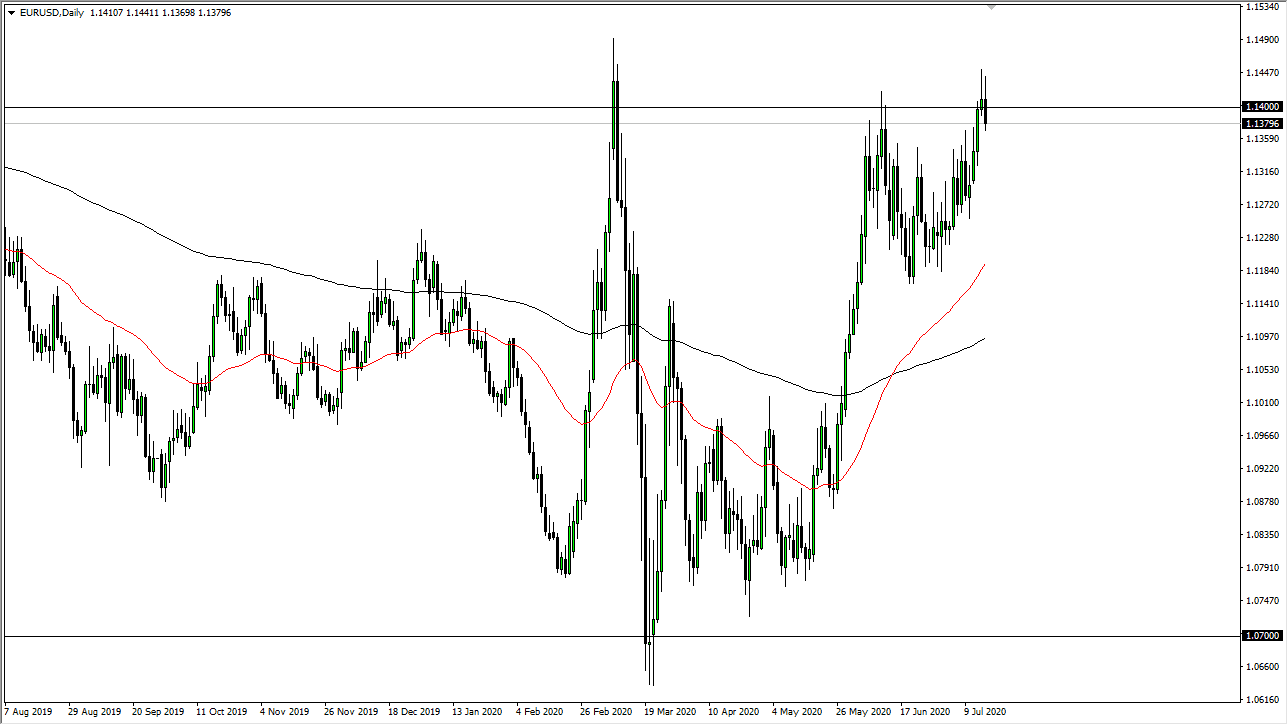

The Euro tried to break above the 1.14 handle again during the trading session on Thursday but gave up the gains. It appears that the Euro is getting a bit extended so although the ECB did not do much as far as a surprise, the reality is that the market continues to find the 1.14 level to be a bit difficult to overcome. I think there is significant resistance between the 1.14 handle and the 1.15 level, so I will not be surprised at all to see this market pull back just a bit before finding buyers again. Do not get me wrong, I recognize that there was a massive shooting star and we have now broken down below it, but I also recognize that there is a lot of support just below as well. Not all shooting stars are equal.

Looking at this chart, I believe that we see plenty of buyers underneath just waiting to get involved, as it is obvious that we are trying to change the overall trend. If and when we can get above the 1.15 handle, it is likely that the trend will change for a bigger move, and I will be all over that trade. In fact, I will be a buyer of the Euro and simply let it run.

The US dollar is facing a lot of pressure from all sides right now, so the Euro will be important to pay attention to because it is essentially the “anti-dollar.” The Australian dollar is another market that looks interesting as we are trying to break out. We are on the verge of a major trend change in the Forex markets, as the US dollar has been strong for roughly 5 years. With that, it is only a matter of time before we get some type of buying opportunity. I believe that the 1.1350 level is support, followed by the 1.13 handle. I have no interest in shorting this market right now, although I do reserve the right to change that opinion in the event of something rather nasty happening. All things being equal though, as we wind down the session on Thursday, we are already starting to see the Euro recover a bit after that sudden fall. The Federal Reserve will continue to expand its balance sheet and that will continue to be a main driver of money away from the US dollar.