The Euro went back and forth during the trading session on Friday as we tried to figure out where to go next. Ultimately, the Euro has been rallying quite significantly over the last month or so, but every time we get just a little bit ahead of where we are now, the sellers step back in. This makes perfect sense because this pair tends to be very choppy to say the least. Furthermore, one of the things that is pushing this market to the upside is the fact that the Federal Reserve is flooding the market with US dollars. Quantitative easing will continue to work against the value of the greenback, but at the same time, we have extraordinarily loose monetary policies coming out of the European Central Bank.

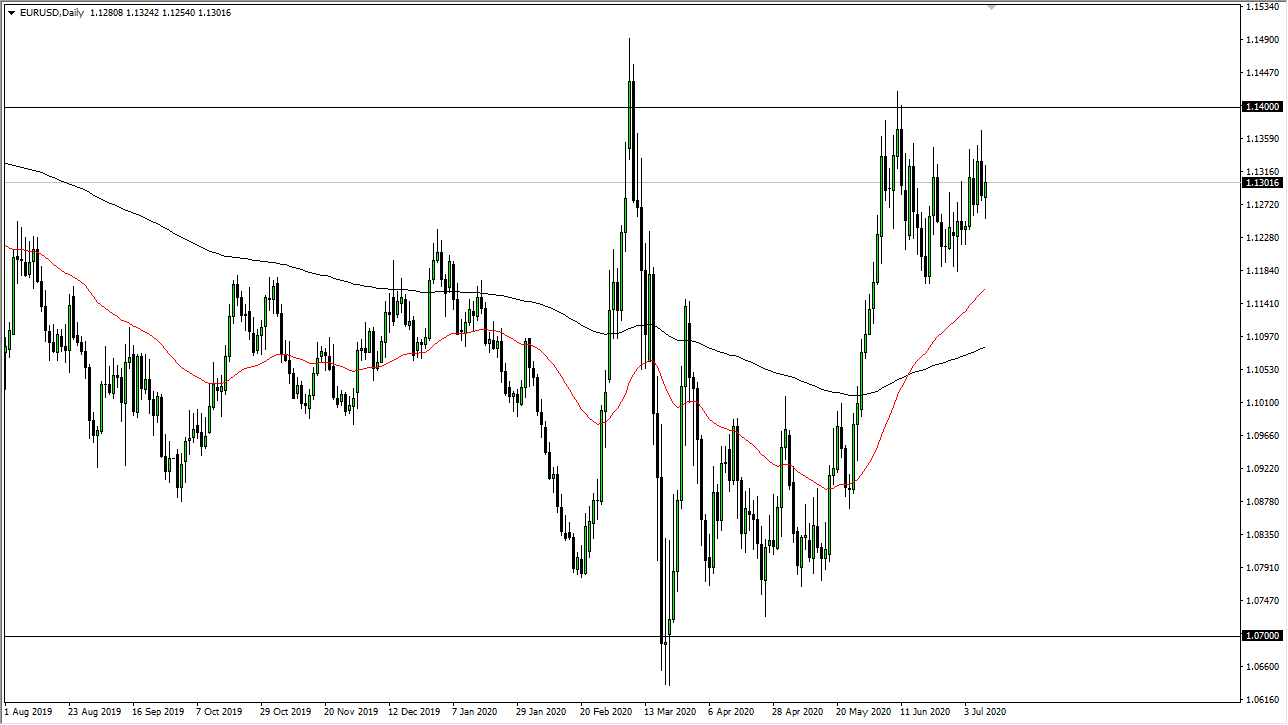

From a technical analysis standpoint, we are still consolidating between the 1.12 level on the bottom and the 1.14 level on the top. Although we have tried to break out several times over the course of the last month or so, we have failed to do so and therefore I think we are still stuck in the same range. If we were to break above the 1.14 handle, then it is likely that there will be a lot of resistance all the way to the 1.15 handle. It is not until we break above the 1.15 handle that I would consider this a bit of a trend change, but at this point, I think we have a lot of work to do before anything like that can happen.

Earnings season is next week, so it is possible that we may get a little bit of US dollar strength or weakness depending on how people perceive it, so, therefore, that is something to pay attention to. Furthermore, the bond markets continue to drive yields lower, and that will have the US dollar rallying. On the other side of the equation though, all of that liquidity continues to work against the value of the greenback. With this, if we were to break down below the 1.1180 level, then we could see a reversal and see US dollar strength as the Euro could go down to the 1.10 level. In the short term, I think we are simply trading in a roughly 200 point range although I am the first person to talk about how soft the weekly candlesticks all look.