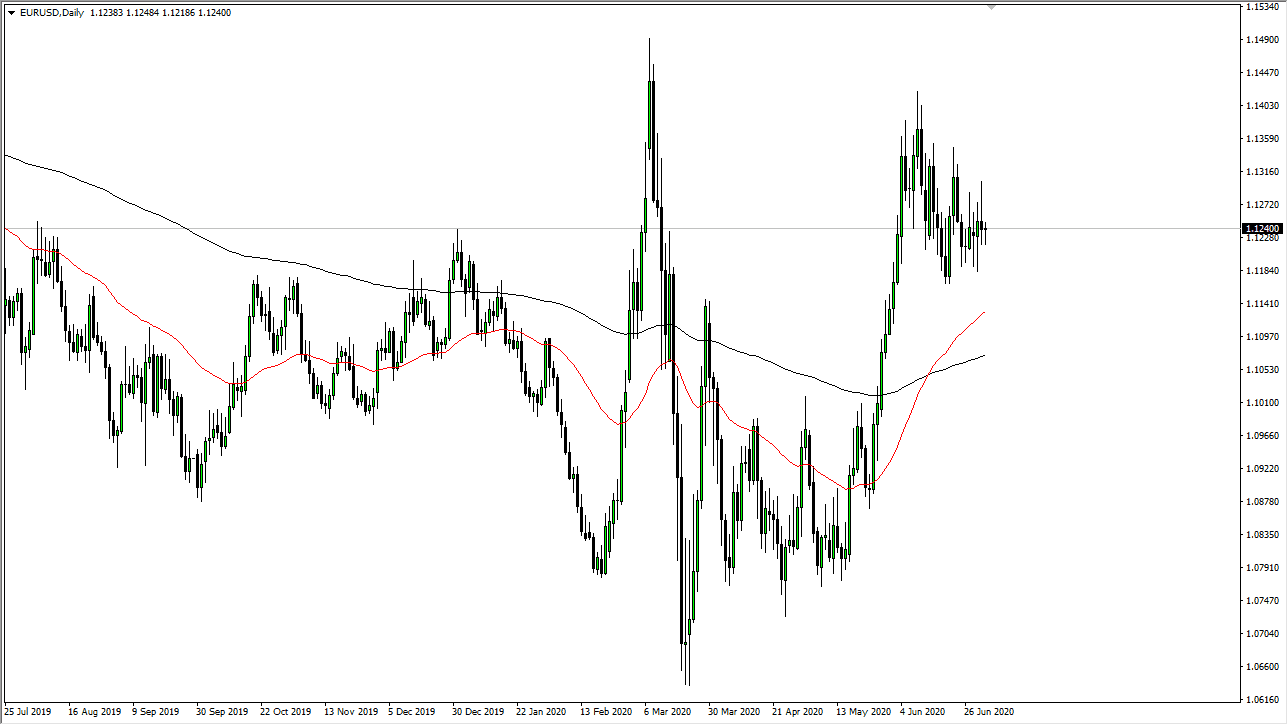

The Euro fell initially during the trading session on Friday, reaching down towards the lows of the previous session on Thursday before bouncing. At this point, the market has shown itself to be somewhat resilient, but you have to keep in mind that the liquidity would have been a bit of an issue as the Americans were away celebrating and observing Independence Day. At this point, looking at the weekly chart we can see that there are multiple shooting stars in a row so I think this market continues to be very much of the same, meaning that you should be selling rallies that show signs of exhaustion.

To the upside, I believe that the 1.14 level is massive resistance that extends all the way to the 1.15 handle, and that is an area that has been important more than once. In fact, I think that is the barrier that will determine what the actual overall long-term direction and trend of this market is, so if we can break above the 1.15 handle, it becomes more of a “buy-and-hold” scenario for the bullish traders out there. Why would we do that? Two words: Federal Reserve.

The Federal Reserve has been flooding the market with US dollars and that has been working against the greenback. However, the European Central Bank has been ultra-easy with its monetary policy as well, so this is essentially a fight between two central banks that are trying to do everything they can to destroy their own currencies. Bond purchases and the like continue to be a major issue with these currencies, both of which are guilty of seeing their own central bank work against their value. Because of this, I anticipate that we are going to see more back-and-forth than anything else.

I would like to see a move below the 1.12 level that I could sell, because we should eventually go down to the 1.10 level, maybe the 1.1050 level where the 200 day EMA is. With that, I think that the market is likely to remain somewhat range-bound, but the weekly candlesticks do look like we are running out of momentum if nothing else. With that being the case, I think we are going to hang around in this area until we get some type of catalyst to move. You will notice that the thick candlestick with a hammer followed by a shooting star on Thursday. That typically means you are setting up a short-term range.