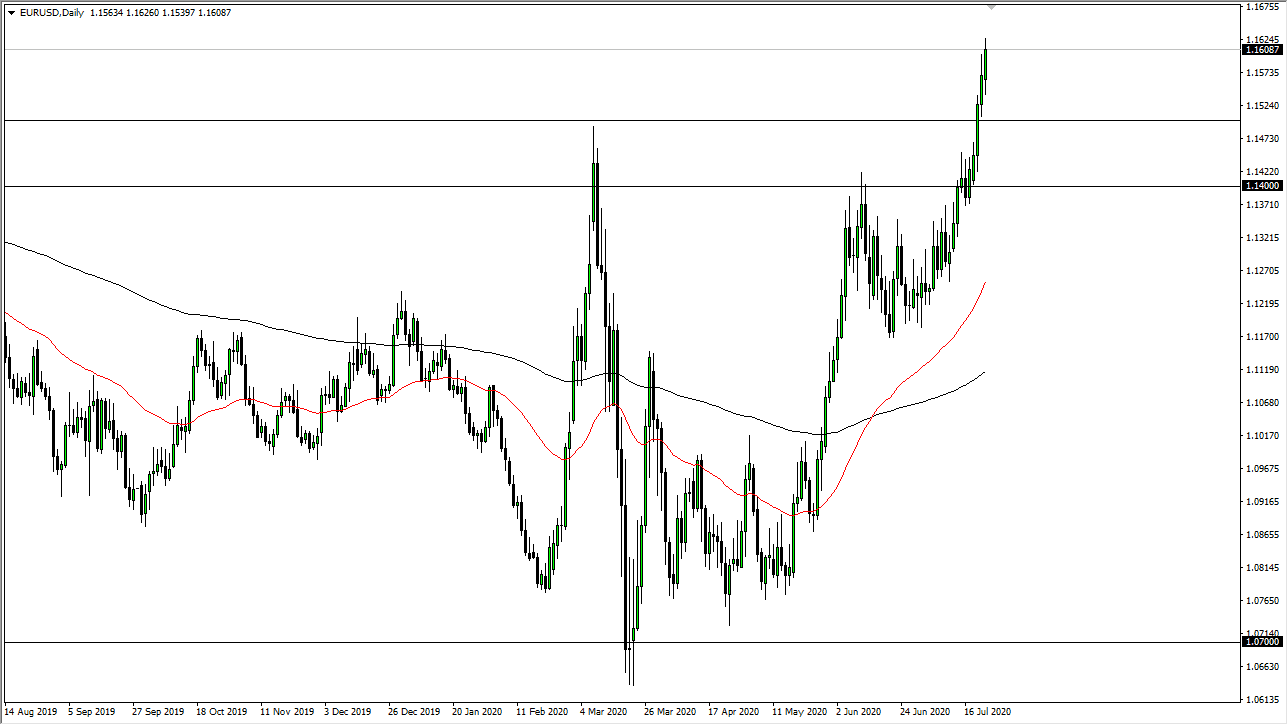

The Euro initially pulled back a bit during the trading session on Thursday, but then shot higher again to reach above the 1.16 level before struggling yet again. At this point, I think the pair is starting to get a bit overbought, as we cannot seem to hang on to the gains without extreme amounts of volatility. Furthermore, we are heading into the weekend so it would make quite a bit of sense for traders to take profits that have been involved in this pair all week. After all, they have made decent money and therefore it is certainly worth paying attention to as to whether or not they decide to “cash out.”

The 1.16 level does seem to be a little bit important, and at that point I am looking for a move to pull back towards the 1.15 handle. This is because we had previously had a significant resistance barrier between the 1.14 level and the 1.15 level, more or less a “band of resistance.” That previous area of resistance should now be supportive, so I am looking for a pullback into that area and some type of support of candle that I can jump all over. I would not hesitate to buy in that range, because breaking above the 1.15 level was a significant signal that the longer-term trend is changing.

This does not necessarily mean that is going to happen overnight, and it does not necessarily mean that we will never see a negative day again. However, it does give us a bias overall, and I therefore I am going to use that bias to color the attitude of my trades. In fact, I believe that the 1.14 level is essentially the short term “floor” in the longer-term move. We have been a bit extended for a while so do not be surprised with this pullback and look to take advantage of it heading into the next week. I would not be a buyer on a break above the highest of the day on Thursday, because we have gotten a bit ahead of ourselves, as the US dollar had been strengthening for most of the last 10 years. Trend changes do not happen very often, but when they do, they tend to be very messy affairs. The EUR/USD pair has shown that to be the case as of late.