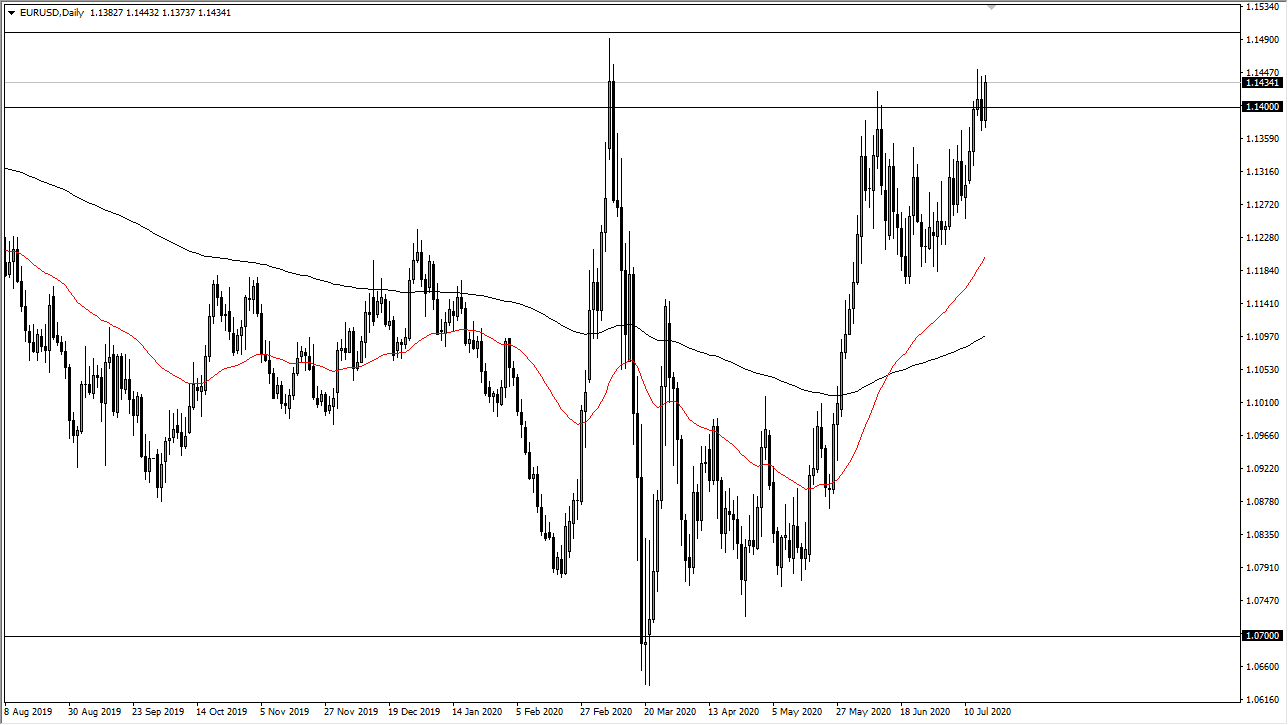

The Euro rallied significantly during the trading session on Friday to close towards the top of the range. This is definitely worth paying attention to, because we have formed a couple of shooting stars in continue to see a lot of trouble above the 1.14 handle. However, you can see that Friday was completely different in the sense that we made that move again but stayed there. That is a very bullish sign and I think it will eventually send the Euro much higher. In fact, we are currently digging away at a major resistance barrier in my estimation that extends all the way from 1.14 to the 1.15 handle above.

If we can break above that level, it is very likely that the market continues to go much higher and it becomes more or less a “buy-and-hold” type of market. The pair does tend to be very choppy and volatile, so it should not be a huge surprise to suggest that it may take a lot of choppy and volatile momentum and trading to get through the top just above the send this market higher.

On the other side of the equation, we could pull back and if we drop below the 1.1375 handle, then I think we probably go looking towards the 1.13 level. I do not see this happening, but you never know, depending on what happens over the weekend we may see some type of run towards the US dollar in general based upon safety.

When you look at the candlestick for the trading session on Friday, it shows just how precarious the situation is just above, as we have seen a lot of the area offer massive resistance and the fact that we could simply sit there tells me that there is a bit more confidence, especially when you think about how we are going into the weekend. If traders are willing to sell on a position for the weekend, actions speak louder than words, and it shows that they believe that this pair is going to go higher. Furthermore, with the central bank in the United States doing everything you can to continue quantitative easing, that works against the value of the US dollar in general, and the Euro is one of the first places that people will go looking to short the US dollar as it is the most liquid market out there.