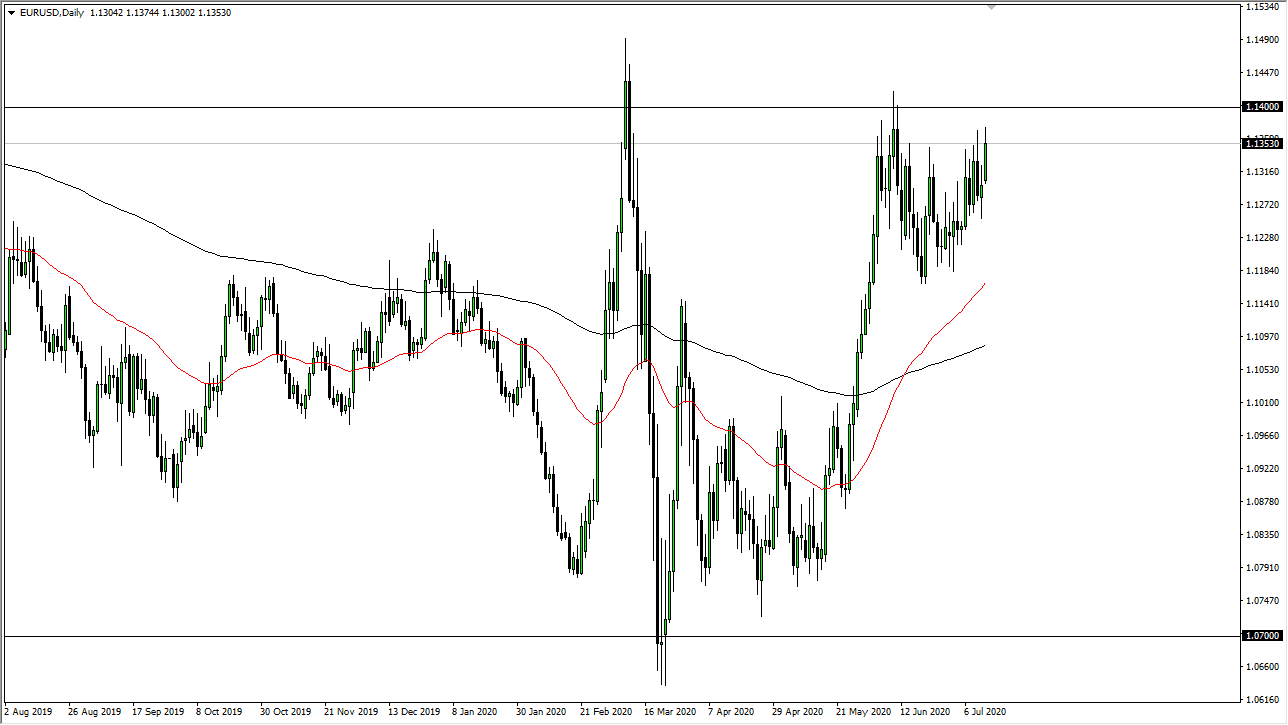

The Euro rallied again during the trading session on Monday, breaking well above the 1.1350 level before giving up all of those gains in what has been a familiar pattern: The Euro rallying towards the 1.14 level and then pulling back. We clearly are being rather stubbornly bullish at the moment, but the sellers have managed to keep the gains under control. I believe the 1.14 level will be crucial going forward so it most certainly should be paid attention to.

In fact, the 1.14 level begins an area that extends all the way to the 1.15 handle, which I think of as a thick zone of selling pressure. If we did manage to break above the 1.15 handle, then I think we are likely to see a longer-term “buy-and-hold” type of market. I doubt it though, and I think what we are probably looking at here is a market that you can continue to fade short-term rallies. Longer-term, we do need to make some type of a decision, but we are still very much in a downtrend despite the fact that we had shot straight up in the air as of late. With that, I believe that the short-term charts tell us that the market is going to bounce around between the 1.12 level on the bottom and the 1.14 level on the top. Eventually, we should get some type of clarity, as the European Union will have to make several key decisions about how they are going to bail out. On the other side of the Atlantic Ocean, you have the Federal Reserve, which is trying everything you can to add liquidity to markets which means quantitative easing, even if they do not use that phrase. Because of that, the US dollar has lost some strength as of late.

Keep in mind that late in the day there was a sudden “risk-off” type of scenario out there, perhaps due to earnings season. People started to bid up the US dollar and it had the same effect over here. At this point, I would anticipate a lot of choppiness but that is pretty much typical when it comes to this pair, as it is one of the most choppiness that you can find. If we were to break down below the 50 day EMA, then it could open up a bit of a “trapdoor” too much lower levels, probably closer to the 1.10 level.