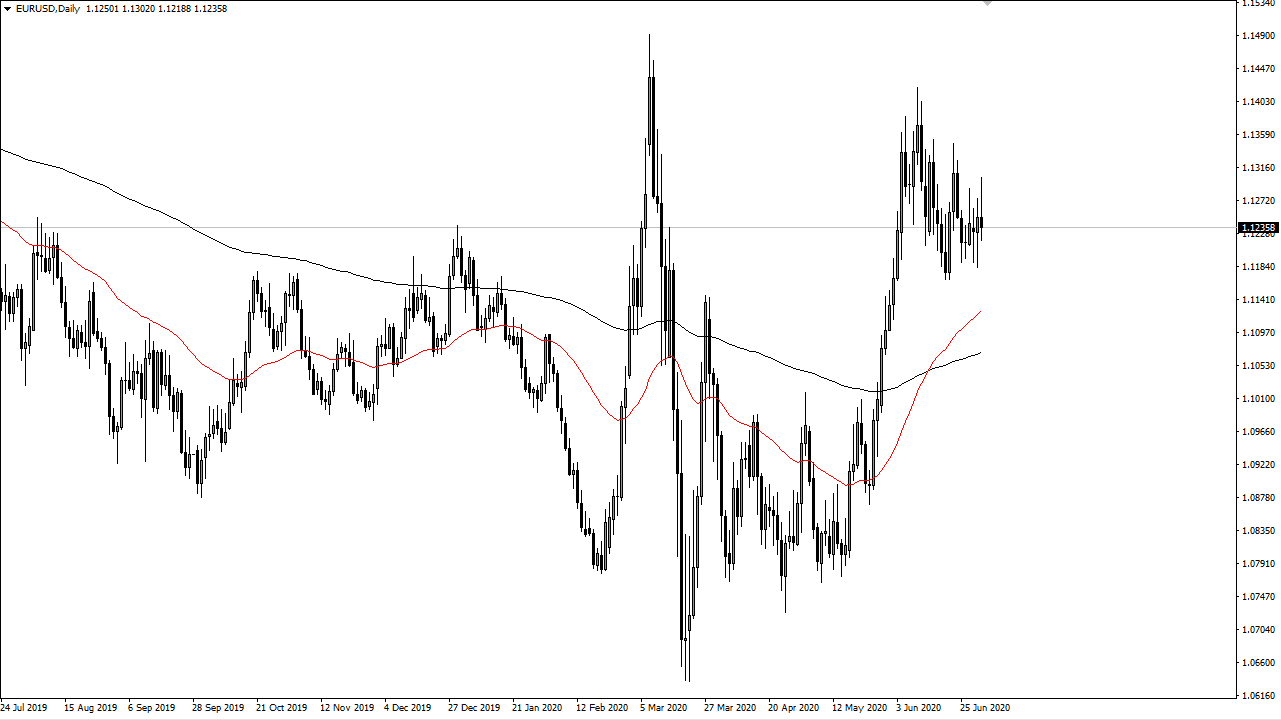

The Euro has rallied pretty significantly during the trading session on Thursday but then rolled over to show signs of exhaustion yet again. It looks to me as if the Euro is comfortable sitting in this general vicinity, but the one thing that we continue to see is that every time we rally, the sellers come back to push the market lower. I think at this point the 1.14 level above is significant resistance, and it has a major amount of selling pressure all the way to the 1.15 handle, something that I do not have any idea that we will break above anytime soon. With that in mind, I am a seller of signs of exhaustion, just as we have seen during the trading session on Thursday.

To the downside, the market could go towards the 1.10 level, maybe even the 1.1050 level as it is where the 200 day EMA currently sits. Recently, we have seen the Euro just grind lower more than anything else. Some people think this is a bullish flag, but I do not believe that is what we are looking at due to the angle of the drop. This just simply a sloppy and messy currency pair that cannot quite figure out what to do with itself. After all, the Federal Reserve is trying to kill the US dollar, but at the same time the European Central Bank continues to be a major issue. After all, they are buying anything that is not nailed to the floor, so it is not difficult to imagine a scenario where we simply chop back and forth.

At this point in time, it is highly likely that we will see a lot of noisy trading followed by a big move, followed by even more noise. I do not necessarily think we break down below the 1.07 level, because that has been such a massive support level as well. With that being the case, I do like the idea of simply looking at this as a range that we will continue to be stuck and for quite some time. With this, it is likely that if you simply wait for some short-term rally that shows signs of exhaustion, you can sell at that point. If we do break down below the 1.1175 handle, we might accelerate to the downside again and that could be a nice trade.