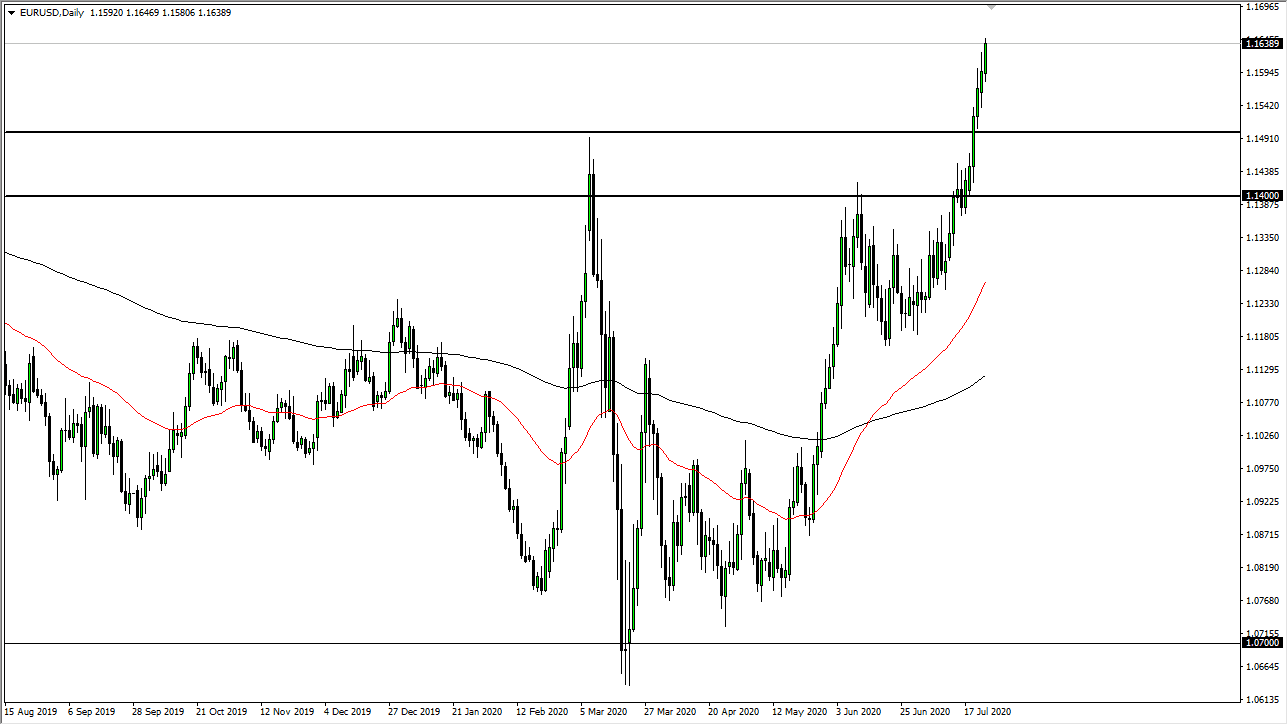

The Euro continues to rally rather significantly, and at this point, that is starting to become a relatively dangerous move. After all, markets do not go straight up in the air forever, but nobody has been bothering to pay attention to that over the last couple of days. Ultimately, I think at this point we will see a bit of a pullback and that is essentially what you need to be waiting for in this market. As you can see, we had recently shot straight up in the air only to pull back towards the 1.12 handle and then base again. I would anticipate that we will probably see something along the lines of that yet again.

I would be very interested in buying the Euro closer to the 1.15 handle, which is quite a bit lower than this area, but all we need is a couple of days’ worth of a pullback and then we get that opportunity. If we do not pullback in this market enough to make it cheap enough to buy, then you can probably translate this into buying the Australian dollar against the US dollar, or perhaps some of the other laggards like the New Zealand dollar. Yes, the Euro looks very bullish, but as a general rule if this market goes higher than the US dollar is going to go lower against most other markets. You have to look for value in a situation like this, and you do not want to pay these extraordinarily high prices for a Euro, although I fully believe that we are going to go higher over the longer term. That being said, the last thing I want to do is sit on losses for a couple of weeks trying to get back to even.

Unfortunately, there are people out there jumping into the Euro at the end of the week probably with large amounts of money as well. They may be lucky and continue to see this move to the upside, but it is very likely that sooner or later they will wake up in the morning with the market down a couple of handles. This is because when markets get overdone like this, they quite often have some type of exaggerated move to the downside as soon as there is some type of uncertainty out there. I am a buyer, but I am a buyer where there is value, not at these nosebleed levels.