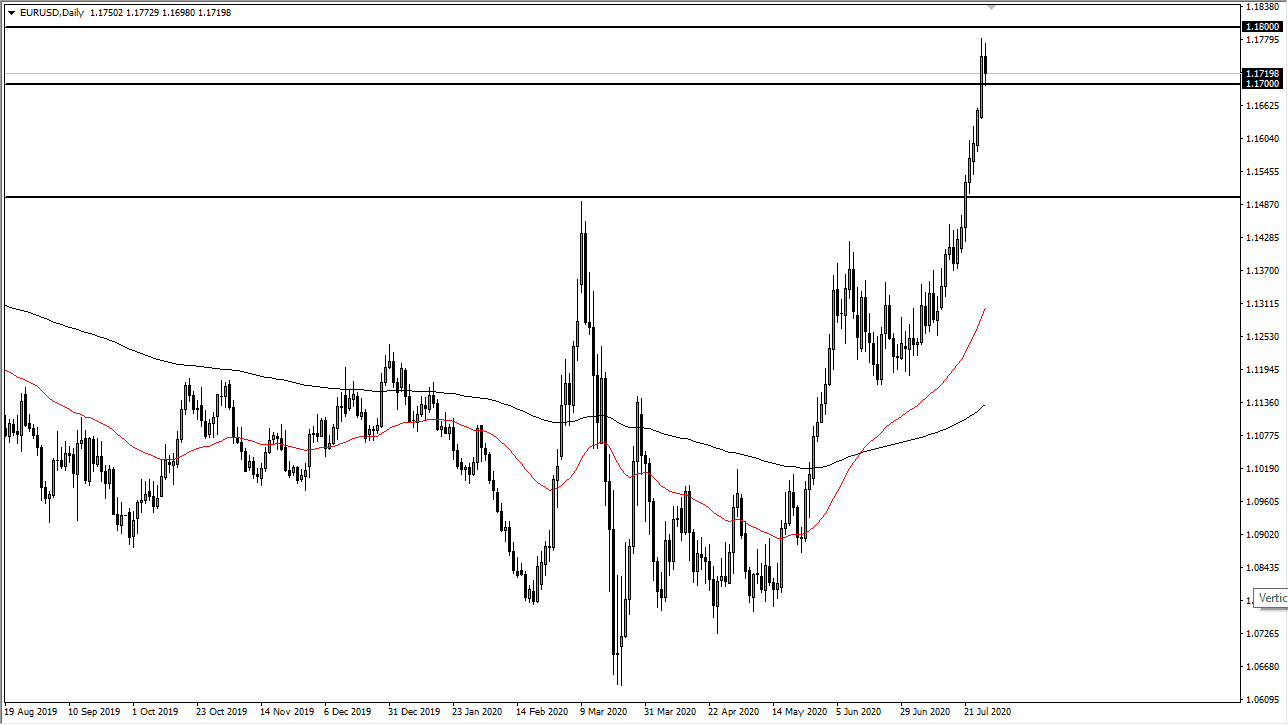

The Euro has initially tried rallying during the trading session on Tuesday but gave back the gains to test the 1.17 handle. The 1.17 level continues to be an area of interest, and therefore it makes sense that we would see a little bit of a bounce from there. Having said that, I think that we will more than likely see this market pull back a bit further, as it has gotten a bit ahead of itself. Furthermore, the parabolic nature this move suggests that we are more than likely going to see plenty of people who are willing to buy value when it happens. After all, it is a clear and present sign that the US dollar is losing strength, as we have seen a couple of impulsive moves lately.

Underneath, I anticipate that the 1.16 level will be supported, just as the 1.15 level will be. In fact, the 1.15 level should be particularly interesting, as it is roughly the 50% Fibonacci retracement level and a large, round, psychologically significant figure. That is an area that was difficult to break above, so now it should offer plenty of support. I do recognize that there is a lot out there going on, but the US dollar is being worked against by the Federal Reserve in general, so that will continue to be the story here.

I think you could probably count on some type of pullback, perhaps heading into the weekend. However, there is also the possibility that we simply go sideways for a while as we did previously, to form a bit of a bullish flag. Breaking above the 1.18 level would be a very strong sign obviously, and I do think it happens eventually. However, I think it is difficult to keep up with this type of move. A break above the 1.18 level more than likely allows this market to go looking towards the 1.20 level above, which is a major target on longer-term time frames. The 1.20 level has been my target for some time, but I did not expect to get all the way up here in a short amount of time. The next couple of days could be very interesting, but I am not looking for buying opportunities quite yet, I need to see the market at lower levels in order to take advantage of what is obviously a long-term uptrend just waiting to happen.