reserve and its quantitative easing programs.

I think this is a market that will eventually find plenty of buyers on dips and I think that the 1.15 level is essentially the “floor” in the market, as it was such a major resistance barrier to overcome. At this point, it is likely to offer massive amounts of buying pressure if we do get down there, but I do not even know that we make that trip. When you look at the price chart, you can see that we have shot straight up in the air, pulled back, and then shot straight up in the area again. At this point, I would anticipate another pullback, much like the one that we had seen to for the bullish flag. We are a bit ahead of ourselves, but these trend changes tend to be very erratic and sudden, and most certainly volatile.

It is likely that the volatility continues but at this point, I have noticed it trying to short this market, even though it is overdone. This is all about the US dollar, and not necessarily about the Euro, so keep that in mind. The Euro is the first place people go to put their money when the US dollar collapses, just as the gold market does the same. The trade is stretched, so I will look for a couple of negative candlesticks before starting to buy again, but some type of support of candle like a hammer or some such support would have me long of this market and getting involved again. I am not interested in a blow-off top like we are currently threatening.