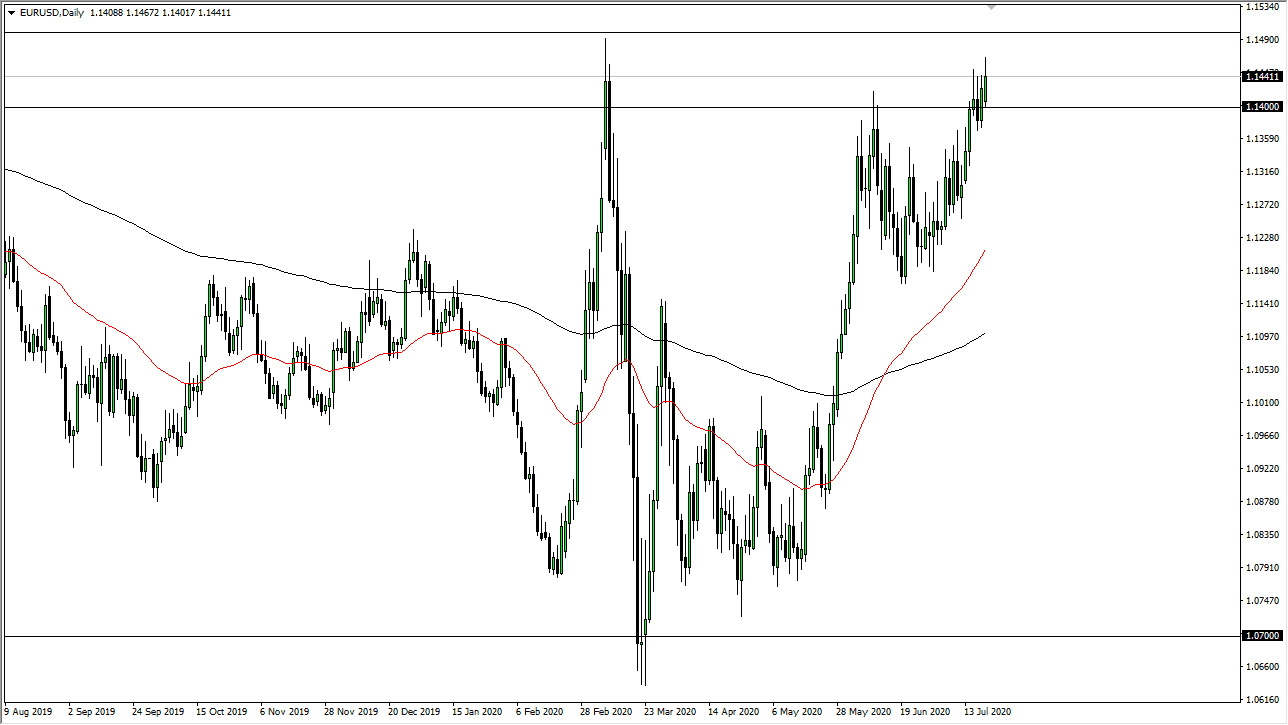

The Euro has rallied a bit during the trading session on Monday, breaking towards the 1.1450 level yet again. We even popped above it for a little bit before given up some of the gains, but what is worth noting is how many times we rally and get turned right back down, it is only a matter of time before the buyers come in and push this pair higher. There is a massive resistance barrier between the 1.14 level and the 1.15 level, so it should not be thought of as a major surprise that we have struggled to get up here.

To the downside, I believe that the market is likely to see the 1.1350 level as support, as it was the top of the “zone of resistance” that had been so prevalent during the previous consolidation. This is a market that I think is going to take off to the upside eventually, as the Federal Reserve is doing what it can to crush its own currency. Quantitative easing continues to be a major theme coming out of the Federal Reserve, and that is negative for the US dollar.

Currently, it should be noted that the Europeans are meeting in response to a potential pandemic stimulus bill, and one should never underestimate the ability of EU officials to completely screw up any type of negotiation. However, so far, the market is willing to give them a pass on their inaction, so I think we are trying to price and grow in the European Union. After all, all central banks around the world are loose with the monetary policy so that will be the name of the game here: chasing growth. The European Union has gotten a bit of a boost due to the fact that they have a better handle on the coronavirus outbreak than the United States, so that is one of the main drivers of currency flows right now. In general, I think that one should but the dips going forward, as it is difficult to imagine this market turning around and breaking down from here. It could, and probably on some type of negative headline. That would be an obvious situation that will present itself, so until that happens it is likely that you buy the dips and take your gains momentarily. If we can get a daily close above the 1.15 handle, then the Euro will have changed its long-term trend.