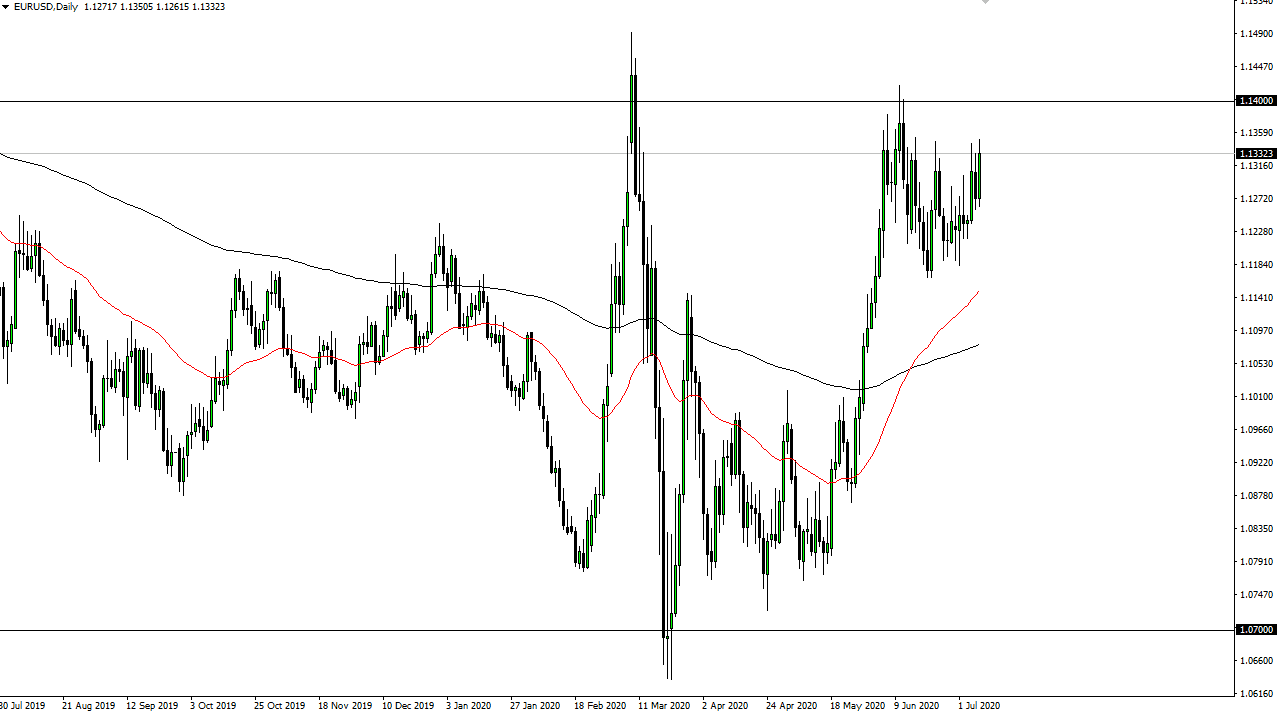

The Euro continues to rally significantly, slamming into the 1.1350 region. There is a significant amount of resistance above there extending all the way to the 1.14 handle, so it is likely that we need to stay on the sidelines and look for signs of exhaustion to either fade this market, but if we were to break above the 1.14 handle, then there is a massive amount of resistance extending all the way to the 1.15 handle, an area that if we were to break above finally it could open up the door for a major trend change. Breaking above that level opens up more of a “buy-and-hold” type of scenario, and there are some pundits out there that believe the extended ECB protection plan about the coronavirus could lift the Euro. That being said, it also assumes that the market is going to be reacting favorably to the overall state of affairs.

Looking at this chart, I think it continues to see a lot of negativity, although we are certainly trying to break through major resistance. To the downside, the market is likely to go looking towards the 1.12 handle, which is support all the way down to the 1.1180 level. If we were to break down below there, the market is likely to go looking towards the 200 day EMA. Because of this, I think that we will continue to see a lot of choppy behavior, but eventually, we should see some type of impulsive move.

All things being equal, the US dollar would of course be very crucial if people are starting to freak out again based upon various problems around the world such as the coronavirus numbers, and slowing down of global economies. This could throw money into the US Treasury market, and demands US dollars. I think at best you are looking at short-term trading in a range right now, and we are approaching the top of that range, so I again start looking towards short-term exhaustion in order to take short-term selling opportunities. With this, if we were to turn around a breakout, that would be a major turn of events, but unfortunately, that does not seem to be highly likely.

I think at this point it is very unlikely that we simply take off in one direction or another, especially considering that the time of year is typically very choppy in general. Summertime trading can be quite unremarkable.